Antero Resources (NYSE:AR - Get Free Report) was upgraded by Wells Fargo & Company from an "underweight" rating to an "equal weight" rating in a research report issued to clients and investors on Tuesday, MarketBeat reports. The firm presently has a $32.00 price objective on the oil and natural gas company's stock, up from their prior price objective of $24.00. Wells Fargo & Company's price target suggests a potential upside of 1.33% from the stock's current price.

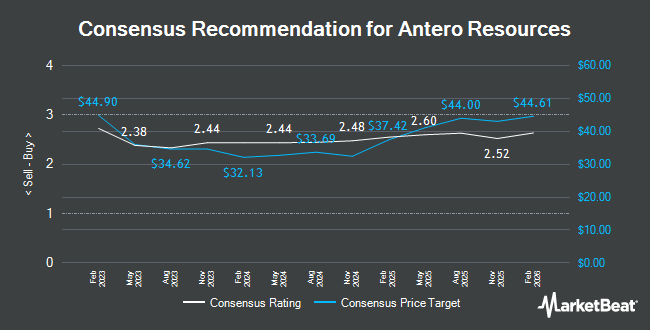

AR has been the subject of several other reports. StockNews.com upgraded Antero Resources to a "sell" rating in a research note on Friday, November 1st. Morgan Stanley lowered their price target on shares of Antero Resources from $39.00 to $38.00 and set an "overweight" rating on the stock in a research report on Monday, September 16th. Truist Financial decreased their price target on Antero Resources from $29.00 to $28.00 and set a "hold" rating on the stock in a research note on Monday, September 30th. Raymond James raised their price target on shares of Antero Resources from $34.00 to $44.00 and gave the company a "strong-buy" rating in a research note on Thursday, November 21st. Finally, Wolfe Research upgraded Antero Resources from a "peer perform" rating to an "outperform" rating and set a $37.00 target price on the stock in a research report on Wednesday, September 11th. One research analyst has rated the stock with a sell rating, eight have given a hold rating, nine have given a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $34.78.

Read Our Latest Stock Analysis on AR

Antero Resources Stock Performance

Shares of Antero Resources stock remained flat at $31.58 on Tuesday. The stock had a trading volume of 3,755,038 shares, compared to its average volume of 4,053,797. Antero Resources has a one year low of $20.56 and a one year high of $36.28. The firm has a market cap of $9.83 billion, a P/E ratio of 225.50 and a beta of 3.42. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.23. The firm's 50 day moving average is $29.92 and its 200-day moving average is $29.77.

Institutional Trading of Antero Resources

Several hedge funds and other institutional investors have recently modified their holdings of the business. UMB Bank n.a. grew its position in Antero Resources by 357.3% during the third quarter. UMB Bank n.a. now owns 878 shares of the oil and natural gas company's stock worth $25,000 after buying an additional 686 shares in the last quarter. True Wealth Design LLC purchased a new position in shares of Antero Resources during the 3rd quarter worth approximately $30,000. Capital Performance Advisors LLP purchased a new position in Antero Resources during the 3rd quarter valued at about $45,000. Mattson Financial Services LLC bought a new stake in Antero Resources in the second quarter worth $64,000. Finally, Signaturefd LLC lifted its stake in shares of Antero Resources by 19.9% in the third quarter. Signaturefd LLC now owns 4,222 shares of the oil and natural gas company's stock worth $121,000 after buying an additional 702 shares in the last quarter. Institutional investors own 83.04% of the company's stock.

Antero Resources Company Profile

(

Get Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Featured Stories

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.