Angi (NASDAQ:ANGI - Get Free Report) is expected to be releasing its earnings data before the market opens on Tuesday, February 11th. Analysts expect Angi to post earnings of ($0.01) per share and revenue of $267.00 million for the quarter. Investors interested in registering for the company's conference call can do so using this link.

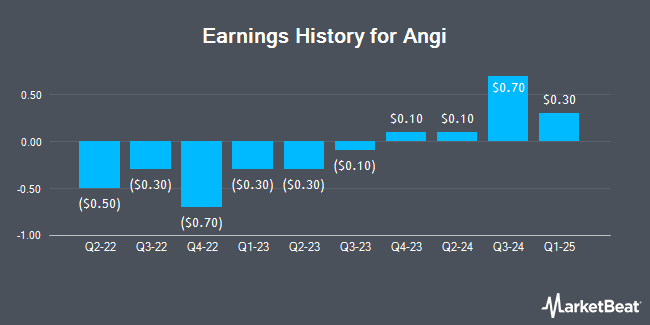

Angi (NASDAQ:ANGI - Get Free Report) last announced its quarterly earnings data on Monday, November 11th. The technology company reported $0.07 EPS for the quarter. The firm had revenue of $296.72 million for the quarter, compared to the consensus estimate of $295.90 million. Angi had a return on equity of 3.79% and a net margin of 2.61%. During the same quarter last year, the business posted ($0.01) earnings per share. On average, analysts expect Angi to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Angi Trading Down 1.1 %

NASDAQ:ANGI traded down $0.02 during trading hours on Friday, hitting $1.76. The company had a trading volume of 482,918 shares, compared to its average volume of 895,433. Angi has a 1 year low of $1.49 and a 1 year high of $3.10. The company has a market cap of $875.20 million, a P/E ratio of 25.14 and a beta of 1.86. The company has a 50-day moving average of $1.77 and a 200 day moving average of $2.19. The company has a current ratio of 2.05, a quick ratio of 2.05 and a debt-to-equity ratio of 0.46.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on ANGI. JPMorgan Chase & Co. restated a "neutral" rating on shares of Angi in a research report on Wednesday, December 18th. The Goldman Sachs Group downgraded shares of Angi from a "buy" rating to a "neutral" rating and cut their price target for the stock from $3.25 to $2.50 in a report on Wednesday, November 13th. JMP Securities reiterated a "market outperform" rating and issued a $3.00 price objective on shares of Angi in a report on Monday, December 16th. Citigroup raised their target price on Angi from $1.70 to $2.00 and gave the stock a "neutral" rating in a research note on Friday, January 31st. Finally, Benchmark decreased their price target on Angi from $7.00 to $6.00 and set a "buy" rating on the stock in a research note on Wednesday, November 13th. Five investment analysts have rated the stock with a hold rating and four have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $3.11.

Get Our Latest Research Report on ANGI

About Angi

(

Get Free Report)

Angi Inc connects home service professionals with consumers in the United States and internationally. The company operates through three segments: Ads and Leads, Services, and International. It provides consumers with tools and resources to help them find local, pre-screened and customer-rated service professionals, matches consumers with independently established home services professionals.

See Also

Before you consider Angi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Angi wasn't on the list.

While Angi currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.