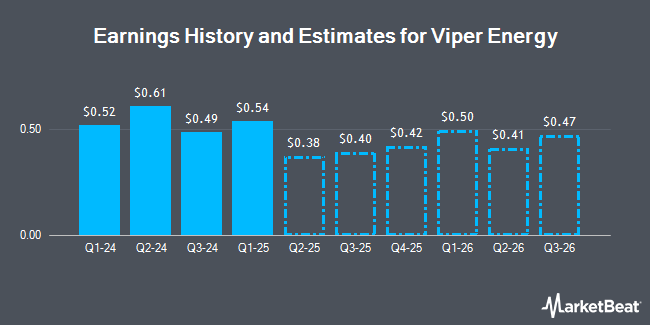

Viper Energy, Inc. (NASDAQ:VNOM - Free Report) - Equities research analysts at Zacks Research lifted their FY2024 earnings estimates for shares of Viper Energy in a report released on Monday, November 25th. Zacks Research analyst R. Department now anticipates that the oil and gas producer will post earnings per share of $1.95 for the year, up from their prior estimate of $1.84. The consensus estimate for Viper Energy's current full-year earnings is $2.02 per share. Zacks Research also issued estimates for Viper Energy's Q1 2026 earnings at $0.37 EPS and FY2026 earnings at $1.84 EPS.

Viper Energy (NASDAQ:VNOM - Get Free Report) last posted its earnings results on Monday, November 4th. The oil and gas producer reported $0.49 earnings per share for the quarter, topping analysts' consensus estimates of $0.47 by $0.02. Viper Energy had a net margin of 24.65% and a return on equity of 6.72%. The firm had revenue of $209.59 million for the quarter, compared to analysts' expectations of $210.54 million. During the same quarter in the previous year, the firm posted $1.10 earnings per share. The company's revenue was down 28.5% on a year-over-year basis.

Other research analysts also recently issued research reports about the company. Bank of America started coverage on Viper Energy in a research note on Tuesday. They issued a "buy" rating and a $64.00 price objective for the company. StockNews.com cut shares of Viper Energy from a "hold" rating to a "sell" rating in a research note on Tuesday, November 5th. TD Securities raised their target price on Viper Energy from $46.00 to $48.00 and gave the stock a "buy" rating in a research report on Thursday, September 12th. Barclays upped their price target on Viper Energy from $52.00 to $58.00 and gave the company an "overweight" rating in a research report on Tuesday, November 5th. Finally, Truist Financial increased their price target on Viper Energy from $57.00 to $64.00 and gave the company a "buy" rating in a research note on Wednesday, November 6th. One analyst has rated the stock with a sell rating and nine have issued a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $55.78.

Check Out Our Latest Report on VNOM

Viper Energy Price Performance

VNOM traded down $0.32 on Thursday, reaching $53.94. The stock had a trading volume of 643,558 shares, compared to its average volume of 887,007. The company has a current ratio of 7.24, a quick ratio of 7.24 and a debt-to-equity ratio of 0.25. The company has a market capitalization of $10.16 billion, a price-to-earnings ratio of 23.15 and a beta of 1.72. Viper Energy has a fifty-two week low of $29.03 and a fifty-two week high of $56.76. The firm has a 50-day moving average of $51.10 and a 200-day moving average of $44.72.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the stock. State Street Corp increased its holdings in shares of Viper Energy by 78.2% during the third quarter. State Street Corp now owns 3,833,257 shares of the oil and gas producer's stock valued at $172,918,000 after acquiring an additional 1,682,183 shares in the last quarter. Massachusetts Financial Services Co. MA raised its holdings in Viper Energy by 12.0% during the second quarter. Massachusetts Financial Services Co. MA now owns 2,085,841 shares of the oil and gas producer's stock worth $78,282,000 after buying an additional 224,021 shares during the last quarter. Geode Capital Management LLC lifted its stake in shares of Viper Energy by 16.0% in the third quarter. Geode Capital Management LLC now owns 1,698,661 shares of the oil and gas producer's stock valued at $76,647,000 after buying an additional 234,048 shares in the last quarter. Merewether Investment Management LP grew its holdings in shares of Viper Energy by 22.9% during the third quarter. Merewether Investment Management LP now owns 860,600 shares of the oil and gas producer's stock valued at $38,822,000 after buying an additional 160,600 shares during the last quarter. Finally, TD Asset Management Inc increased its position in shares of Viper Energy by 2.6% during the second quarter. TD Asset Management Inc now owns 841,414 shares of the oil and gas producer's stock worth $31,578,000 after acquiring an additional 21,420 shares in the last quarter. 87.72% of the stock is owned by institutional investors.

Viper Energy Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, November 21st. Stockholders of record on Thursday, November 14th were paid a $0.30 dividend. The ex-dividend date of this dividend was Thursday, November 14th. This represents a $1.20 annualized dividend and a dividend yield of 2.22%. Viper Energy's dividend payout ratio is currently 51.50%.

About Viper Energy

(

Get Free Report)

Viper Energy, Inc owns and acquires mineral and royalty interests in oil and natural gas properties in the Permian Basin, North America. Viper Energy Partners GP LLC operates as the general partner of the company. The company was formerly known as Viper Energy Partners LP and changed its name to Viper Energy, Inc in November 2023.

Read More

Before you consider Viper Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viper Energy wasn't on the list.

While Viper Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.