Schubert & Co reduced its position in Apple Inc. (NASDAQ:AAPL - Free Report) by 6.0% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 73,741 shares of the iPhone maker's stock after selling 4,711 shares during the quarter. Apple makes up approximately 12.4% of Schubert & Co's portfolio, making the stock its 2nd biggest position. Schubert & Co's holdings in Apple were worth $18,466,000 at the end of the most recent quarter.

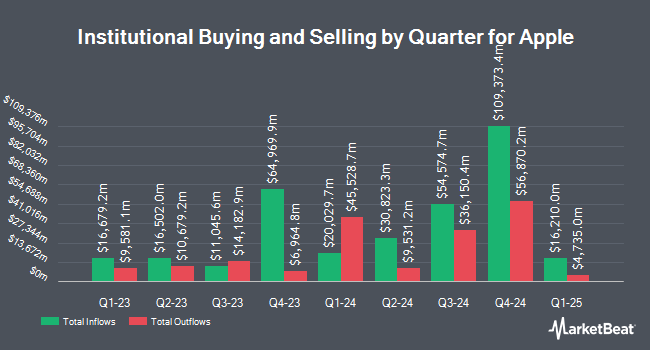

A number of other institutional investors and hedge funds also recently bought and sold shares of the business. Drystone LLC purchased a new stake in Apple during the 4th quarter worth about $25,000. SPX Gestao de Recursos Ltda purchased a new stake in shares of Apple during the third quarter worth approximately $71,000. Teachers Insurance & Annuity Association of America acquired a new stake in Apple in the third quarter valued at approximately $77,000. ARK Investment Management LLC acquired a new stake in Apple in the third quarter valued at approximately $110,000. Finally, Collier Financial purchased a new position in Apple in the fourth quarter worth approximately $140,000. 67.73% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other news, CEO Timothy D. Cook sold 108,136 shares of the firm's stock in a transaction dated Wednesday, April 2nd. The stock was sold at an average price of $223.65, for a total value of $24,184,616.40. Following the transaction, the chief executive officer now directly owns 3,280,295 shares in the company, valued at $733,637,976.75. This trade represents a 3.19 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, COO Jeffrey E. Williams sold 35,493 shares of Apple stock in a transaction dated Wednesday, April 2nd. The shares were sold at an average price of $224.01, for a total value of $7,950,786.93. Following the completion of the transaction, the chief operating officer now directly owns 390,059 shares in the company, valued at $87,377,116.59. This represents a 8.34 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 182,451 shares of company stock valued at $40,818,720. 0.06% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently weighed in on AAPL shares. DA Davidson reduced their price objective on shares of Apple from $290.00 to $230.00 and set a "buy" rating on the stock in a report on Monday, April 14th. Sanford C. Bernstein raised their price target on Apple from $240.00 to $260.00 and gave the company an "outperform" rating in a research note on Friday, January 3rd. Redburn Partners set a $230.00 price target on Apple in a report on Friday, January 31st. Barclays increased their price objective on Apple from $183.00 to $197.00 and gave the company an "underweight" rating in a report on Friday, January 31st. Finally, Oppenheimer cut Apple from an "outperform" rating to a "market perform" rating in a research note on Wednesday, January 29th. Two investment analysts have rated the stock with a sell rating, eleven have given a hold rating, twenty-two have issued a buy rating and two have assigned a strong buy rating to the stock. According to MarketBeat, Apple currently has an average rating of "Moderate Buy" and a consensus target price of $233.88.

Check Out Our Latest Analysis on Apple

Apple Stock Performance

NASDAQ AAPL opened at $208.37 on Friday. Apple Inc. has a twelve month low of $168.15 and a twelve month high of $260.10. The business's 50-day moving average price is $216.41 and its 200 day moving average price is $229.42. The company has a current ratio of 0.92, a quick ratio of 0.88 and a debt-to-equity ratio of 1.26. The company has a market capitalization of $3.13 trillion, a PE ratio of 33.07, a price-to-earnings-growth ratio of 2.44 and a beta of 1.26.

Apple (NASDAQ:AAPL - Get Free Report) last released its earnings results on Thursday, January 30th. The iPhone maker reported $2.40 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.36 by $0.04. Apple had a net margin of 24.30% and a return on equity of 160.83%. On average, research analysts predict that Apple Inc. will post 7.28 earnings per share for the current year.

Apple Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, February 13th. Stockholders of record on Monday, February 10th were issued a dividend of $0.25 per share. The ex-dividend date of this dividend was Monday, February 10th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 0.48%. Apple's payout ratio is 15.87%.

Apple Company Profile

(

Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

Recommended Stories

Want to see what other hedge funds are holding AAPL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Apple Inc. (NASDAQ:AAPL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.