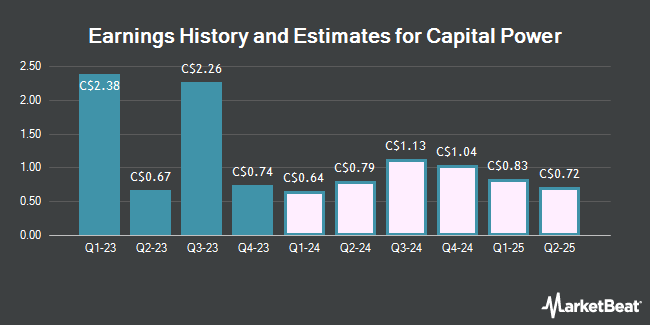

Capital Power Co. (TSE:CPX - Free Report) - Analysts at National Bank Financial upped their FY2025 earnings estimates for shares of Capital Power in a report issued on Tuesday, December 17th. National Bank Financial analyst P. Kenny now expects that the company will post earnings per share of $3.22 for the year, up from their previous forecast of $3.21. The consensus estimate for Capital Power's current full-year earnings is $2.82 per share. National Bank Financial also issued estimates for Capital Power's FY2026 earnings at $3.18 EPS.

Several other research analysts have also recently commented on the company. Scotiabank raised their target price on Capital Power from C$66.00 to C$69.00 and gave the stock an "outperform" rating in a research report on Wednesday. National Bankshares raised their price objective on shares of Capital Power from C$56.00 to C$65.00 and gave the stock an "outperform" rating in a report on Wednesday. ATB Capital lifted their target price on shares of Capital Power from C$57.00 to C$63.00 and gave the company a "sector perform" rating in a research report on Wednesday. TD Securities increased their price target on shares of Capital Power from C$61.00 to C$70.00 and gave the stock a "buy" rating in a research report on Wednesday, December 4th. Finally, Royal Bank of Canada decreased their price objective on Capital Power from C$54.00 to C$53.00 and set a "sector perform" rating on the stock in a report on Thursday, October 31st. Six equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of C$61.22.

Get Our Latest Stock Report on CPX

Capital Power Stock Performance

Shares of CPX stock traded up C$0.55 during mid-day trading on Friday, reaching C$63.15. The stock had a trading volume of 1,087,008 shares, compared to its average volume of 499,640. Capital Power has a one year low of C$33.90 and a one year high of C$68.73. The firm has a market cap of C$8.21 billion, a PE ratio of 12.50, a P/E/G ratio of 0.91 and a beta of 0.64. The firm's 50 day simple moving average is C$57.79 and its 200 day simple moving average is C$48.21. The company has a quick ratio of 0.55, a current ratio of 0.88 and a debt-to-equity ratio of 133.46.

Capital Power Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Tuesday, December 31st will be given a dividend of $0.652 per share. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $2.61 dividend on an annualized basis and a yield of 4.13%. Capital Power's dividend payout ratio (DPR) is presently 51.68%.

Insider Activity at Capital Power

In related news, Senior Officer Bryan Deneve sold 6,100 shares of the firm's stock in a transaction that occurred on Friday, October 4th. The shares were sold at an average price of C$50.55, for a total value of C$308,355.00. Insiders own 0.17% of the company's stock.

About Capital Power

(

Get Free Report)

Capital Power Corporation develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States. It generates electricity from various energy sources, including wind, solar, waste heat, natural gas, and coal. The company owns an approximately 7,500 megawatts (MW) of power generation capacity at 29 facilities.

Read More

Before you consider Capital Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capital Power wasn't on the list.

While Capital Power currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.