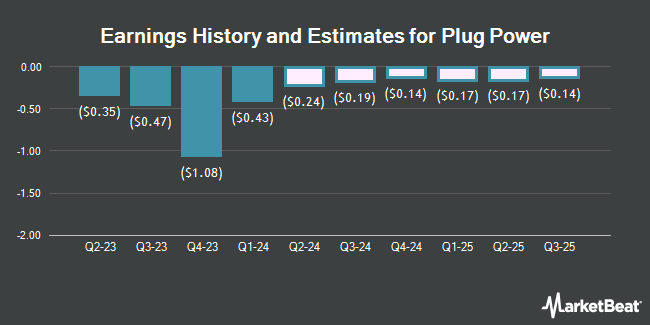

Plug Power Inc. (NASDAQ:PLUG - Free Report) - Equities researchers at Roth Capital lifted their FY2024 earnings per share estimates for shares of Plug Power in a research report issued on Tuesday, November 12th. Roth Capital analyst C. Irwin now expects that the electronics maker will post earnings per share of ($1.27) for the year, up from their previous estimate of ($1.28). The consensus estimate for Plug Power's current full-year earnings is ($1.16) per share. Roth Capital also issued estimates for Plug Power's Q4 2024 earnings at ($0.24) EPS, Q4 2025 earnings at ($0.08) EPS and FY2025 earnings at ($0.60) EPS.

Plug Power (NASDAQ:PLUG - Get Free Report) last announced its quarterly earnings results on Tuesday, November 12th. The electronics maker reported ($0.25) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.24) by ($0.01). The firm had revenue of $173.70 million for the quarter, compared to analyst estimates of $207.25 million. Plug Power had a negative net margin of 214.05% and a negative return on equity of 46.99%. The business's revenue was down 12.6% compared to the same quarter last year. During the same period last year, the firm posted ($0.47) EPS.

PLUG has been the subject of a number of other reports. Craig Hallum reduced their target price on shares of Plug Power from $4.00 to $3.00 and set a "buy" rating for the company in a report on Thursday. Wells Fargo & Company reduced their price objective on Plug Power from $3.00 to $2.00 and set an "equal weight" rating for the company in a research note on Thursday. Susquehanna cut their target price on Plug Power from $3.00 to $2.00 and set a "neutral" rating on the stock in a research report on Monday, August 12th. Royal Bank of Canada reduced their target price on Plug Power from $3.50 to $2.50 and set a "sector perform" rating for the company in a report on Monday, August 12th. Finally, Canaccord Genuity Group dropped their price target on Plug Power from $2.50 to $2.25 and set a "hold" rating on the stock in a research note on Wednesday. Four investment analysts have rated the stock with a sell rating, eleven have assigned a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, Plug Power has an average rating of "Hold" and an average price target of $4.52.

Check Out Our Latest Research Report on Plug Power

Plug Power Price Performance

Shares of PLUG traded down $0.10 during midday trading on Friday, reaching $1.87. The stock had a trading volume of 59,276,267 shares, compared to its average volume of 41,205,961. The firm's 50 day moving average price is $2.08 and its 200-day moving average price is $2.40. Plug Power has a 52 week low of $1.60 and a 52 week high of $5.14. The company has a market capitalization of $1.64 billion, a P/E ratio of -0.87 and a beta of 1.81. The company has a debt-to-equity ratio of 0.15, a current ratio of 2.08 and a quick ratio of 0.91.

Hedge Funds Weigh In On Plug Power

Institutional investors and hedge funds have recently modified their holdings of the business. Duff & Phelps Investment Management Co. increased its holdings in shares of Plug Power by 31.7% during the third quarter. Duff & Phelps Investment Management Co. now owns 75,160 shares of the electronics maker's stock valued at $170,000 after acquiring an additional 18,110 shares in the last quarter. Main Management ETF Advisors LLC purchased a new position in shares of Plug Power during the third quarter valued at approximately $823,000. XTX Topco Ltd bought a new stake in Plug Power during the third quarter worth $2,174,000. Stifel Financial Corp lifted its stake in Plug Power by 23.4% during the 3rd quarter. Stifel Financial Corp now owns 1,398,398 shares of the electronics maker's stock valued at $3,160,000 after acquiring an additional 265,514 shares in the last quarter. Finally, Millburn Ridgefield Corp grew its stake in shares of Plug Power by 79.9% in the 3rd quarter. Millburn Ridgefield Corp now owns 12,681 shares of the electronics maker's stock worth $29,000 after acquiring an additional 5,631 shares in the last quarter. 43.48% of the stock is currently owned by institutional investors.

About Plug Power

(

Get Free Report)

Plug Power Inc develops hydrogen and fuel cell product solutions in North America, Europe, Asia, and internationally. The company offers GenDrive, a hydrogen-fueled proton exchange membrane (PEM) fuel cell system that provides power to material handling electric vehicles; GenSure, a stationary fuel cell solution that offers modular PEM fuel cell power to support the backup and grid-support power requirements of the telecommunications, transportation, and utility sectors; ProGen, a fuel cell stack and engine technology used in mobility and stationary fuel cell systems, and as engines in electric delivery vans; GenFuel, a liquid hydrogen fueling delivery, generation, storage, and dispensing system; GenCare, an ongoing Internet of Things-based maintenance and on-site service program for GenDrive fuel cell systems, GenSure fuel cell systems, GenFuel hydrogen storage and dispensing products, and ProGen fuel cell engines; and GenKey, an integrated turn-key solution for transitioning to fuel cell power.

Recommended Stories

Before you consider Plug Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plug Power wasn't on the list.

While Plug Power currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.