Anthracite Investment Company Inc. lifted its holdings in shares of Shopify Inc. (NYSE:SHOP - Free Report) TSE: SHOP by 21.7% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 28,000 shares of the software maker's stock after buying an additional 5,000 shares during the quarter. Anthracite Investment Company Inc.'s holdings in Shopify were worth $2,244,000 at the end of the most recent quarter.

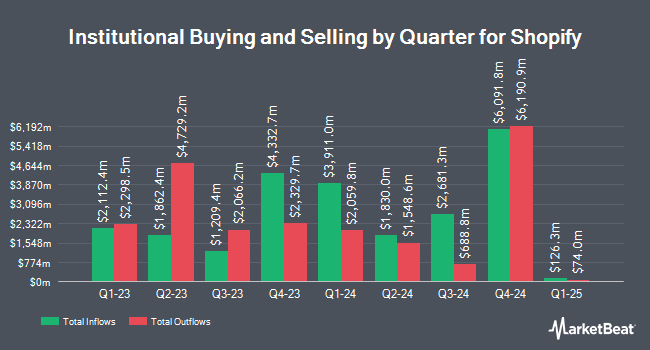

Several other institutional investors and hedge funds also recently bought and sold shares of SHOP. Oliver Lagore Vanvalin Investment Group grew its position in shares of Shopify by 100.0% in the second quarter. Oliver Lagore Vanvalin Investment Group now owns 400 shares of the software maker's stock valued at $26,000 after purchasing an additional 200 shares in the last quarter. Cultivar Capital Inc. purchased a new stake in shares of Shopify in the second quarter worth about $33,000. Hazlett Burt & Watson Inc. bought a new position in shares of Shopify in the second quarter valued at approximately $33,000. Rosenberg Matthew Hamilton increased its holdings in Shopify by 41.3% during the 3rd quarter. Rosenberg Matthew Hamilton now owns 455 shares of the software maker's stock worth $36,000 after acquiring an additional 133 shares during the period. Finally, Thurston Springer Miller Herd & Titak Inc. purchased a new stake in Shopify in the 2nd quarter worth approximately $39,000. 69.27% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research firms have recently weighed in on SHOP. Royal Bank of Canada upped their price target on shares of Shopify from $100.00 to $130.00 and gave the stock an "outperform" rating in a report on Wednesday, November 13th. Atb Cap Markets cut Shopify from a "strong-buy" rating to a "hold" rating in a report on Tuesday, November 12th. Piper Sandler boosted their price target on shares of Shopify from $67.00 to $94.00 and gave the stock a "neutral" rating in a research note on Wednesday, November 13th. Roth Mkm upped their target price on shares of Shopify from $77.00 to $79.00 and gave the stock a "buy" rating in a research report on Thursday, August 8th. Finally, Evercore ISI lifted their price target on Shopify from $75.00 to $80.00 and gave the stock an "outperform" rating in a research note on Thursday, August 8th. One equities research analyst has rated the stock with a sell rating, seventeen have given a hold rating, twenty-three have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $94.95.

View Our Latest Stock Report on SHOP

Shopify Stock Down 0.6 %

Shares of NYSE:SHOP traded down $0.62 during trading on Wednesday, reaching $103.97. 7,627,643 shares of the stock traded hands, compared to its average volume of 9,339,732. Shopify Inc. has a 52-week low of $48.56 and a 52-week high of $115.62. The stock has a 50-day moving average of $83.46 and a two-hundred day moving average of $71.48. The company has a debt-to-equity ratio of 0.10, a quick ratio of 7.10 and a current ratio of 7.10. The stock has a market cap of $134.16 billion, a P/E ratio of 97.74, a price-to-earnings-growth ratio of 3.45 and a beta of 2.36.

About Shopify

(

Free Report)

Shopify Inc, a commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America. The company's platform enables merchants to displays, manages, markets, and sells its products through various sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces; and enables to manage products and inventory, process orders and payments, fulfill and ship orders, new buyers and build customer relationships, source products, leverage analytics and reporting, manage cash, payments and transactions, and access financing.

Further Reading

Before you consider Shopify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Shopify wasn't on the list.

While Shopify currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.