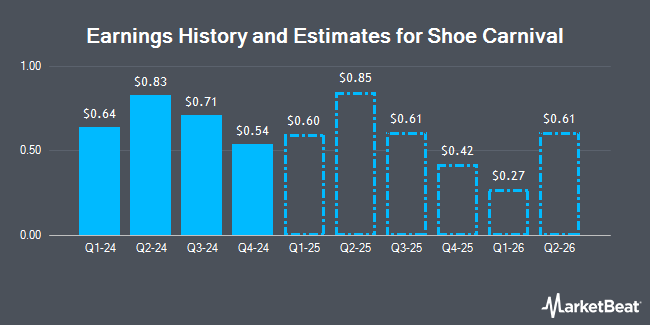

Shoe Carnival, Inc. (NASDAQ:SCVL - Free Report) - Stock analysts at Seaport Res Ptn reduced their FY2026 earnings estimates for shares of Shoe Carnival in a research note issued on Tuesday, March 11th. Seaport Res Ptn analyst M. Kummetz now expects that the company will earn $2.60 per share for the year, down from their prior estimate of $2.93. The consensus estimate for Shoe Carnival's current full-year earnings is $2.60 per share. Seaport Res Ptn also issued estimates for Shoe Carnival's FY2027 earnings at $2.90 EPS.

Separately, StockNews.com upgraded shares of Shoe Carnival from a "sell" rating to a "hold" rating in a report on Saturday, November 30th.

Get Our Latest Analysis on SCVL

Shoe Carnival Price Performance

NASDAQ:SCVL traded up $0.35 on Friday, reaching $22.72. The stock had a trading volume of 533,188 shares, compared to its average volume of 318,763. The company has a market cap of $617.42 million, a price-to-earnings ratio of 8.35 and a beta of 1.51. The firm's fifty day moving average is $25.73 and its two-hundred day moving average is $33.28. Shoe Carnival has a 12-month low of $20.51 and a 12-month high of $46.92.

Institutional Investors Weigh In On Shoe Carnival

Several hedge funds have recently modified their holdings of the stock. Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in shares of Shoe Carnival in the fourth quarter worth approximately $2,513,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its position in shares of Shoe Carnival by 19.3% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 59,740 shares of the company's stock worth $1,976,000 after acquiring an additional 9,671 shares during the last quarter. Voloridge Investment Management LLC acquired a new stake in shares of Shoe Carnival in the fourth quarter worth approximately $1,231,000. Wolverine Trading LLC acquired a new stake in shares of Shoe Carnival in the fourth quarter worth approximately $372,000. Finally, Vident Advisory LLC acquired a new stake in shares of Shoe Carnival in the fourth quarter worth approximately $486,000. 66.05% of the stock is owned by institutional investors and hedge funds.

Shoe Carnival announced that its board has initiated a stock buyback program on Thursday, December 12th that authorizes the company to repurchase $50.00 million in outstanding shares. This repurchase authorization authorizes the company to repurchase up to 5.2% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's board believes its shares are undervalued.

Shoe Carnival Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, April 21st. Investors of record on Monday, April 7th will be given a $0.15 dividend. The ex-dividend date of this dividend is Monday, April 7th. This is a boost from Shoe Carnival's previous quarterly dividend of $0.14. This represents a $0.60 annualized dividend and a dividend yield of 2.64%. Shoe Carnival's dividend payout ratio (DPR) is currently 19.85%.

Shoe Carnival Company Profile

(

Get Free Report)

Shoe Carnival, Inc, together with its subsidiaries, operates as a family footwear retailer in the United States. The company offers range of dress, casual, work, and athletic shoes, as well as sandals and boots for men, women, and children; and various accessories. The company also operates stores, and sells its products through online shopping at shoecarnival.com, as well as through mobile app.

Featured Articles

Before you consider Shoe Carnival, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shoe Carnival wasn't on the list.

While Shoe Carnival currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.