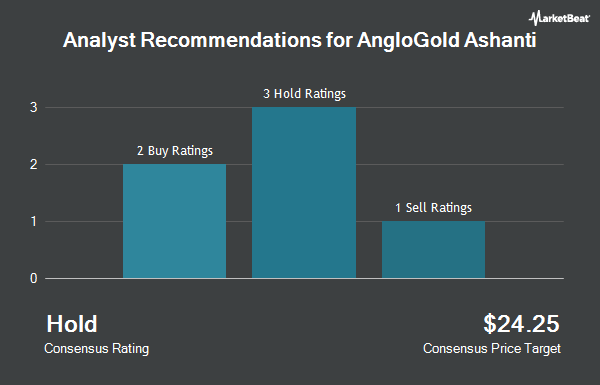

Shares of AngloGold Ashanti plc (NYSE:AU - Get Free Report) have received an average recommendation of "Moderate Buy" from the six brokerages that are currently covering the firm, MarketBeat reports. One investment analyst has rated the stock with a sell rating, one has given a hold rating and four have issued a buy rating on the company. The average twelve-month price objective among brokerages that have issued a report on the stock in the last year is $31.75.

Several equities analysts have commented on the stock. Investec upgraded shares of AngloGold Ashanti from a "hold" rating to a "buy" rating in a research note on Friday, October 18th. JPMorgan Chase & Co. lowered their target price on AngloGold Ashanti from $37.00 to $32.00 and set an "overweight" rating for the company in a research note on Friday, December 6th. StockNews.com lowered AngloGold Ashanti from a "buy" rating to a "hold" rating in a research report on Tuesday, November 12th. Royal Bank of Canada raised AngloGold Ashanti from a "sector perform" rating to an "outperform" rating and set a $31.00 price objective for the company in a research report on Tuesday, December 3rd. Finally, Scotiabank raised shares of AngloGold Ashanti from a "sector underperform" rating to a "sector perform" rating and set a $30.00 target price on the stock in a report on Thursday, November 21st.

Read Our Latest Stock Analysis on AngloGold Ashanti

Institutional Investors Weigh In On AngloGold Ashanti

Institutional investors have recently bought and sold shares of the business. Sprott Inc. increased its stake in shares of AngloGold Ashanti by 0.7% in the fourth quarter. Sprott Inc. now owns 91,168 shares of the mining company's stock worth $2,104,000 after buying an additional 662 shares during the last quarter. Bank of New York Mellon Corp grew its holdings in AngloGold Ashanti by 9.9% during the 4th quarter. Bank of New York Mellon Corp now owns 599,937 shares of the mining company's stock worth $13,847,000 after acquiring an additional 54,096 shares in the last quarter. Allianz Asset Management GmbH grew its holdings in AngloGold Ashanti by 39.0% during the 4th quarter. Allianz Asset Management GmbH now owns 1,934,603 shares of the mining company's stock worth $44,651,000 after acquiring an additional 542,463 shares in the last quarter. Handelsbanken Fonder AB increased its position in shares of AngloGold Ashanti by 13.0% in the 4th quarter. Handelsbanken Fonder AB now owns 135,064 shares of the mining company's stock worth $3,117,000 after purchasing an additional 15,564 shares during the last quarter. Finally, Rhumbline Advisers raised its stake in shares of AngloGold Ashanti by 9.3% in the 4th quarter. Rhumbline Advisers now owns 10,745 shares of the mining company's stock valued at $248,000 after purchasing an additional 910 shares in the last quarter. 36.09% of the stock is currently owned by hedge funds and other institutional investors.

AngloGold Ashanti Stock Up 3.6 %

AU traded up $1.10 during trading hours on Friday, reaching $31.96. The company's stock had a trading volume of 2,731,354 shares, compared to its average volume of 2,434,507. The business's 50-day moving average is $25.77 and its 200-day moving average is $27.25. The company has a current ratio of 1.73, a quick ratio of 1.14 and a debt-to-equity ratio of 0.46. AngloGold Ashanti has a fifty-two week low of $16.49 and a fifty-two week high of $32.57.

AngloGold Ashanti Company Profile

(

Get Free ReportAngloGold Ashanti plc operates as a gold mining company in Africa, Australia, and the Americas. The company primarily explores for gold, as well as produces silver and sulphuric acid as by-products. Its flagship property is a 100% owned Geita mine located in the Lake Victoria goldfields of the Mwanza region in north-western Tanzania.

Featured Articles

Before you consider AngloGold Ashanti, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AngloGold Ashanti wasn't on the list.

While AngloGold Ashanti currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.