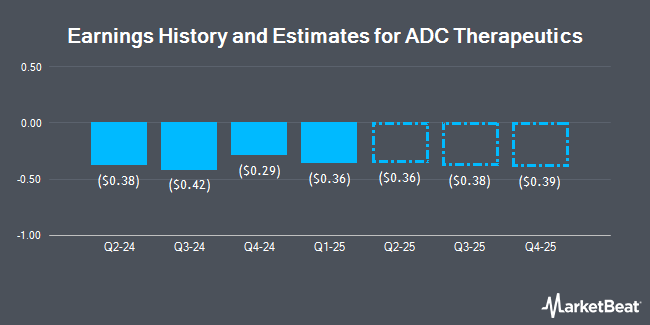

ADC Therapeutics SA (NYSE:ADCT - Free Report) - Equities researchers at HC Wainwright issued their FY2024 EPS estimates for shares of ADC Therapeutics in a note issued to investors on Wednesday, December 11th. HC Wainwright analyst R. Burns expects that the company will post earnings of ($1.75) per share for the year. HC Wainwright has a "Buy" rating on the stock. The consensus estimate for ADC Therapeutics' current full-year earnings is ($1.67) per share. HC Wainwright also issued estimates for ADC Therapeutics' Q4 2024 earnings at ($0.41) EPS, Q1 2025 earnings at ($0.41) EPS, Q2 2025 earnings at ($0.42) EPS, Q3 2025 earnings at ($0.43) EPS, Q4 2025 earnings at ($0.44) EPS and FY2025 earnings at ($1.70) EPS.

ADC Therapeutics (NYSE:ADCT - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported ($0.42) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.36) by ($0.06). The firm had revenue of $18.46 million during the quarter, compared to analyst estimates of $18.76 million. During the same quarter last year, the firm posted ($0.58) earnings per share.

A number of other analysts also recently weighed in on ADCT. Guggenheim reissued a "buy" rating and set a $10.00 price target on shares of ADC Therapeutics in a research report on Thursday. Stephens started coverage on shares of ADC Therapeutics in a report on Friday, November 8th. They set an "overweight" rating and a $6.00 price objective for the company. Five research analysts have rated the stock with a buy rating, According to MarketBeat, the company has an average rating of "Buy" and a consensus price target of $8.00.

Get Our Latest Analysis on ADC Therapeutics

ADC Therapeutics Trading Down 4.5 %

ADCT stock traded down $0.09 during midday trading on Friday, hitting $1.89. 1,468,980 shares of the company's stock were exchanged, compared to its average volume of 700,270. The firm has a 50 day moving average price of $2.70 and a 200-day moving average price of $2.99. ADC Therapeutics has a 12-month low of $1.18 and a 12-month high of $6.04. The stock has a market capitalization of $182.74 million, a price-to-earnings ratio of -0.79 and a beta of 1.52.

Insider Transactions at ADC Therapeutics

In related news, major shareholder Redmile Group, Llc sold 25,352 shares of the business's stock in a transaction dated Wednesday, December 4th. The shares were sold at an average price of $2.07, for a total transaction of $52,478.64. Following the completion of the sale, the insider now owns 15,566,731 shares of the company's stock, valued at $32,223,133.17. This represents a 0.16 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 4.10% of the company's stock.

Hedge Funds Weigh In On ADC Therapeutics

Large investors have recently bought and sold shares of the business. Sanibel Captiva Trust Company Inc. increased its position in ADC Therapeutics by 9.7% in the second quarter. Sanibel Captiva Trust Company Inc. now owns 113,000 shares of the company's stock worth $357,000 after buying an additional 10,000 shares during the period. Bank of New York Mellon Corp bought a new position in shares of ADC Therapeutics during the second quarter worth about $648,000. Rhumbline Advisers acquired a new stake in shares of ADC Therapeutics in the 2nd quarter worth about $272,000. Acadian Asset Management LLC bought a new stake in ADC Therapeutics in the 2nd quarter valued at about $51,000. Finally, XTX Topco Ltd lifted its position in ADC Therapeutics by 129.0% in the 2nd quarter. XTX Topco Ltd now owns 56,863 shares of the company's stock valued at $180,000 after purchasing an additional 32,034 shares during the last quarter. Institutional investors own 41.10% of the company's stock.

ADC Therapeutics Company Profile

(

Get Free Report)

ADC Therapeutics SA focuses on advancing its proprietary antibody drug conjugate (ADC) technology platform to transform the treatment paradigm for patients with hematologic malignancies and solid tumors. Its flagship product is ZYNLONTA, a CD19-directed ADC, received accelerated approval from the U.S.

Featured Articles

Before you consider ADC Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADC Therapeutics wasn't on the list.

While ADC Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.