Pathstone Holdings LLC raised its stake in shares of Anheuser-Busch InBev SA/NV (NYSE:BUD - Free Report) by 9.9% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 144,066 shares of the consumer goods maker's stock after purchasing an additional 13,008 shares during the period. Pathstone Holdings LLC's holdings in Anheuser-Busch InBev SA/NV were worth $9,550,000 at the end of the most recent reporting period.

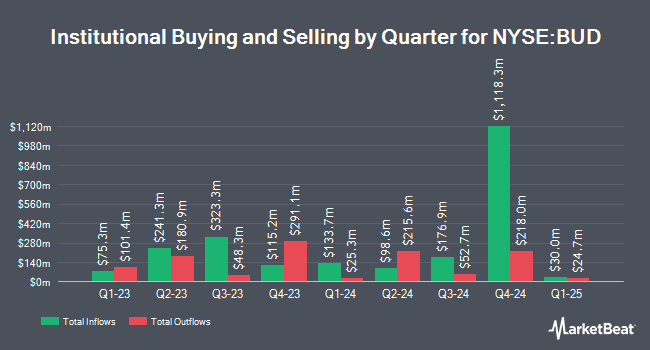

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Capital International Investors lifted its position in shares of Anheuser-Busch InBev SA/NV by 1.8% in the 1st quarter. Capital International Investors now owns 2,163,607 shares of the consumer goods maker's stock valued at $131,504,000 after acquiring an additional 38,747 shares in the last quarter. Seafarer Capital Partners LLC boosted its holdings in Anheuser-Busch InBev SA/NV by 11.2% in the 3rd quarter. Seafarer Capital Partners LLC now owns 1,059,000 shares of the consumer goods maker's stock valued at $70,201,000 after purchasing an additional 107,000 shares during the period. Armistice Capital LLC boosted its stake in Anheuser-Busch InBev SA/NV by 19.5% in the 2nd quarter. Armistice Capital LLC now owns 839,000 shares of the consumer goods maker's stock valued at $48,788,000 after buying an additional 137,000 shares in the last quarter. Raymond James & Associates grew its holdings in Anheuser-Busch InBev SA/NV by 33.7% during the 2nd quarter. Raymond James & Associates now owns 726,470 shares of the consumer goods maker's stock worth $42,244,000 after acquiring an additional 183,301 shares during the last quarter. Finally, Envestnet Asset Management Inc. increased its position in Anheuser-Busch InBev SA/NV by 10.2% in the second quarter. Envestnet Asset Management Inc. now owns 611,578 shares of the consumer goods maker's stock worth $35,563,000 after purchasing an additional 56,422 shares during the period. 5.53% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities research analysts have commented on BUD shares. Morgan Stanley boosted their price target on shares of Anheuser-Busch InBev SA/NV from $68.50 to $73.00 and gave the stock an "overweight" rating in a research report on Tuesday, September 10th. Evercore ISI upgraded Anheuser-Busch InBev SA/NV to a "strong-buy" rating in a research report on Monday, September 30th. TD Cowen lowered Anheuser-Busch InBev SA/NV from a "buy" rating to a "hold" rating and boosted their price objective for the stock from $68.00 to $88.00 in a report on Tuesday, October 8th. Barclays raised shares of Anheuser-Busch InBev SA/NV to a "strong-buy" rating in a report on Wednesday, October 9th. Finally, Citigroup raised shares of Anheuser-Busch InBev SA/NV from a "neutral" rating to a "buy" rating in a research report on Tuesday, October 1st. Three investment analysts have rated the stock with a hold rating, five have issued a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $79.00.

Get Our Latest Stock Analysis on BUD

Anheuser-Busch InBev SA/NV Trading Down 1.1 %

Shares of BUD traded down $0.62 during mid-day trading on Thursday, reaching $54.58. 1,460,723 shares of the company's stock traded hands, compared to its average volume of 1,637,962. Anheuser-Busch InBev SA/NV has a 12 month low of $54.57 and a 12 month high of $67.49. The company has a debt-to-equity ratio of 0.85, a current ratio of 0.69 and a quick ratio of 0.51. The stock has a market cap of $98.09 billion, a P/E ratio of 17.03, a P/E/G ratio of 1.79 and a beta of 1.12. The stock's 50-day moving average is $62.49 and its two-hundred day moving average is $61.90.

Anheuser-Busch InBev SA/NV Company Profile

(

Free Report)

Anheuser-Busch InBev SA/NV produces, distributes, exports, markets, and sells beer and beverages. It offers a portfolio of approximately 500 beer brands, which primarily include Budweiser, Corona, and Stella Artois; Beck's, Hoegaarden, Leffe, and Michelob Ultra; and Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol brands.

See Also

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.