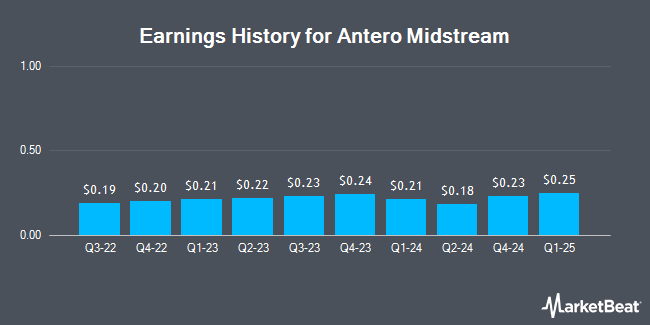

Antero Midstream (NYSE:AM - Get Free Report) announced its earnings results on Wednesday. The pipeline company reported $0.23 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.24 by ($0.01), Zacks reports. Antero Midstream had a return on equity of 18.91% and a net margin of 36.16%.

Antero Midstream Trading Down 0.8 %

AM stock traded down $0.14 during trading on Friday, reaching $16.69. 3,691,977 shares of the stock traded hands, compared to its average volume of 2,609,920. The firm has a market capitalization of $8.03 billion, a PE ratio of 20.60 and a beta of 2.31. The company has a debt-to-equity ratio of 1.49, a current ratio of 1.09 and a quick ratio of 1.09. The business's 50 day moving average price is $15.68 and its 200-day moving average price is $15.20. Antero Midstream has a 52-week low of $12.15 and a 52-week high of $16.99.

Antero Midstream Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, February 12th. Investors of record on Wednesday, January 29th were given a $0.225 dividend. This represents a $0.90 annualized dividend and a dividend yield of 5.39%. The ex-dividend date was Wednesday, January 29th. Antero Midstream's dividend payout ratio (DPR) is currently 111.11%.

Analyst Ratings Changes

Several research firms recently weighed in on AM. StockNews.com upgraded Antero Midstream from a "hold" rating to a "buy" rating in a research report on Tuesday, February 4th. Wells Fargo & Company downgraded shares of Antero Midstream from an "overweight" rating to an "equal weight" rating and set a $16.00 price objective for the company. in a research note on Wednesday, December 18th.

Read Our Latest Report on AM

Antero Midstream Company Profile

(

Get Free Report)

Antero Midstream Corporation owns, operates, and develops midstream energy assets in the Appalachian Basin. It operates in two segments, Gathering and Processing, and Water Handling. The Gathering and Processing segment includes a network of gathering pipelines and compressor stations that collects and processes production from Antero Resources' wells in West Virginia and Ohio.

Featured Stories

Before you consider Antero Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Midstream wasn't on the list.

While Antero Midstream currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.