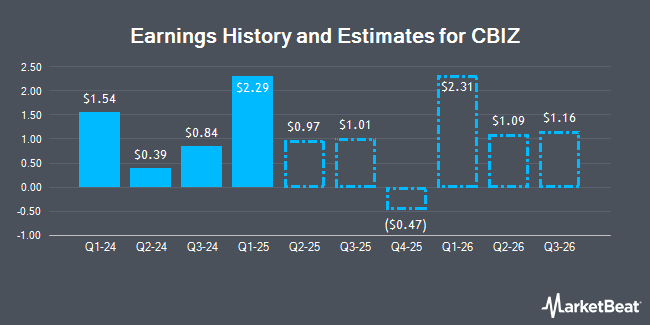

CBIZ, Inc. (NYSE:CBZ - Free Report) - William Blair lifted their Q3 2025 EPS estimates for shares of CBIZ in a research note issued on Thursday, November 21st. William Blair analyst A. Nicholas now forecasts that the business services provider will post earnings of $0.83 per share for the quarter, up from their prior estimate of $0.81. The consensus estimate for CBIZ's current full-year earnings is $2.65 per share.

Several other brokerages also recently weighed in on CBZ. StockNews.com downgraded shares of CBIZ from a "hold" rating to a "sell" rating in a report on Wednesday, November 20th. Sidoti raised shares of CBIZ from a "neutral" rating to a "buy" rating and increased their price objective for the stock from $80.00 to $86.00 in a research report on Monday, August 12th.

Check Out Our Latest Stock Analysis on CBIZ

CBIZ Stock Performance

Shares of CBZ stock traded up $1.85 during mid-day trading on Monday, reaching $82.64. 131,812 shares of the company's stock traded hands, compared to its average volume of 316,222. The firm has a market capitalization of $4.15 billion, a PE ratio of 34.23 and a beta of 0.91. The company has a debt-to-equity ratio of 0.36, a quick ratio of 1.49 and a current ratio of 1.49. The firm has a 50 day moving average price of $70.00 and a two-hundred day moving average price of $73.07. CBIZ has a 12 month low of $57.01 and a 12 month high of $86.36.

CBIZ (NYSE:CBZ - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The business services provider reported $0.84 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.76 by $0.08. CBIZ had a net margin of 7.08% and a return on equity of 15.12%. The firm had revenue of $438.90 million during the quarter, compared to the consensus estimate of $440.16 million. During the same quarter in the previous year, the firm posted $0.66 EPS. The company's revenue for the quarter was up 6.9% compared to the same quarter last year.

Hedge Funds Weigh In On CBIZ

A number of hedge funds have recently added to or reduced their stakes in the stock. Quest Partners LLC boosted its stake in shares of CBIZ by 2,980.0% during the second quarter. Quest Partners LLC now owns 462 shares of the business services provider's stock valued at $34,000 after purchasing an additional 447 shares in the last quarter. Signaturefd LLC raised its holdings in shares of CBIZ by 55.8% during the third quarter. Signaturefd LLC now owns 961 shares of the business services provider's stock worth $65,000 after purchasing an additional 344 shares during the last quarter. Quarry LP increased its holdings in CBIZ by 6,335.3% in the third quarter. Quarry LP now owns 1,094 shares of the business services provider's stock valued at $74,000 after buying an additional 1,077 shares in the last quarter. Picton Mahoney Asset Management acquired a new stake in shares of CBIZ in the second quarter valued at about $82,000. Finally, KBC Group NV grew its position in shares of CBIZ by 29.7% in the third quarter. KBC Group NV now owns 1,553 shares of the business services provider's stock valued at $105,000 after purchasing an additional 356 shares during the period. 87.44% of the stock is currently owned by institutional investors.

About CBIZ

(

Get Free Report)

CBIZ, Inc provides financial, insurance, and advisory services in the United States and Canada. It operates through Financial Services, Benefits and Insurance Services, and National Practices segments. The Financial Services segment offers accounting and tax, financial advisory, valuation, risk and advisory, and government healthcare consulting services.

Featured Stories

Before you consider CBIZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBIZ wasn't on the list.

While CBIZ currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.