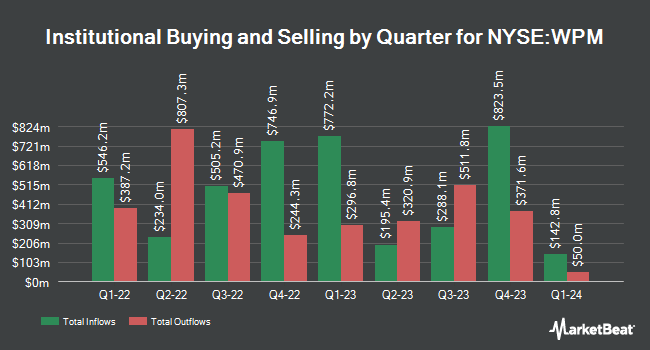

Andra AP fonden bought a new stake in Wheaton Precious Metals Corp. (NYSE:WPM - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 34,700 shares of the company's stock, valued at approximately $1,952,000.

A number of other hedge funds and other institutional investors also recently bought and sold shares of WPM. Versant Capital Management Inc acquired a new stake in Wheaton Precious Metals in the fourth quarter valued at $29,000. Promus Capital LLC acquired a new stake in Wheaton Precious Metals in the fourth quarter valued at $32,000. Laurel Wealth Advisors LLC acquired a new stake in Wheaton Precious Metals in the fourth quarter valued at $39,000. Quintet Private Bank Europe S.A. acquired a new stake in Wheaton Precious Metals in the fourth quarter valued at $39,000. Finally, GAMMA Investing LLC acquired a new stake in Wheaton Precious Metals in the fourth quarter valued at $41,000. Institutional investors and hedge funds own 70.34% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently weighed in on WPM. UBS Group began coverage on Wheaton Precious Metals in a research report on Monday, November 18th. They issued a "buy" rating and a $78.00 price target for the company. Stifel Canada upgraded Wheaton Precious Metals from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, February 4th. Nine analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and a consensus target price of $71.67.

Get Our Latest Stock Report on Wheaton Precious Metals

Wheaton Precious Metals Stock Performance

WPM stock traded down $0.99 during trading on Monday, hitting $69.51. The stock had a trading volume of 2,169,801 shares, compared to its average volume of 1,523,158. The company's 50 day moving average price is $63.23 and its two-hundred day moving average price is $62.35. Wheaton Precious Metals Corp. has a 1-year low of $43.18 and a 1-year high of $71.81. The stock has a market cap of $31.53 billion, a price-to-earnings ratio of 51.87, a price-to-earnings-growth ratio of 1.91 and a beta of 0.77.

Wheaton Precious Metals Profile

(

Free Report)

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Further Reading

Before you consider Wheaton Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wheaton Precious Metals wasn't on the list.

While Wheaton Precious Metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.