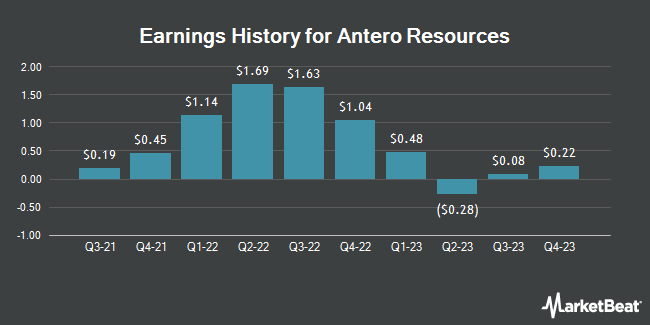

Antero Resources (NYSE:AR - Get Free Report) posted its quarterly earnings results on Wednesday. The oil and natural gas company reported $0.54 EPS for the quarter, topping the consensus estimate of $0.40 by $0.14, Zacks reports. Antero Resources had a net margin of 1.03% and a negative return on equity of 0.59%.

Antero Resources Stock Performance

Shares of AR traded down $0.31 during midday trading on Friday, hitting $39.84. 3,880,629 shares of the stock traded hands, compared to its average volume of 4,851,639. Antero Resources has a 1-year low of $22.01 and a 1-year high of $41.53. The firm has a market capitalization of $12.40 billion, a PE ratio of 284.57 and a beta of 3.33. The company has a debt-to-equity ratio of 0.23, a quick ratio of 0.28 and a current ratio of 0.28. The business's 50 day moving average price is $36.43 and its two-hundred day moving average price is $31.21.

Wall Street Analyst Weigh In

AR has been the subject of several research analyst reports. UBS Group upped their target price on shares of Antero Resources from $39.00 to $44.00 and gave the company a "neutral" rating in a report on Thursday. StockNews.com upgraded shares of Antero Resources to a "sell" rating in a report on Thursday. JPMorgan Chase & Co. upped their target price on shares of Antero Resources from $36.00 to $38.00 and gave the company an "overweight" rating in a report on Tuesday, January 14th. The Goldman Sachs Group increased their price target on shares of Antero Resources from $39.00 to $44.00 and gave the stock a "buy" rating in a research note on Thursday, January 23rd. Finally, Bank of America started coverage on shares of Antero Resources in a research report on Monday, October 28th. They set a "buy" rating and a $36.00 price objective for the company. One investment analyst has rated the stock with a sell rating, eight have issued a hold rating, eight have issued a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $39.44.

Check Out Our Latest Stock Analysis on Antero Resources

Antero Resources Company Profile

(

Get Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Further Reading

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.