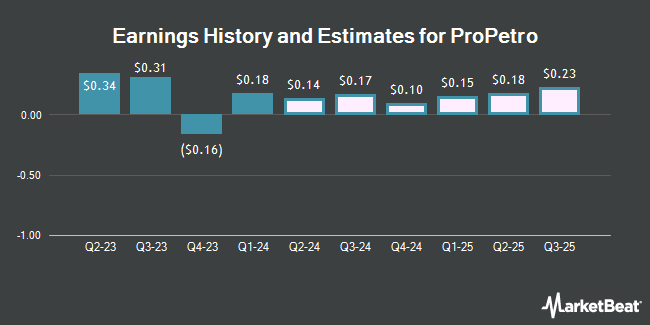

ProPetro Holding Corp. (NYSE:PUMP - Free Report) - Equities researchers at Zacks Research raised their FY2024 earnings estimates for ProPetro in a report released on Monday, December 9th. Zacks Research analyst N. Choudhury now expects that the company will post earnings per share of $0.27 for the year, up from their previous forecast of $0.26. The consensus estimate for ProPetro's current full-year earnings is $0.28 per share. Zacks Research also issued estimates for ProPetro's Q4 2024 earnings at $0.00 EPS, Q3 2025 earnings at $0.11 EPS, Q1 2026 earnings at $0.16 EPS and FY2026 earnings at $0.49 EPS.

A number of other research analysts also recently commented on the company. Barclays reduced their price target on ProPetro from $13.00 to $12.00 and set an "overweight" rating for the company in a report on Wednesday, October 16th. Citigroup decreased their price target on shares of ProPetro from $8.50 to $8.00 and set a "neutral" rating for the company in a research report on Thursday, October 31st. Stifel Nicolaus cut their price target on shares of ProPetro from $12.00 to $11.00 and set a "buy" rating on the stock in a report on Friday, October 11th. Finally, JPMorgan Chase & Co. raised shares of ProPetro from an "underweight" rating to a "neutral" rating and set a $10.00 target price for the company in a research report on Friday, December 6th. Three equities research analysts have rated the stock with a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Hold" and an average target price of $10.25.

Check Out Our Latest Stock Analysis on ProPetro

ProPetro Stock Up 4.0 %

PUMP stock traded up $0.37 during trading on Wednesday, reaching $9.66. The stock had a trading volume of 2,561,194 shares, compared to its average volume of 1,443,509. The company has a current ratio of 1.20, a quick ratio of 1.14 and a debt-to-equity ratio of 0.05. The firm has a fifty day moving average price of $7.99 and a 200 day moving average price of $8.23. The company has a market capitalization of $994.30 million, a P/E ratio of -6.99 and a beta of 2.07. ProPetro has a 1-year low of $6.53 and a 1-year high of $10.02.

Insider Buying and Selling at ProPetro

In related news, CFO David Scott Schorlemer bought 4,500 shares of the firm's stock in a transaction on Monday, November 4th. The stock was bought at an average cost of $6.86 per share, for a total transaction of $30,870.00. Following the completion of the purchase, the chief financial officer now directly owns 112,992 shares in the company, valued at approximately $775,125.12. The trade was a 4.15 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.88% of the stock is owned by insiders.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in PUMP. Franklin Resources Inc. lifted its stake in ProPetro by 5.8% in the third quarter. Franklin Resources Inc. now owns 61,979 shares of the company's stock valued at $513,000 after buying an additional 3,417 shares during the last quarter. Barclays PLC lifted its position in ProPetro by 109.2% in the 3rd quarter. Barclays PLC now owns 242,057 shares of the company's stock valued at $1,855,000 after purchasing an additional 126,346 shares during the last quarter. XTX Topco Ltd boosted its stake in ProPetro by 268.0% during the 3rd quarter. XTX Topco Ltd now owns 42,208 shares of the company's stock valued at $323,000 after purchasing an additional 30,737 shares during the period. Weiss Asset Management LP bought a new position in ProPetro in the 3rd quarter worth about $2,292,000. Finally, Quadrature Capital Ltd increased its stake in shares of ProPetro by 24.1% in the third quarter. Quadrature Capital Ltd now owns 20,252 shares of the company's stock valued at $155,000 after purchasing an additional 3,927 shares during the period. Institutional investors and hedge funds own 84.70% of the company's stock.

ProPetro Company Profile

(

Get Free Report)

ProPetro Holding Corp. operates as an integrated oilfield services company. The company provides hydraulic fracturing, wireline, cementing, and other complementary oilfield completion services to upstream oil and gas companies in the Permian Basin. ProPetro Holding Corp. was founded in 2007 and is headquartered in Midland, Texas.

Recommended Stories

Before you consider ProPetro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProPetro wasn't on the list.

While ProPetro currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.