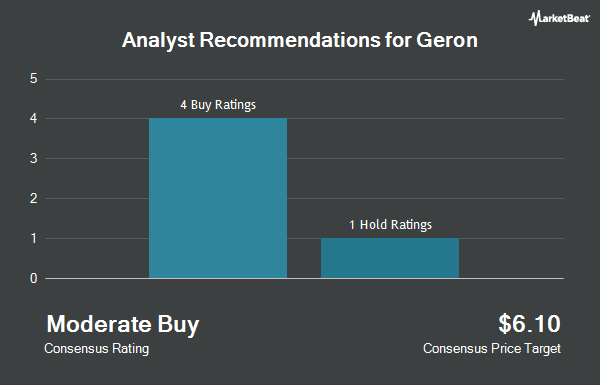

Shares of Geron Co. (NASDAQ:GERN - Get Free Report) have been given a consensus recommendation of "Buy" by the twelve ratings firms that are presently covering the company, Marketbeat.com reports. One research analyst has rated the stock with a hold rating, nine have given a buy rating and two have given a strong buy rating to the company. The average 12 month target price among analysts that have covered the stock in the last year is $6.91.

A number of research analysts have commented on GERN shares. Needham & Company LLC increased their target price on Geron from $6.00 to $7.00 and gave the stock a "buy" rating in a report on Monday, January 13th. HC Wainwright reiterated a "buy" rating and set a $9.00 price target on shares of Geron in a research report on Tuesday, December 10th. Barclays raised Geron to a "strong-buy" rating in a research note on Friday, November 29th. Finally, B. Riley decreased their target price on Geron from $5.50 to $3.50 and set a "buy" rating for the company in a research report on Tuesday.

Check Out Our Latest Stock Report on GERN

Hedge Funds Weigh In On Geron

A number of institutional investors have recently made changes to their positions in GERN. SBI Securities Co. Ltd. bought a new position in shares of Geron in the fourth quarter worth about $28,000. Integrated Wealth Concepts LLC bought a new position in shares of Geron in the fourth quarter worth about $36,000. GF Fund Management CO. LTD. acquired a new stake in Geron during the fourth quarter worth about $45,000. Fifth Lane Capital LP acquired a new stake in Geron during the fourth quarter worth about $53,000. Finally, Readystate Asset Management LP acquired a new stake in Geron during the third quarter worth about $58,000. 73.71% of the stock is currently owned by institutional investors.

Geron Price Performance

GERN traded down $0.06 during trading on Friday, reaching $2.58. 8,950,085 shares of the stock were exchanged, compared to its average volume of 11,789,030. The company has a debt-to-equity ratio of 0.04, a current ratio of 2.89 and a quick ratio of 2.74. Geron has a 1 year low of $1.64 and a 1 year high of $5.34. The business's 50 day moving average price is $3.13 and its two-hundred day moving average price is $3.88. The company has a market capitalization of $1.56 billion, a price-to-earnings ratio of -8.05 and a beta of 0.53.

About Geron

(

Get Free ReportGeron Corporation, a late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies. It develops imetelstat, a telomerase inhibitor that is in Phase 3 clinical trials, which inhibits the uncontrolled proliferation of malignant stem and progenitor cells in myeloid hematologic malignancies for the treatment of low or intermediate-1 risk myelodysplastic syndromes and intermediate-2 or high-risk myelofibrosis.

Featured Articles

Before you consider Geron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Geron wasn't on the list.

While Geron currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.