Natixis Advisors LLC decreased its holdings in shares of Anheuser-Busch InBev SA/NV (NYSE:BUD - Free Report) by 7.3% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 147,852 shares of the consumer goods maker's stock after selling 11,724 shares during the quarter. Natixis Advisors LLC's holdings in Anheuser-Busch InBev SA/NV were worth $7,403,000 as of its most recent SEC filing.

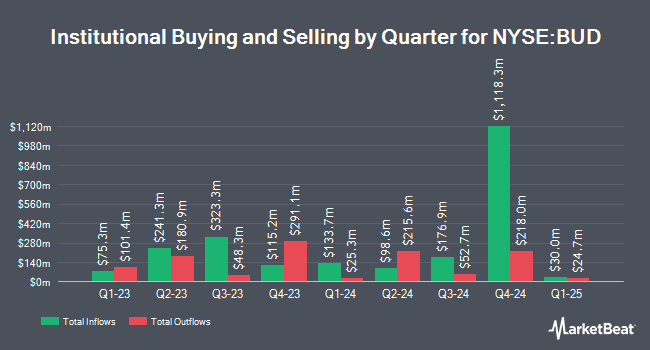

A number of other hedge funds and other institutional investors have also made changes to their positions in the business. Holocene Advisors LP raised its holdings in shares of Anheuser-Busch InBev SA/NV by 22.8% in the 3rd quarter. Holocene Advisors LP now owns 4,331,636 shares of the consumer goods maker's stock worth $287,144,000 after purchasing an additional 803,257 shares during the period. Raymond James Financial Inc. purchased a new position in shares of Anheuser-Busch InBev SA/NV in the fourth quarter valued at $37,311,000. Fisher Asset Management LLC grew its stake in shares of Anheuser-Busch InBev SA/NV by 6.0% during the third quarter. Fisher Asset Management LLC now owns 10,307,014 shares of the consumer goods maker's stock valued at $683,252,000 after acquiring an additional 587,329 shares in the last quarter. Alberta Investment Management Corp acquired a new stake in Anheuser-Busch InBev SA/NV during the 4th quarter valued at approximately $28,540,000. Finally, Penn Davis Mcfarland Inc. raised its position in shares of Anheuser-Busch InBev SA/NV by 34.0% in the 4th quarter. Penn Davis Mcfarland Inc. now owns 467,519 shares of the consumer goods maker's stock valued at $23,409,000 after purchasing an additional 118,686 shares in the last quarter. Hedge funds and other institutional investors own 5.53% of the company's stock.

Anheuser-Busch InBev SA/NV Stock Performance

Shares of NYSE BUD traded up $0.23 during mid-day trading on Tuesday, hitting $61.76. The company had a trading volume of 1,522,473 shares, compared to its average volume of 1,752,293. Anheuser-Busch InBev SA/NV has a 12 month low of $45.94 and a 12 month high of $67.49. The stock has a market cap of $110.99 billion, a price-to-earnings ratio of 19.06, a PEG ratio of 1.73 and a beta of 0.96. The company has a debt-to-equity ratio of 0.85, a current ratio of 0.69 and a quick ratio of 0.51. The firm's 50 day simple moving average is $54.71 and its two-hundred day simple moving average is $56.85.

Anheuser-Busch InBev SA/NV (NYSE:BUD - Get Free Report) last announced its quarterly earnings results on Wednesday, February 26th. The consumer goods maker reported $0.88 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.75 by $0.13. Anheuser-Busch InBev SA/NV had a net margin of 10.98% and a return on equity of 15.29%. The company had revenue of $14.84 billion during the quarter, compared to the consensus estimate of $14.07 billion. As a group, equities research analysts forecast that Anheuser-Busch InBev SA/NV will post 3.37 earnings per share for the current year.

Analyst Ratings Changes

Several analysts have issued reports on the company. TD Cowen cut their price objective on Anheuser-Busch InBev SA/NV from $65.00 to $55.00 and set a "hold" rating on the stock in a research note on Wednesday, January 8th. Deutsche Bank Aktiengesellschaft raised shares of Anheuser-Busch InBev SA/NV from a "hold" rating to a "buy" rating in a report on Monday, March 3rd. One analyst has rated the stock with a hold rating, four have given a buy rating and two have assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and a consensus target price of $64.00.

Read Our Latest Stock Analysis on BUD

Anheuser-Busch InBev SA/NV Profile

(

Free Report)

Anheuser-Busch InBev SA/NV produces, distributes, exports, markets, and sells beer and beverages. It offers a portfolio of approximately 500 beer brands, which primarily include Budweiser, Corona, and Stella Artois; Beck's, Hoegaarden, Leffe, and Michelob Ultra; and Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol brands.

Featured Articles

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.