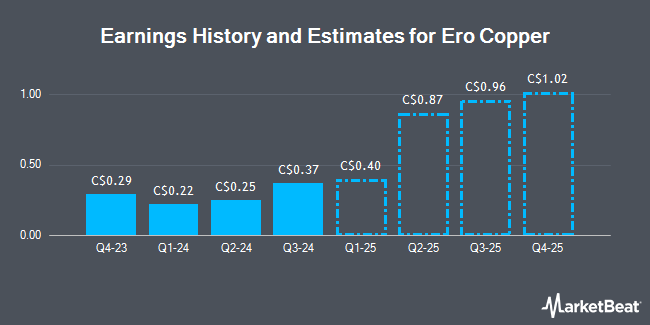

Ero Copper Corp. (TSE:ERO - Free Report) - Analysts at National Bank Financial decreased their Q4 2024 earnings per share (EPS) estimates for Ero Copper in a research report issued on Tuesday, February 4th. National Bank Financial analyst S. Nagle now anticipates that the company will post earnings of $0.25 per share for the quarter, down from their previous estimate of $0.30. The consensus estimate for Ero Copper's current full-year earnings is $4.74 per share.

Several other equities analysts also recently commented on ERO. National Bankshares lowered their price objective on shares of Ero Copper from C$33.00 to C$31.50 and set a "sector perform" rating for the company in a research note on Tuesday, October 15th. The Goldman Sachs Group upgraded Ero Copper to a "strong-buy" rating in a research note on Monday, December 2nd. Eight Capital reduced their price target on Ero Copper from C$40.00 to C$34.00 in a research note on Wednesday, November 6th. Jefferies Financial Group lowered their price objective on Ero Copper from C$33.00 to C$29.00 in a research report on Tuesday, January 7th. Finally, TD Securities reduced their target price on shares of Ero Copper from C$30.00 to C$27.00 and set a "hold" rating on the stock in a research report on Thursday, November 7th. Four equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat.com, Ero Copper currently has an average rating of "Moderate Buy" and an average target price of C$32.92.

Read Our Latest Analysis on ERO

Ero Copper Trading Up 1.2 %

Shares of TSE ERO traded up C$0.23 during mid-day trading on Thursday, hitting C$19.08. The stock had a trading volume of 529,212 shares, compared to its average volume of 309,048. The business has a 50 day moving average price of C$19.94 and a two-hundred day moving average price of C$24.21. Ero Copper has a 1 year low of C$18.38 and a 1 year high of C$32.89. The company has a debt-to-equity ratio of 82.63, a quick ratio of 1.43 and a current ratio of 0.68. The firm has a market cap of C$1.97 billion, a P/E ratio of -73.38, a price-to-earnings-growth ratio of -0.72 and a beta of 1.98.

Insider Activity

In other Ero Copper news, Director Chantal Gosselin purchased 10,000 shares of Ero Copper stock in a transaction dated Friday, December 27th. The stock was purchased at an average price of C$19.44 per share, with a total value of C$194,400.00. 10.37% of the stock is owned by corporate insiders.

About Ero Copper

(

Get Free Report)

Ero Copper Corp. engages in the exploration, development, and production of mining projects in Brazil. The company is involved in the production and sale of copper concentrate from the Caraíba operations located in the Curaçá Valley, northeastern Bahia state, Brazil, as well as gold and silver by-products.

Read More

Before you consider Ero Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ero Copper wasn't on the list.

While Ero Copper currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.