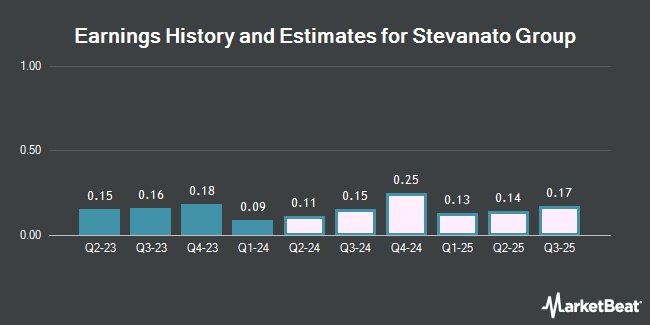

Stevanato Group S.p.A. (NYSE:STVN - Free Report) - Stock analysts at William Blair issued their Q1 2026 earnings per share (EPS) estimates for shares of Stevanato Group in a research note issued to investors on Friday, March 7th. William Blair analyst M. Larew forecasts that the company will post earnings per share of $0.13 for the quarter. William Blair currently has a "Outperform" rating on the stock. The consensus estimate for Stevanato Group's current full-year earnings is $0.50 per share. William Blair also issued estimates for Stevanato Group's Q2 2026 earnings at $0.15 EPS, Q3 2026 earnings at $0.17 EPS and Q4 2026 earnings at $0.23 EPS.

Stevanato Group (NYSE:STVN - Get Free Report) last issued its quarterly earnings results on Thursday, March 6th. The company reported €0.20 ($0.22) earnings per share (EPS) for the quarter, meeting the consensus estimate of €0.20 ($0.22). Stevanato Group had a return on equity of 9.86% and a net margin of 10.47%. The company had revenue of €352.68 million for the quarter, compared to analysts' expectations of €346.26 million.

A number of other research analysts also recently weighed in on STVN. UBS Group lowered their price target on Stevanato Group from $24.00 to $23.50 and set a "neutral" rating on the stock in a report on Friday, March 7th. Morgan Stanley reaffirmed an "equal weight" rating and issued a $23.00 target price (down from $24.00) on shares of Stevanato Group in a research report on Tuesday, December 3rd. Wolfe Research started coverage on Stevanato Group in a report on Friday, December 13th. They set an "outperform" rating and a $28.00 price target for the company. Finally, Bank of America boosted their price target on Stevanato Group from $24.00 to $26.00 and gave the company a "buy" rating in a research note on Friday, December 13th. Two research analysts have rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat.com, Stevanato Group presently has a consensus rating of "Moderate Buy" and a consensus target price of €27.75 ($30.16).

Get Our Latest Stock Analysis on STVN

Stevanato Group Price Performance

Shares of NYSE STVN traded down €0.24 ($0.26) during mid-day trading on Monday, reaching €20.90 ($22.72). The company had a trading volume of 3,306 shares, compared to its average volume of 342,551. The company has a current ratio of 1.81, a quick ratio of 1.21 and a debt-to-equity ratio of 0.22. The stock has a market cap of $6.33 billion, a PE ratio of 44.47, a P/E/G ratio of 7.18 and a beta of 0.60. The company has a 50-day moving average price of €21.39 and a two-hundred day moving average price of €20.59. Stevanato Group has a 1-year low of €16.56 ($18.00) and a 1-year high of €33.49 ($36.40).

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of STVN. Thornburg Investment Management Inc. grew its position in Stevanato Group by 48.1% in the 4th quarter. Thornburg Investment Management Inc. now owns 1,122,098 shares of the company's stock worth $24,451,000 after purchasing an additional 364,471 shares during the last quarter. Silvercrest Asset Management Group LLC lifted its holdings in shares of Stevanato Group by 18.4% during the 4th quarter. Silvercrest Asset Management Group LLC now owns 342,947 shares of the company's stock worth $7,473,000 after acquiring an additional 53,401 shares during the period. Polar Capital Holdings Plc lifted its holdings in shares of Stevanato Group by 33.1% during the 4th quarter. Polar Capital Holdings Plc now owns 874,813 shares of the company's stock worth $19,062,000 after acquiring an additional 217,623 shares during the period. LMR Partners LLP bought a new position in shares of Stevanato Group in the fourth quarter worth about $413,000. Finally, Granahan Investment Management LLC raised its stake in shares of Stevanato Group by 95.2% in the fourth quarter. Granahan Investment Management LLC now owns 226,401 shares of the company's stock worth $4,933,000 after acquiring an additional 110,418 shares during the last quarter.

About Stevanato Group

(

Get Free Report)

Stevanato Group S.p.A. engages in the design, production, and distribution of products and processes to provide integrated solutions for bio-pharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific. The company operates in two segments, Biopharmaceutical and Diagnostic Solutions; and Engineering.

Read More

Before you consider Stevanato Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stevanato Group wasn't on the list.

While Stevanato Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.