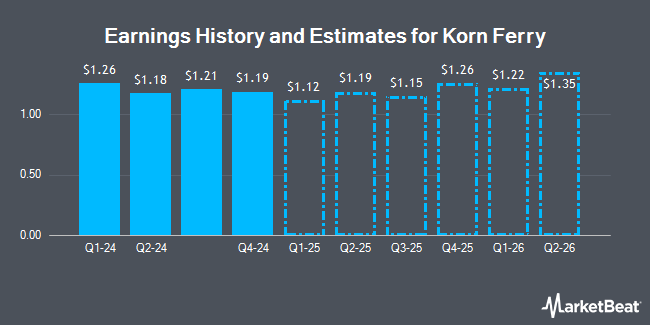

Korn Ferry (NYSE:KFY - Free Report) - Research analysts at William Blair upped their FY2025 earnings per share (EPS) estimates for Korn Ferry in a report issued on Monday, November 4th. William Blair analyst T. Romeo now anticipates that the business services provider will post earnings of $4.81 per share for the year, up from their prior forecast of $4.79. The consensus estimate for Korn Ferry's current full-year earnings is $4.83 per share.

Korn Ferry (NYSE:KFY - Get Free Report) last issued its earnings results on Thursday, September 5th. The business services provider reported $1.18 EPS for the quarter, beating analysts' consensus estimates of $1.12 by $0.06. Korn Ferry had a return on equity of 13.73% and a net margin of 6.68%. The firm had revenue of $682.80 million for the quarter, compared to the consensus estimate of $663.84 million. During the same quarter in the previous year, the company posted $0.99 earnings per share. The business's quarterly revenue was down 3.3% compared to the same quarter last year.

Korn Ferry Stock Up 7.4 %

NYSE KFY traded up $5.46 on Wednesday, reaching $79.37. The stock had a trading volume of 697,097 shares, compared to its average volume of 280,537. The company has a market capitalization of $4.13 billion, a price-to-earnings ratio of 22.68 and a beta of 1.55. The business has a 50 day moving average price of $71.69 and a 200 day moving average price of $68.55. Korn Ferry has a 1 year low of $47.28 and a 1 year high of $79.54. The company has a current ratio of 2.15, a quick ratio of 2.15 and a debt-to-equity ratio of 0.23.

Korn Ferry Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Thursday, September 19th were paid a dividend of $0.37 per share. The ex-dividend date was Thursday, September 19th. This represents a $1.48 annualized dividend and a dividend yield of 1.86%. Korn Ferry's dividend payout ratio (DPR) is presently 42.29%.

Insider Transactions at Korn Ferry

In other news, CFO Robert P. Rozek sold 20,921 shares of the company's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $75.53, for a total transaction of $1,580,163.13. Following the completion of the sale, the chief financial officer now owns 154,535 shares in the company, valued at approximately $11,672,028.55. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In related news, CFO Robert P. Rozek sold 20,921 shares of the business's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $75.53, for a total transaction of $1,580,163.13. Following the completion of the transaction, the chief financial officer now owns 154,535 shares of the company's stock, valued at approximately $11,672,028.55. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Debra J. Perry sold 5,280 shares of the business's stock in a transaction dated Tuesday, October 15th. The stock was sold at an average price of $73.30, for a total value of $387,024.00. Following the transaction, the director now directly owns 46,180 shares of the company's stock, valued at $3,384,994. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 86,201 shares of company stock worth $6,329,320. 1.40% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Korn Ferry

Several large investors have recently made changes to their positions in the business. Seizert Capital Partners LLC lifted its position in shares of Korn Ferry by 21.9% during the 3rd quarter. Seizert Capital Partners LLC now owns 72,496 shares of the business services provider's stock worth $5,455,000 after purchasing an additional 13,017 shares during the last quarter. Natixis Advisors LLC raised its holdings in Korn Ferry by 2.3% in the 3rd quarter. Natixis Advisors LLC now owns 43,423 shares of the business services provider's stock valued at $3,267,000 after acquiring an additional 986 shares in the last quarter. Empowered Funds LLC acquired a new position in Korn Ferry in the 3rd quarter valued at approximately $1,214,000. Victory Capital Management Inc. raised its holdings in Korn Ferry by 3.6% in the 3rd quarter. Victory Capital Management Inc. now owns 797,315 shares of the business services provider's stock valued at $59,990,000 after acquiring an additional 27,773 shares in the last quarter. Finally, Meritage Portfolio Management raised its holdings in Korn Ferry by 9.3% in the 3rd quarter. Meritage Portfolio Management now owns 5,019 shares of the business services provider's stock valued at $378,000 after acquiring an additional 428 shares in the last quarter. Institutional investors and hedge funds own 98.82% of the company's stock.

About Korn Ferry

(

Get Free Report)

Korn Ferry, together with its subsidiaries, provides organizational consulting services worldwide. It operates through four segments: Consulting, Digital, Executive Search, and Recruitment Process Outsourcing (RPO) & Professional Search. The company provides executive search services to recruit board level, chief executive, other senior executive, and general management talent of organizations.

Recommended Stories

Before you consider Korn Ferry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Korn Ferry wasn't on the list.

While Korn Ferry currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.