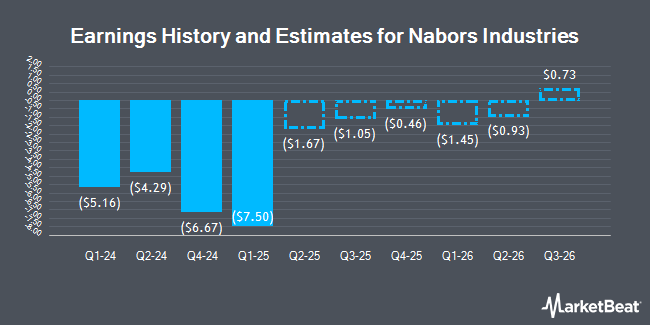

Nabors Industries Ltd. (NYSE:NBR - Free Report) - Atb Cap Markets issued their FY2027 earnings per share (EPS) estimates for Nabors Industries in a note issued to investors on Tuesday, December 10th. Atb Cap Markets analyst W. Syed forecasts that the oil and gas company will post earnings per share of $0.54 for the year. The consensus estimate for Nabors Industries' current full-year earnings is ($15.52) per share.

Several other research analysts also recently weighed in on the company. Citigroup upped their price target on Nabors Industries from $75.00 to $80.00 and gave the stock a "neutral" rating in a research note on Thursday, October 31st. Evercore ISI decreased their target price on Nabors Industries from $94.00 to $85.00 and set an "in-line" rating on the stock in a research report on Thursday, October 24th. Barclays cut their price target on Nabors Industries from $110.00 to $88.00 and set an "equal weight" rating for the company in a report on Wednesday, October 16th. Royal Bank of Canada reaffirmed a "sector perform" rating and set a $102.00 price objective on shares of Nabors Industries in a report on Wednesday, October 16th. Finally, Susquehanna cut their target price on shares of Nabors Industries from $79.00 to $77.00 and set a "neutral" rating for the company in a report on Thursday, October 24th. Seven equities research analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $97.00.

Check Out Our Latest Analysis on NBR

Nabors Industries Price Performance

Shares of NYSE:NBR traded down $1.51 during trading on Thursday, hitting $67.12. 307,708 shares of the company's stock were exchanged, compared to its average volume of 285,239. The business's 50-day simple moving average is $74.79 and its 200 day simple moving average is $74.61. The company has a market cap of $718.79 million, a price-to-earnings ratio of -3.74 and a beta of 2.05. Nabors Industries has a 52-week low of $59.67 and a 52-week high of $105.96. The company has a debt-to-equity ratio of 5.43, a current ratio of 1.88 and a quick ratio of 1.63.

Institutional Trading of Nabors Industries

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in NBR. Price T Rowe Associates Inc. MD raised its holdings in shares of Nabors Industries by 6.6% in the first quarter. Price T Rowe Associates Inc. MD now owns 6,471 shares of the oil and gas company's stock worth $558,000 after buying an additional 399 shares during the period. SG Americas Securities LLC bought a new stake in shares of Nabors Industries during the second quarter worth $159,000. Bank of New York Mellon Corp boosted its stake in shares of Nabors Industries by 42.8% during the second quarter. Bank of New York Mellon Corp now owns 115,084 shares of the oil and gas company's stock valued at $8,189,000 after purchasing an additional 34,473 shares during the period. Van ECK Associates Corp grew its holdings in shares of Nabors Industries by 6.8% in the second quarter. Van ECK Associates Corp now owns 197,177 shares of the oil and gas company's stock worth $14,031,000 after purchasing an additional 12,622 shares during the last quarter. Finally, Nicola Wealth Management LTD. increased its stake in Nabors Industries by 182.9% in the 2nd quarter. Nicola Wealth Management LTD. now owns 23,200 shares of the oil and gas company's stock worth $1,651,000 after buying an additional 15,000 shares during the period. 81.92% of the stock is owned by hedge funds and other institutional investors.

Nabors Industries Company Profile

(

Get Free Report)

Nabors Industries Ltd. provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the United States and internationally. The company operates through four segments: U.S. Drilling, International Drilling, Drilling Solutions, and Rig Technologies. It provides tubular running services, including casing and tubing running, and torque monitoring; managed pressure drilling services; and drilling-bit steering systems and rig instrumentation software.

Recommended Stories

Before you consider Nabors Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nabors Industries wasn't on the list.

While Nabors Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.