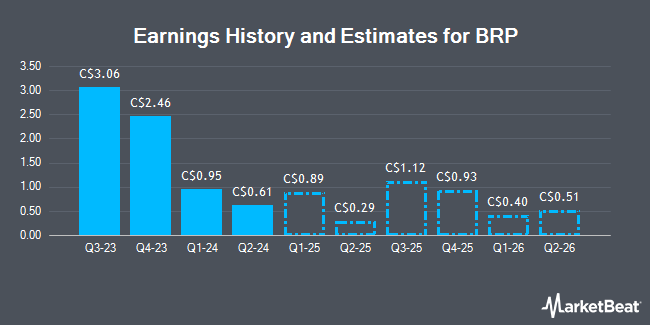

BRP Inc. (TSE:DOO - Free Report) - Equities research analysts at National Bank Financial issued their FY2027 earnings per share (EPS) estimates for BRP in a report released on Monday, February 24th. National Bank Financial analyst C. Doerksen expects that the company will post earnings per share of $5.81 for the year. The consensus estimate for BRP's current full-year earnings is $6.89 per share.

Several other equities analysts have also recently issued reports on DOO. Raymond James decreased their price target on BRP from C$100.00 to C$98.00 in a report on Monday, December 9th. TD Securities raised their price target on BRP from C$81.00 to C$83.00 and gave the company a "hold" rating in a report on Monday, December 9th. Citigroup cut BRP from a "buy" rating to a "neutral" rating and decreased their price target for the company from C$90.00 to C$70.00 in a report on Monday, February 3rd. Scotiabank decreased their price target on BRP from C$91.00 to C$86.00 and set a "sector perform" rating on the stock in a report on Monday, December 9th. Finally, Canaccord Genuity Group decreased their price target on BRP from C$88.00 to C$80.00 in a report on Wednesday, November 27th. Ten investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat, BRP presently has a consensus rating of "Hold" and an average target price of C$87.17.

View Our Latest Stock Report on BRP

BRP Trading Up 1.7 %

BRP stock traded up C$0.96 during mid-day trading on Wednesday, hitting C$57.37. The stock had a trading volume of 160,949 shares, compared to its average volume of 169,902. The stock has a 50-day simple moving average of C$68.63 and a two-hundred day simple moving average of C$75.32. The stock has a market capitalization of C$4.22 billion, a PE ratio of 21.62, a P/E/G ratio of 2.05 and a beta of 2.28. BRP has a 12 month low of C$55.98 and a 12 month high of C$102.46. The company has a current ratio of 1.37, a quick ratio of 0.20 and a debt-to-equity ratio of 573.79.

About BRP

(

Get Free Report)

BRP Inc, together with its subsidiaries, designs, develops, manufactures, distributes, and markets powersports vehicles and marine products in the United States, Canada, Europe, the Asia Pacific, Mexico, Austria, and internationally. The Powersports segment offers year-round products, such as Can-Am all-terrain vehicles, side-by-side vehicles, and three-wheeled vehicles; and seasonal products, including Ski-Doo and Lynx snowmobiles, Sea-Doo personal watercrafts and pontoons, Rotax engines for karts and recreational aircraft, and Pinion gearboxes with smart shift systems.

Read More

Before you consider BRP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BRP wasn't on the list.

While BRP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.