Andra AP fonden decreased its stake in Owens Corning (NYSE:OC - Free Report) by 92.8% during the 4th quarter, according to the company in its most recent disclosure with the SEC. The firm owned 4,600 shares of the construction company's stock after selling 59,000 shares during the period. Andra AP fonden's holdings in Owens Corning were worth $783,000 as of its most recent filing with the SEC.

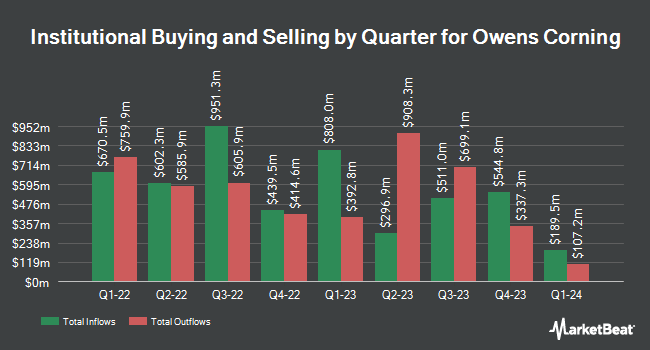

Other hedge funds have also added to or reduced their stakes in the company. State Street Corp increased its stake in shares of Owens Corning by 4.7% in the third quarter. State Street Corp now owns 4,181,421 shares of the construction company's stock worth $738,104,000 after purchasing an additional 187,001 shares in the last quarter. Nordea Investment Management AB increased its stake in shares of Owens Corning by 12.5% in the fourth quarter. Nordea Investment Management AB now owns 2,148,610 shares of the construction company's stock worth $366,166,000 after purchasing an additional 238,694 shares in the last quarter. Pacer Advisors Inc. increased its stake in shares of Owens Corning by 16.4% in the third quarter. Pacer Advisors Inc. now owns 1,854,100 shares of the construction company's stock worth $327,286,000 after purchasing an additional 261,564 shares in the last quarter. Caisse DE Depot ET Placement DU Quebec increased its stake in shares of Owens Corning by 31.6% in the third quarter. Caisse DE Depot ET Placement DU Quebec now owns 824,013 shares of the construction company's stock worth $145,455,000 after purchasing an additional 197,667 shares in the last quarter. Finally, JPMorgan Chase & Co. increased its stake in shares of Owens Corning by 113.9% in the third quarter. JPMorgan Chase & Co. now owns 797,743 shares of the construction company's stock worth $140,818,000 after purchasing an additional 424,786 shares in the last quarter. Institutional investors own 88.40% of the company's stock.

Insider Transactions at Owens Corning

In other news, insider Gunner Smith sold 17,450 shares of the business's stock in a transaction that occurred on Friday, December 13th. The shares were sold at an average price of $191.19, for a total value of $3,336,265.50. Following the completion of the sale, the insider now directly owns 18,866 shares in the company, valued at approximately $3,606,990.54. The trade was a 48.05 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, insider Monaco Nicolas Del sold 1,750 shares of the business's stock in a transaction that occurred on Thursday, February 6th. The stock was sold at an average price of $183.97, for a total transaction of $321,947.50. Following the completion of the sale, the insider now owns 11,635 shares of the company's stock, valued at approximately $2,140,490.95. The trade was a 13.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.89% of the company's stock.

Owens Corning Trading Down 0.7 %

Shares of Owens Corning stock opened at $144.54 on Monday. Owens Corning has a 1 year low of $140.94 and a 1 year high of $214.53. The firm has a market cap of $12.36 billion, a PE ratio of 12.30, a PEG ratio of 1.88 and a beta of 1.52. The company has a debt-to-equity ratio of 0.89, a current ratio of 1.44 and a quick ratio of 0.85. The company has a 50 day simple moving average of $172.91 and a two-hundred day simple moving average of $178.38.

Owens Corning (NYSE:OC - Get Free Report) last announced its earnings results on Monday, February 24th. The construction company reported $3.22 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.87 by $0.35. Owens Corning had a net margin of 9.92% and a return on equity of 25.82%. The business had revenue of $2.84 billion during the quarter, compared to analyst estimates of $2.88 billion. During the same period in the previous year, the business posted $3.21 earnings per share. Owens Corning's revenue for the quarter was up 23.3% on a year-over-year basis. Analysts expect that Owens Corning will post 15.49 earnings per share for the current fiscal year.

Owens Corning Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, April 10th. Stockholders of record on Monday, March 10th will be issued a $0.69 dividend. The ex-dividend date of this dividend is Monday, March 10th. This represents a $2.76 dividend on an annualized basis and a dividend yield of 1.91%. Owens Corning's payout ratio is 37.70%.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on OC shares. UBS Group reduced their target price on shares of Owens Corning from $245.00 to $235.00 and set a "buy" rating for the company in a research note on Tuesday, February 25th. Citigroup reduced their target price on shares of Owens Corning from $212.00 to $207.00 and set a "buy" rating for the company in a research note on Monday, January 6th. Wells Fargo & Company reduced their price objective on shares of Owens Corning from $225.00 to $200.00 and set an "overweight" rating for the company in a research note on Tuesday, February 25th. Loop Capital reduced their price objective on shares of Owens Corning from $215.00 to $210.00 and set a "buy" rating for the company in a research note on Friday, January 10th. Finally, Royal Bank of Canada reduced their price objective on shares of Owens Corning from $224.00 to $212.00 and set an "outperform" rating for the company in a research note on Tuesday, February 25th. Five equities research analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat, Owens Corning currently has an average rating of "Moderate Buy" and an average price target of $204.18.

View Our Latest Stock Analysis on Owens Corning

Owens Corning Company Profile

(

Free Report)

Owens Corning manufactures and sells building and construction materials in the United States, Europe, the Asia Pacific, and internationally. It operates in three segments: Roofing, Insulation, and Composites. The Roofing segment manufactures and sells laminate and strip asphalt roofing shingles, oxidized asphalt materials, and roofing components used in residential and commercial construction, and specialty applications.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Owens Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Owens Corning wasn't on the list.

While Owens Corning currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report