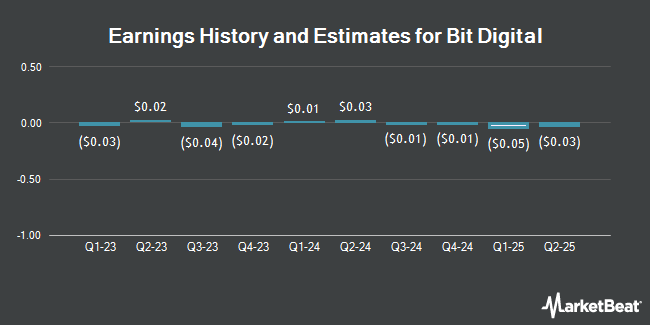

Bit Digital, Inc. (NASDAQ:BTBT - Free Report) - Investment analysts at Noble Financial raised their FY2025 earnings estimates for shares of Bit Digital in a report released on Tuesday, November 5th. Noble Financial analyst J. Gomes now anticipates that the company will earn $0.36 per share for the year, up from their prior forecast of $0.34. The consensus estimate for Bit Digital's current full-year earnings is ($0.06) per share.

BTBT has been the subject of several other reports. B. Riley assumed coverage on shares of Bit Digital in a report on Thursday, October 24th. They issued a "buy" rating and a $6.00 price objective for the company. HC Wainwright upped their target price on shares of Bit Digital from $6.00 to $7.00 and gave the company a "buy" rating in a research note on Wednesday, October 16th.

Get Our Latest Stock Analysis on BTBT

Bit Digital Trading Up 1.5 %

NASDAQ BTBT traded up $0.06 during trading on Thursday, hitting $4.16. The company had a trading volume of 12,769,565 shares, compared to its average volume of 9,286,135. Bit Digital has a one year low of $1.76 and a one year high of $5.27. The company has a market cap of $277.97 million, a price-to-earnings ratio of 17.08 and a beta of 4.79. The company's fifty day moving average is $3.38 and its 200-day moving average is $3.10.

Bit Digital (NASDAQ:BTBT - Get Free Report) last issued its quarterly earnings data on Monday, August 19th. The company reported ($0.01) EPS for the quarter, topping the consensus estimate of ($0.03) by $0.02. Bit Digital had a net margin of 33.30% and a negative return on equity of 1.48%. The business had revenue of $28.95 million during the quarter, compared to analyst estimates of $26.63 million.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the company. Bleakley Financial Group LLC bought a new position in shares of Bit Digital in the first quarter worth about $33,000. Squarepoint Ops LLC bought a new position in Bit Digital in the 2nd quarter worth approximately $2,126,000. Millennium Management LLC grew its holdings in Bit Digital by 66.6% during the 2nd quarter. Millennium Management LLC now owns 2,586,392 shares of the company's stock valued at $8,225,000 after buying an additional 1,033,767 shares in the last quarter. Mirae Asset Global Investments Co. Ltd. raised its position in shares of Bit Digital by 9.5% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,910,596 shares of the company's stock valued at $5,483,000 after buying an additional 165,044 shares during the last quarter. Finally, The Manufacturers Life Insurance Company raised its position in shares of Bit Digital by 42.4% during the second quarter. The Manufacturers Life Insurance Company now owns 44,219 shares of the company's stock valued at $141,000 after buying an additional 13,170 shares during the last quarter. Institutional investors own 47.70% of the company's stock.

Bit Digital Company Profile

(

Get Free Report)

Bit Digital, Inc, together with its subsidiaries, engages in the bitcoin mining business. It is also involved in the treasury management activities; and digital asset staking and digital asset mining businesses, as well as ethereum staking activities. In addition, it provides specialized cloud-infrastructure services for artificial intelligence applications.

Featured Articles

Before you consider Bit Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bit Digital wasn't on the list.

While Bit Digital currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.