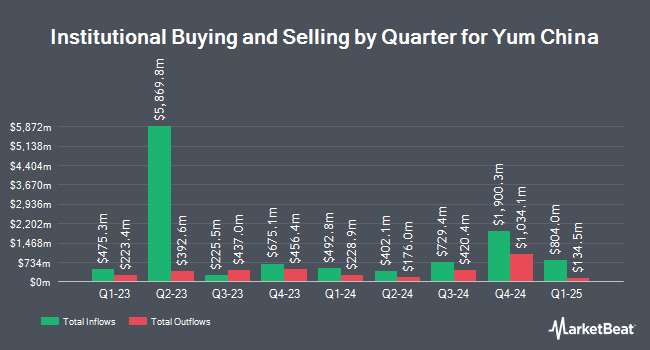

APG Asset Management N.V. lowered its position in Yum China Holdings, Inc. (NYSE:YUMC - Free Report) by 18.7% during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 61,759 shares of the company's stock after selling 14,173 shares during the quarter. APG Asset Management N.V.'s holdings in Yum China were worth $2,873,000 at the end of the most recent quarter.

Other large investors also recently added to or reduced their stakes in the company. Kentucky Trust Co bought a new stake in shares of Yum China during the 4th quarter valued at about $29,000. Graney & King LLC purchased a new position in Yum China in the 4th quarter worth approximately $39,000. EverSource Wealth Advisors LLC raised its position in shares of Yum China by 58.5% during the 4th quarter. EverSource Wealth Advisors LLC now owns 878 shares of the company's stock valued at $42,000 after buying an additional 324 shares in the last quarter. Atlas Capital Advisors Inc. purchased a new position in Yum China in the fourth quarter worth $48,000. Finally, Quadrant Capital Group LLC raised its position in Yum China by 85.6% during the fourth quarter. Quadrant Capital Group LLC now owns 1,060 shares of the company's stock valued at $51,000 after purchasing an additional 489 shares in the last quarter. Institutional investors own 85.58% of the company's stock.

Insider Buying and Selling at Yum China

In related news, insider Jeff Kuai sold 3,900 shares of Yum China stock in a transaction dated Monday, February 17th. The stock was sold at an average price of $48.21, for a total value of $188,019.00. Following the completion of the sale, the insider now directly owns 56,602 shares in the company, valued at approximately $2,728,782.42. This trade represents a 6.45 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Joey Wat sold 37,252 shares of the business's stock in a transaction dated Wednesday, March 5th. The stock was sold at an average price of $49.71, for a total value of $1,851,796.92. Following the completion of the transaction, the chief executive officer now directly owns 382,657 shares of the company's stock, valued at approximately $19,021,879.47. This trade represents a 8.87 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 45,152 shares of company stock worth $2,242,176. 0.30% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Several analysts have issued reports on YUMC shares. Daiwa America upgraded shares of Yum China to a "strong-buy" rating in a research report on Wednesday, April 9th. StockNews.com lowered shares of Yum China from a "buy" rating to a "hold" rating in a report on Tuesday, February 25th. One analyst has rated the stock with a hold rating, two have assigned a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Buy" and a consensus target price of $48.70.

Check Out Our Latest Research Report on YUMC

Yum China Trading Down 1.5 %

Shares of Yum China stock traded down $0.67 during midday trading on Tuesday, reaching $44.49. 3,986,900 shares of the company's stock traded hands, compared to its average volume of 2,936,939. The stock has a 50 day moving average of $49.24 and a 200-day moving average of $47.60. The company has a debt-to-equity ratio of 0.01, a quick ratio of 1.15 and a current ratio of 1.29. The company has a market cap of $16.73 billion, a PE ratio of 19.09, a price-to-earnings-growth ratio of 1.72 and a beta of 0.32. Yum China Holdings, Inc. has a 12 month low of $28.50 and a 12 month high of $53.99.

Yum China (NYSE:YUMC - Get Free Report) last posted its quarterly earnings results on Thursday, February 6th. The company reported $0.30 earnings per share for the quarter, missing the consensus estimate of $0.31 by ($0.01). Yum China had a return on equity of 13.83% and a net margin of 8.06%. As a group, equities analysts expect that Yum China Holdings, Inc. will post 2.54 EPS for the current fiscal year.

Yum China Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, March 27th. Investors of record on Thursday, March 6th were given a dividend of $0.24 per share. This represents a $0.96 annualized dividend and a yield of 2.16%. This is an increase from Yum China's previous quarterly dividend of $0.16. The ex-dividend date was Thursday, March 6th. Yum China's dividend payout ratio is 41.20%.

Yum China Company Profile

(

Free Report)

Yum China Holdings, Inc owns, operates, and franchises restaurants in the People's Republic of China. The company operates through KFC, Pizza Hut, and All Other segments. It operates restaurants under the KFC, Pizza Hut, Taco Bell, Lavazza, Little Sheep, and Huang Ji Huang concepts. The company also operates V-Gold Mall, a mobile e-commerce platform to sell products; and offers online food deliver services.

Further Reading

Before you consider Yum China, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yum China wasn't on the list.

While Yum China currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.