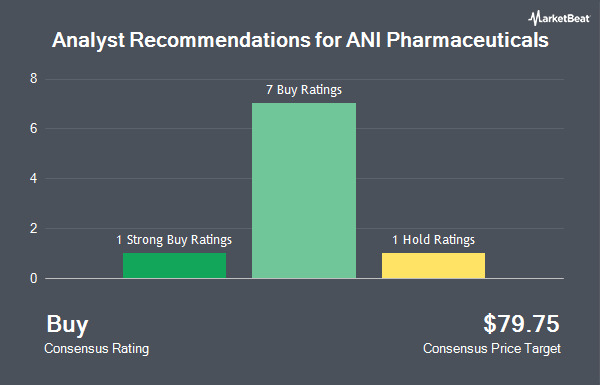

Shares of ANI Pharmaceuticals, Inc. (NASDAQ:ANIP - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the six brokerages that are presently covering the stock, Marketbeat reports. One research analyst has rated the stock with a hold recommendation and five have given a buy recommendation to the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $77.33.

ANIP has been the subject of a number of recent analyst reports. Truist Financial upped their price objective on ANI Pharmaceuticals from $60.00 to $62.00 and gave the company a "hold" rating in a research note on Tuesday, October 22nd. Raymond James upped their price objective on ANI Pharmaceuticals from $81.00 to $83.00 and gave the company an "outperform" rating in a research note on Wednesday, September 18th. StockNews.com downgraded ANI Pharmaceuticals from a "buy" rating to a "hold" rating in a research note on Saturday, September 7th. HC Wainwright reiterated a "buy" rating and set a $94.00 price target on shares of ANI Pharmaceuticals in a research note on Tuesday, September 17th. Finally, Piper Sandler began coverage on ANI Pharmaceuticals in a research note on Friday, October 11th. They set an "overweight" rating and a $68.00 price target for the company.

Read Our Latest Stock Report on ANI Pharmaceuticals

ANI Pharmaceuticals Stock Up 0.6 %

Shares of ANIP traded up $0.35 during trading hours on Thursday, reaching $58.75. 53,301 shares of the stock traded hands, compared to its average volume of 213,544. The company has a market cap of $1.24 billion, a price-to-earnings ratio of 49.91 and a beta of 0.71. The company has a current ratio of 3.97, a quick ratio of 3.07 and a debt-to-equity ratio of 0.62. The stock has a fifty day simple moving average of $58.78 and a 200 day simple moving average of $61.60. ANI Pharmaceuticals has a 52 week low of $48.20 and a 52 week high of $70.81.

ANI Pharmaceuticals (NASDAQ:ANIP - Get Free Report) last announced its quarterly earnings data on Tuesday, August 6th. The specialty pharmaceutical company reported $1.02 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.95 by $0.07. The firm had revenue of $138.00 million during the quarter, compared to the consensus estimate of $129.09 million. ANI Pharmaceuticals had a return on equity of 15.64% and a net margin of 5.01%. The business's revenue for the quarter was up 18.5% on a year-over-year basis. During the same quarter in the prior year, the company earned $1.06 EPS. On average, equities analysts forecast that ANI Pharmaceuticals will post 3.51 EPS for the current year.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in ANIP. Vanguard Group Inc. increased its stake in ANI Pharmaceuticals by 1.4% in the 1st quarter. Vanguard Group Inc. now owns 1,306,432 shares of the specialty pharmaceutical company's stock worth $90,314,000 after acquiring an additional 17,460 shares during the last quarter. Dimensional Fund Advisors LP raised its stake in ANI Pharmaceuticals by 3.5% in the second quarter. Dimensional Fund Advisors LP now owns 630,226 shares of the specialty pharmaceutical company's stock valued at $40,132,000 after purchasing an additional 21,053 shares in the last quarter. Millennium Management LLC lifted its position in ANI Pharmaceuticals by 1,005.8% during the second quarter. Millennium Management LLC now owns 230,079 shares of the specialty pharmaceutical company's stock valued at $14,651,000 after purchasing an additional 209,272 shares during the last quarter. Thompson Siegel & Walmsley LLC grew its stake in ANI Pharmaceuticals by 1.5% in the 2nd quarter. Thompson Siegel & Walmsley LLC now owns 195,743 shares of the specialty pharmaceutical company's stock worth $12,465,000 after buying an additional 2,986 shares in the last quarter. Finally, Mizuho Markets Americas LLC purchased a new position in ANI Pharmaceuticals in the 3rd quarter worth approximately $11,670,000. 76.05% of the stock is currently owned by hedge funds and other institutional investors.

ANI Pharmaceuticals Company Profile

(

Get Free ReportANI Pharmaceuticals, Inc, a biopharmaceutical company, develops, manufactures, and markets branded and generic prescription pharmaceuticals in the United States and Canada. The company manufactures oral solid dose products; semi-solids, liquids, and topicals; controlled substances; and potent products, as well as performs contract development and manufacturing of pharmaceutical products.

See Also

Before you consider ANI Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ANI Pharmaceuticals wasn't on the list.

While ANI Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.