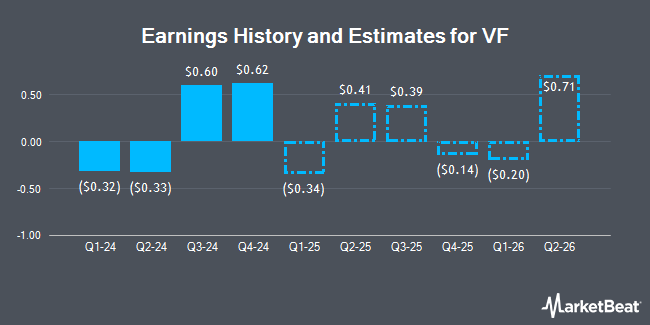

VF Corporation (NYSE:VFC - Free Report) - Equities research analysts at Zacks Research issued their Q3 2025 earnings per share (EPS) estimates for shares of VF in a research report issued on Monday, November 11th. Zacks Research analyst R. Department forecasts that the textile maker will post earnings per share of $0.33 for the quarter. The consensus estimate for VF's current full-year earnings is $0.48 per share. Zacks Research also issued estimates for VF's Q4 2025 earnings at ($0.20) EPS, FY2025 earnings at $0.40 EPS, Q1 2026 earnings at ($0.28) EPS, Q2 2026 earnings at $0.70 EPS, Q3 2026 earnings at $0.47 EPS, Q4 2026 earnings at ($0.05) EPS, FY2026 earnings at $0.84 EPS, Q1 2027 earnings at ($0.20) EPS, Q2 2027 earnings at $0.74 EPS and FY2027 earnings at $1.08 EPS.

VF (NYSE:VFC - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The textile maker reported $0.60 EPS for the quarter, topping analysts' consensus estimates of $0.41 by $0.19. The business had revenue of $2.76 billion for the quarter, compared to analyst estimates of $2.72 billion. VF had a negative net margin of 6.68% and a positive return on equity of 12.53%. The firm's revenue for the quarter was down 5.6% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.63 earnings per share.

Other research analysts have also recently issued reports about the company. Evercore ISI raised their price target on VF from $14.00 to $16.00 and gave the company an "in-line" rating in a research note on Wednesday, August 7th. Telsey Advisory Group raised their target price on shares of VF from $19.00 to $21.00 and gave the company a "market perform" rating in a research note on Tuesday, October 29th. Stifel Nicolaus boosted their target price on shares of VF from $21.00 to $25.00 and gave the stock a "buy" rating in a report on Monday, October 14th. Wells Fargo & Company cut shares of VF from an "equal weight" rating to an "underweight" rating and cut their price target for the company from $16.00 to $15.00 in a research note on Monday, October 14th. Finally, StockNews.com upgraded shares of VF from a "sell" rating to a "hold" rating in a research note on Saturday, October 26th. Three equities research analysts have rated the stock with a sell rating, thirteen have given a hold rating and three have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $18.19.

Get Our Latest Report on VF

VF Stock Down 1.4 %

NYSE:VFC traded down $0.28 on Wednesday, hitting $19.99. 6,936,267 shares of the company's stock were exchanged, compared to its average volume of 8,264,162. The company has a market cap of $7.78 billion, a P/E ratio of -11.55, a price-to-earnings-growth ratio of 7.89 and a beta of 1.52. The firm has a 50-day moving average price of $19.28 and a 200-day moving average price of $16.24. The company has a debt-to-equity ratio of 2.86, a current ratio of 1.30 and a quick ratio of 0.88. VF has a 52 week low of $11.00 and a 52 week high of $23.09.

Hedge Funds Weigh In On VF

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Segall Bryant & Hamill LLC raised its position in VF by 1.8% during the third quarter. Segall Bryant & Hamill LLC now owns 3,663,341 shares of the textile maker's stock valued at $73,084,000 after purchasing an additional 65,919 shares in the last quarter. Hanseatic Management Services Inc. bought a new stake in shares of VF during the 3rd quarter worth $640,000. Arkadios Wealth Advisors boosted its stake in VF by 5.3% in the third quarter. Arkadios Wealth Advisors now owns 24,108 shares of the textile maker's stock valued at $481,000 after buying an additional 1,217 shares in the last quarter. Fiduciary Alliance LLC grew its position in VF by 18.9% in the third quarter. Fiduciary Alliance LLC now owns 240,100 shares of the textile maker's stock valued at $4,790,000 after acquiring an additional 38,088 shares during the last quarter. Finally, Future Financial Wealth Managment LLC acquired a new position in VF during the third quarter worth about $40,000. 86.84% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In other VF news, Director Richard Carucci acquired 15,000 shares of the company's stock in a transaction on Thursday, August 22nd. The stock was acquired at an average price of $16.70 per share, for a total transaction of $250,500.00. Following the purchase, the director now directly owns 230,178 shares of the company's stock, valued at $3,843,972.60. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. 0.70% of the stock is currently owned by company insiders.

VF Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Tuesday, December 10th will be given a $0.09 dividend. The ex-dividend date of this dividend is Tuesday, December 10th. This represents a $0.36 dividend on an annualized basis and a dividend yield of 1.80%. VF's payout ratio is presently -20.81%.

About VF

(

Get Free Report)

V.F. Corporation, together with its subsidiaries, engages in the design, procurement, marketing, and distribution of branded lifestyle apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific. It operates through three segments: Outdoor, Active, and Work.

Featured Articles

Before you consider VF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VF wasn't on the list.

While VF currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.