Franklin Resources Inc. increased its stake in shares of Antero Resources Co. (NYSE:AR - Free Report) by 40.6% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 756,128 shares of the oil and natural gas company's stock after acquiring an additional 218,517 shares during the quarter. Franklin Resources Inc. owned approximately 0.24% of Antero Resources worth $21,209,000 at the end of the most recent quarter.

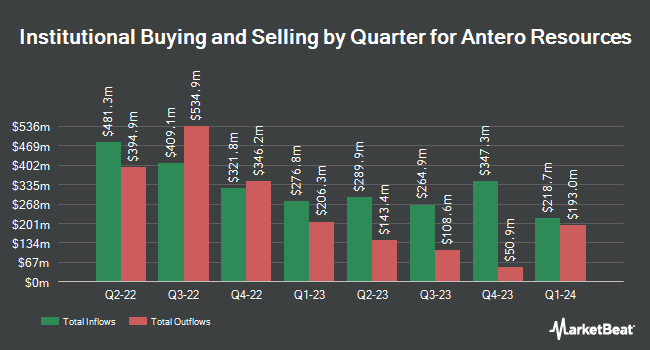

A number of other large investors have also bought and sold shares of the stock. Geode Capital Management LLC boosted its position in shares of Antero Resources by 1.3% during the 3rd quarter. Geode Capital Management LLC now owns 4,852,246 shares of the oil and natural gas company's stock worth $139,054,000 after purchasing an additional 61,490 shares in the last quarter. Massachusetts Financial Services Co. MA raised its stake in Antero Resources by 4.8% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 2,664,628 shares of the oil and natural gas company's stock worth $76,342,000 after buying an additional 122,815 shares during the period. Connor Clark & Lunn Investment Management Ltd. grew its stake in Antero Resources by 85.1% in the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 167,882 shares of the oil and natural gas company's stock valued at $4,810,000 after acquiring an additional 77,193 shares during the period. Driehaus Capital Management LLC bought a new stake in shares of Antero Resources during the second quarter valued at approximately $17,307,000. Finally, Kailix Advisors LLC bought a new position in shares of Antero Resources in the 3rd quarter worth $17,327,000. 83.04% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

AR has been the topic of several research reports. StockNews.com upgraded shares of Antero Resources to a "sell" rating in a report on Friday, November 1st. Truist Financial lowered their target price on shares of Antero Resources from $29.00 to $28.00 and set a "hold" rating on the stock in a report on Monday, September 30th. Citigroup lifted their price target on Antero Resources from $29.00 to $35.00 and gave the company a "neutral" rating in a research note on Friday, December 6th. The Goldman Sachs Group dropped their target price on Antero Resources from $36.00 to $32.00 and set a "buy" rating on the stock in a report on Friday, September 6th. Finally, Mizuho lifted their target price on Antero Resources from $35.00 to $40.00 and gave the company a "neutral" rating in a research report on Monday. One analyst has rated the stock with a sell rating, eight have assigned a hold rating, nine have issued a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $34.78.

Get Our Latest Report on Antero Resources

Antero Resources Stock Performance

AR traded up $0.07 on Friday, hitting $30.93. The company's stock had a trading volume of 6,512,977 shares, compared to its average volume of 4,061,116. The company's 50 day simple moving average is $30.04 and its 200-day simple moving average is $29.75. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.23. Antero Resources Co. has a 12 month low of $20.56 and a 12 month high of $36.28. The firm has a market cap of $9.62 billion, a P/E ratio of 220.93 and a beta of 3.42.

About Antero Resources

(

Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Recommended Stories

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.