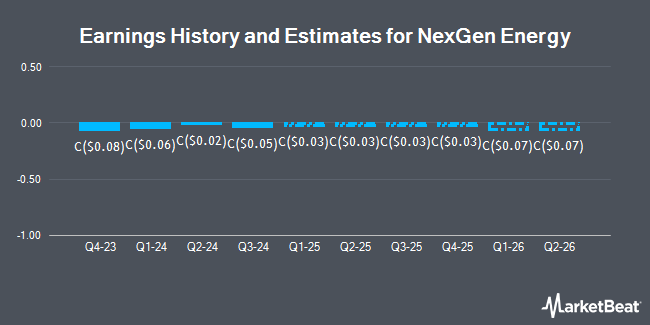

NexGen Energy Ltd. (TSE:NXE - Free Report) - Equities researchers at Ventum Cap Mkts boosted their FY2027 earnings per share estimates for NexGen Energy in a report released on Wednesday, March 12th. Ventum Cap Mkts analyst A. Terentiew now anticipates that the company will earn ($0.08) per share for the year, up from their prior forecast of ($0.19). The consensus estimate for NexGen Energy's current full-year earnings is ($0.07) per share. Ventum Cap Mkts also issued estimates for NexGen Energy's FY2028 earnings at ($0.18) EPS.

Other analysts also recently issued research reports about the company. Raymond James raised their price objective on NexGen Energy from C$12.00 to C$13.50 in a research report on Wednesday, November 20th. TD Securities decreased their price target on shares of NexGen Energy from C$13.00 to C$12.00 and set a "buy" rating on the stock in a research note on Thursday, March 6th. National Bankshares dropped their price objective on shares of NexGen Energy from C$13.50 to C$12.50 and set an "outperform" rating for the company in a research note on Friday, March 7th. Cormark raised their price objective on shares of NexGen Energy from C$13.00 to C$13.50 in a report on Wednesday, November 20th. Finally, Royal Bank of Canada upped their target price on shares of NexGen Energy from C$10.00 to C$15.00 in a research note on Thursday, November 21st. Six investment analysts have rated the stock with a buy rating and four have given a strong buy rating to the stock. According to MarketBeat, NexGen Energy presently has a consensus rating of "Buy" and a consensus price target of C$13.28.

Get Our Latest Stock Report on NXE

NexGen Energy Stock Performance

Shares of TSE NXE traded up C$0.14 during mid-day trading on Monday, hitting C$7.23. The company had a trading volume of 1,474,215 shares, compared to its average volume of 1,770,751. NexGen Energy has a 12 month low of C$6.44 and a 12 month high of C$12.51. The firm has a market cap of C$4.09 billion, a P/E ratio of 27.68 and a beta of 1.76. The business's 50-day simple moving average is C$8.59 and its 200-day simple moving average is C$9.43. The company has a debt-to-equity ratio of 35.49, a current ratio of 1.16 and a quick ratio of 8.20.

Insider Transactions at NexGen Energy

In other NexGen Energy news, Director Leigh Robert Curyer purchased 1,500,000 shares of the business's stock in a transaction that occurred on Friday, December 20th. The stock was acquired at an average cost of C$10.05 per share, with a total value of C$15,075,000.00. 7.96% of the stock is owned by company insiders.

About NexGen Energy

(

Get Free Report)

NexGen Energy Ltd is a mineral exploration company. It is engaged in the acquisition, exploration, evaluation and development of uranium properties in Canada. The company's projects portfolio consists of ROOK I, Radio Property, and the IsoEnergy, at the Athabasca Basin. The Rook I property hosts the world-class Arrow Zone, the Bow discovery.

Featured Stories

Before you consider NexGen Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexGen Energy wasn't on the list.

While NexGen Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.