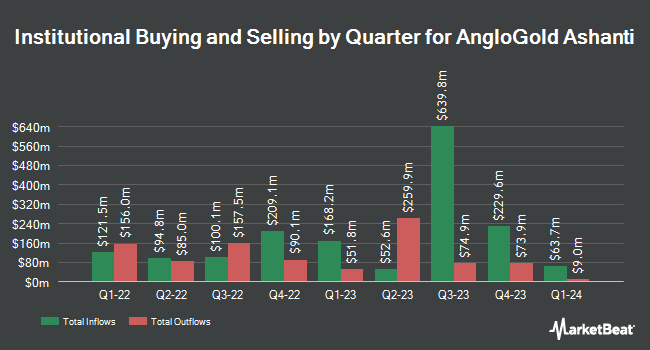

Hussman Strategic Advisors Inc. lowered its holdings in AngloGold Ashanti plc (NYSE:AU - Free Report) by 20.0% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 102,000 shares of the mining company's stock after selling 25,500 shares during the quarter. Hussman Strategic Advisors Inc.'s holdings in AngloGold Ashanti were worth $2,354,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. R Squared Ltd acquired a new position in shares of AngloGold Ashanti during the fourth quarter valued at about $36,000. Decker Retirement Planning Inc. bought a new position in AngloGold Ashanti in the 4th quarter valued at about $69,000. SG Americas Securities LLC acquired a new position in AngloGold Ashanti during the 3rd quarter valued at about $126,000. JPMorgan Chase & Co. increased its holdings in AngloGold Ashanti by 378.2% during the 3rd quarter. JPMorgan Chase & Co. now owns 4,782 shares of the mining company's stock worth $127,000 after purchasing an additional 3,782 shares in the last quarter. Finally, Blue Trust Inc. increased its holdings in AngloGold Ashanti by 72.6% during the 3rd quarter. Blue Trust Inc. now owns 5,991 shares of the mining company's stock worth $151,000 after purchasing an additional 2,520 shares in the last quarter. Institutional investors own 36.09% of the company's stock.

Wall Street Analysts Forecast Growth

AU has been the topic of a number of recent research reports. Royal Bank of Canada restated an "outperform" rating and issued a $36.00 target price on shares of AngloGold Ashanti in a report on Thursday. Scotiabank raised shares of AngloGold Ashanti from a "sector underperform" rating to a "sector perform" rating and set a $30.00 price objective on the stock in a report on Thursday, November 21st. StockNews.com lowered shares of AngloGold Ashanti from a "buy" rating to a "hold" rating in a research note on Tuesday, November 12th. Finally, JPMorgan Chase & Co. cut their price target on shares of AngloGold Ashanti from $37.00 to $32.00 and set an "overweight" rating on the stock in a report on Friday, December 6th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and four have issued a buy rating to the stock. According to MarketBeat.com, AngloGold Ashanti currently has a consensus rating of "Hold" and an average target price of $33.00.

View Our Latest Analysis on AU

AngloGold Ashanti Stock Performance

Shares of AngloGold Ashanti stock traded down $0.39 during trading hours on Friday, hitting $31.63. 2,709,866 shares of the company's stock traded hands, compared to its average volume of 2,493,384. AngloGold Ashanti plc has a 12-month low of $17.01 and a 12-month high of $33.77. The company has a current ratio of 1.73, a quick ratio of 1.14 and a debt-to-equity ratio of 0.46. The company has a fifty day simple moving average of $27.42 and a 200-day simple moving average of $27.65.

AngloGold Ashanti (NYSE:AU - Get Free Report) last posted its quarterly earnings data on Wednesday, February 19th. The mining company reported $0.89 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.99 by ($0.10). The company had revenue of $1.75 billion for the quarter, compared to analyst estimates of $1.75 billion. As a group, analysts anticipate that AngloGold Ashanti plc will post 3.83 earnings per share for the current fiscal year.

AngloGold Ashanti Increases Dividend

The business also recently declared a semi-annual dividend, which will be paid on Friday, March 28th. Investors of record on Friday, March 14th will be issued a $0.69 dividend. This represents a dividend yield of 2.8%. The ex-dividend date of this dividend is Friday, March 14th. This is a boost from AngloGold Ashanti's previous semi-annual dividend of $0.22.

AngloGold Ashanti Company Profile

(

Free Report)

AngloGold Ashanti plc operates as a gold mining company in Africa, Australia, and the Americas. The company primarily explores for gold, as well as produces silver and sulphuric acid as by-products. Its flagship property is a 100% owned Geita mine located in the Lake Victoria goldfields of the Mwanza region in north-western Tanzania.

Read More

Before you consider AngloGold Ashanti, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AngloGold Ashanti wasn't on the list.

While AngloGold Ashanti currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.