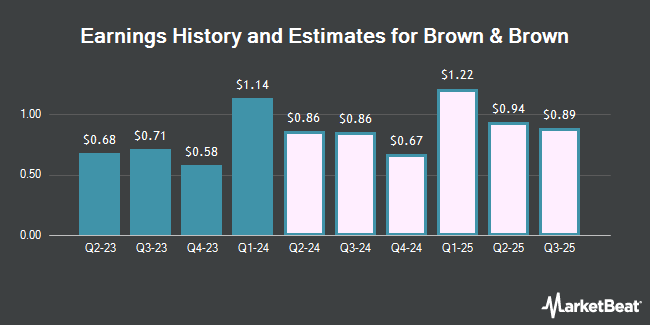

Brown & Brown, Inc. (NYSE:BRO - Free Report) - Analysts at Zacks Research boosted their FY2024 EPS estimates for shares of Brown & Brown in a research note issued on Monday, November 18th. Zacks Research analyst T. De now expects that the financial services provider will post earnings per share of $3.72 for the year, up from their previous estimate of $3.67. The consensus estimate for Brown & Brown's current full-year earnings is $3.73 per share. Zacks Research also issued estimates for Brown & Brown's Q4 2024 earnings at $0.74 EPS, Q1 2025 earnings at $1.23 EPS, Q2 2025 earnings at $1.00 EPS, Q3 2025 earnings at $0.94 EPS, Q4 2025 earnings at $0.88 EPS, FY2025 earnings at $4.05 EPS, Q1 2026 earnings at $1.13 EPS, Q2 2026 earnings at $1.04 EPS, Q3 2026 earnings at $1.09 EPS and FY2026 earnings at $4.36 EPS.

BRO has been the subject of several other research reports. Wells Fargo & Company boosted their price objective on shares of Brown & Brown from $112.00 to $114.00 and gave the company an "overweight" rating in a research note on Thursday, October 10th. Royal Bank of Canada increased their target price on shares of Brown & Brown from $113.00 to $118.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Jefferies Financial Group raised their target price on shares of Brown & Brown from $98.00 to $104.00 and gave the stock a "hold" rating in a report on Wednesday, October 9th. StockNews.com cut Brown & Brown from a "buy" rating to a "hold" rating in a report on Saturday, November 2nd. Finally, Raymond James increased their price target on shares of Brown & Brown from $95.00 to $110.00 and gave the stock an "outperform" rating in a research note on Thursday, July 25th. One research analyst has rated the stock with a sell rating, five have assigned a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $106.50.

Get Our Latest Report on BRO

Brown & Brown Stock Performance

BRO traded down $0.16 during trading on Wednesday, hitting $109.19. 277,387 shares of the company traded hands, compared to its average volume of 1,312,507. The firm has a market cap of $31.22 billion, a P/E ratio of 29.80, a price-to-earnings-growth ratio of 2.54 and a beta of 0.82. Brown & Brown has a one year low of $69.13 and a one year high of $114.08. The company has a quick ratio of 1.73, a current ratio of 1.73 and a debt-to-equity ratio of 0.52. The stock's fifty day moving average is $105.63 and its 200 day moving average is $98.46.

Brown & Brown (NYSE:BRO - Get Free Report) last released its quarterly earnings data on Monday, October 28th. The financial services provider reported $0.91 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.88 by $0.03. Brown & Brown had a net margin of 22.65% and a return on equity of 17.12%. The company had revenue of $1.19 billion for the quarter, compared to analysts' expectations of $1.16 billion. During the same quarter in the prior year, the firm earned $0.71 EPS. The business's revenue was up 11.0% on a year-over-year basis.

Brown & Brown Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, November 13th. Stockholders of record on Wednesday, November 6th were issued a $0.15 dividend. The ex-dividend date was Wednesday, November 6th. This is an increase from Brown & Brown's previous quarterly dividend of $0.13. This represents a $0.60 dividend on an annualized basis and a dividend yield of 0.55%. Brown & Brown's dividend payout ratio (DPR) is currently 16.35%.

Insider Activity

In related news, Chairman Hyatt J. Brown sold 134,640 shares of the business's stock in a transaction on Thursday, August 29th. The stock was sold at an average price of $104.51, for a total transaction of $14,071,226.40. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Company insiders own 16.43% of the company's stock.

Institutional Trading of Brown & Brown

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Principal Financial Group Inc. lifted its position in Brown & Brown by 0.7% during the 2nd quarter. Principal Financial Group Inc. now owns 12,804,979 shares of the financial services provider's stock worth $1,144,893,000 after acquiring an additional 86,824 shares during the period. Allspring Global Investments Holdings LLC lifted its holdings in shares of Brown & Brown by 0.7% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 3,915,425 shares of the financial services provider's stock valued at $405,638,000 after buying an additional 28,180 shares during the period. The Manufacturers Life Insurance Company lifted its holdings in shares of Brown & Brown by 24.6% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 3,489,305 shares of the financial services provider's stock valued at $311,979,000 after buying an additional 687,783 shares during the period. Barclays PLC lifted its holdings in shares of Brown & Brown by 17.8% in the 3rd quarter. Barclays PLC now owns 2,466,582 shares of the financial services provider's stock valued at $255,537,000 after buying an additional 371,980 shares during the period. Finally, Royal London Asset Management Ltd. lifted its holdings in shares of Brown & Brown by 105.1% in the 2nd quarter. Royal London Asset Management Ltd. now owns 2,068,333 shares of the financial services provider's stock valued at $184,930,000 after buying an additional 1,059,711 shares during the period. Institutional investors and hedge funds own 71.01% of the company's stock.

Brown & Brown Company Profile

(

Get Free Report)

Brown & Brown, Inc markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally. It operates through four segments: Retail, National Programs, Wholesale Brokerage, and Services. The Retail segment provides property and casualty, employee benefits insurance products, personal insurance products, specialties insurance products, risk management strategies, loss control survey and analysis, consultancy, and claims processing services.

Recommended Stories

Before you consider Brown & Brown, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brown & Brown wasn't on the list.

While Brown & Brown currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report