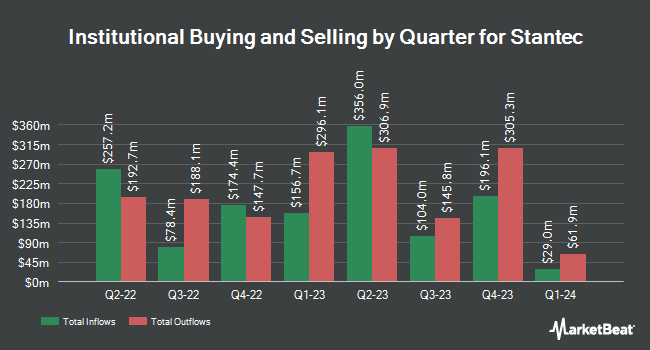

APG Asset Management N.V. bought a new stake in Stantec Inc. (NYSE:STN - Free Report) TSE: STN during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund bought 55,200 shares of the business services provider's stock, valued at approximately $4,180,000.

A number of other hedge funds have also modified their holdings of STN. Norges Bank purchased a new stake in Stantec in the fourth quarter valued at approximately $110,221,000. Bank of Montreal Can raised its holdings in shares of Stantec by 9.5% in the 4th quarter. Bank of Montreal Can now owns 3,496,408 shares of the business services provider's stock valued at $273,970,000 after buying an additional 302,979 shares during the period. Connor Clark & Lunn Investment Management Ltd. grew its position in Stantec by 11.7% in the 4th quarter. Connor Clark & Lunn Investment Management Ltd. now owns 1,983,637 shares of the business services provider's stock valued at $155,433,000 after acquiring an additional 207,470 shares in the last quarter. Clearbridge Investments LLC boosted its stake in shares of Stantec by 90.5% in the fourth quarter. Clearbridge Investments LLC now owns 373,983 shares of the business services provider's stock valued at $29,339,000 after purchasing an additional 177,692 shares during the period. Finally, Geode Capital Management LLC boosted its stake in shares of Stantec by 31.7% in the fourth quarter. Geode Capital Management LLC now owns 689,644 shares of the business services provider's stock valued at $55,465,000 after purchasing an additional 166,063 shares during the period. 63.86% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Separately, Raymond James raised shares of Stantec from a "market perform" rating to an "outperform" rating in a research report on Wednesday, February 26th. Five research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company presently has a consensus rating of "Buy".

Read Our Latest Analysis on Stantec

Stantec Stock Performance

NYSE:STN traded up $0.76 during trading hours on Tuesday, reaching $86.74. 245,616 shares of the company's stock were exchanged, compared to its average volume of 136,055. Stantec Inc. has a 1-year low of $73.18 and a 1-year high of $90.24. The company has a quick ratio of 1.42, a current ratio of 1.42 and a debt-to-equity ratio of 0.54. The firm has a market capitalization of $9.89 billion, a price-to-earnings ratio of 39.43 and a beta of 1.00. The company has a 50-day moving average of $81.83 and a 200 day moving average of $81.56.

Stantec Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Friday, March 28th will be issued a $0.1574 dividend. This is an increase from Stantec's previous quarterly dividend of $0.16. The ex-dividend date is Friday, March 28th. This represents a $0.63 annualized dividend and a dividend yield of 0.73%. Stantec's payout ratio is presently 26.61%.

Stantec Profile

(

Free Report)

Stantec Inc provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally. It offers evaluation, planning, and designing infrastructure solutions; solutions for sustainable water resources, planning, management, and infrastructure; environmental services; integrated architecture, engineering, interior design, and planning solutions for buildings; and energy and resources solutions.

See Also

Before you consider Stantec, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stantec wasn't on the list.

While Stantec currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.