Choice Wealth Advisors LLC lessened its holdings in shares of Apple Inc. (NASDAQ:AAPL - Free Report) by 6.8% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 34,050 shares of the iPhone maker's stock after selling 2,491 shares during the quarter. Apple makes up about 4.0% of Choice Wealth Advisors LLC's investment portfolio, making the stock its 11th biggest position. Choice Wealth Advisors LLC's holdings in Apple were worth $7,934,000 as of its most recent SEC filing.

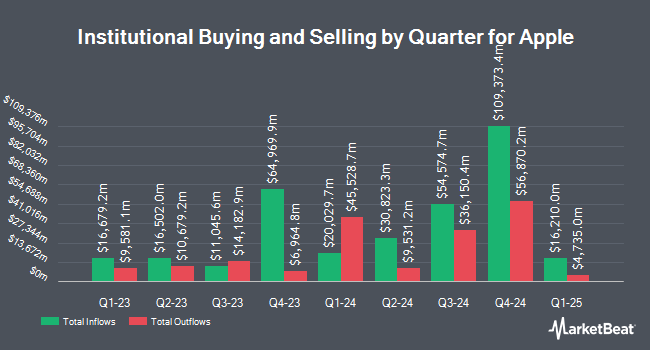

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. Verus Financial Partners Inc. lifted its holdings in Apple by 0.3% in the 2nd quarter. Verus Financial Partners Inc. now owns 16,929 shares of the iPhone maker's stock worth $3,566,000 after buying an additional 48 shares during the period. Brown Financial Advisory grew its holdings in Apple by 3.8% in the second quarter. Brown Financial Advisory now owns 1,364 shares of the iPhone maker's stock worth $287,000 after purchasing an additional 50 shares during the period. Core Wealth Management Inc. increased its position in Apple by 1.7% during the 2nd quarter. Core Wealth Management Inc. now owns 2,968 shares of the iPhone maker's stock valued at $625,000 after buying an additional 50 shares in the last quarter. Lowery Thomas LLC lifted its stake in shares of Apple by 0.7% in the second quarter. Lowery Thomas LLC now owns 7,607 shares of the iPhone maker's stock worth $1,602,000 after buying an additional 50 shares in the last quarter. Finally, Klein Pavlis & Peasley Financial Inc. increased its holdings in shares of Apple by 1.1% in the 2nd quarter. Klein Pavlis & Peasley Financial Inc. now owns 4,505 shares of the iPhone maker's stock worth $949,000 after purchasing an additional 51 shares in the last quarter. Hedge funds and other institutional investors own 60.41% of the company's stock.

Apple Trading Up 0.6 %

Shares of AAPL traded up $1.35 during mid-day trading on Friday, reaching $229.87. 38,168,252 shares of the company's stock traded hands, compared to its average volume of 43,855,068. The company has a debt-to-equity ratio of 1.51, a current ratio of 0.87 and a quick ratio of 0.83. The stock's 50-day moving average is $227.73 and its two-hundred day moving average is $218.06. Apple Inc. has a 12 month low of $164.07 and a 12 month high of $237.49. The stock has a market cap of $3.47 trillion, a P/E ratio of 37.81, a P/E/G ratio of 2.24 and a beta of 1.24.

Apple (NASDAQ:AAPL - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The iPhone maker reported $1.64 EPS for the quarter, beating the consensus estimate of $1.60 by $0.04. The company had revenue of $94.93 billion for the quarter, compared to the consensus estimate of $94.52 billion. Apple had a return on equity of 152.94% and a net margin of 23.97%. Apple's quarterly revenue was up 6.1% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.46 EPS. Research analysts forecast that Apple Inc. will post 7.43 earnings per share for the current fiscal year.

Apple Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, November 14th. Stockholders of record on Monday, November 11th were given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a dividend yield of 0.44%. The ex-dividend date of this dividend was Friday, November 8th. Apple's dividend payout ratio (DPR) is presently 16.45%.

Wall Street Analysts Forecast Growth

AAPL has been the subject of a number of research analyst reports. Jefferies Financial Group downgraded shares of Apple from a "buy" rating to a "hold" rating and lifted their target price for the stock from $205.00 to $212.92 in a research report on Monday, October 7th. Rosenblatt Securities increased their price objective on shares of Apple from $261.00 to $262.00 and gave the stock a "buy" rating in a research note on Friday, November 1st. Tigress Financial boosted their target price on shares of Apple from $245.00 to $295.00 and gave the company a "strong-buy" rating in a research report on Wednesday, August 28th. JPMorgan Chase & Co. reiterated an "overweight" rating and set a $265.00 price target on shares of Apple in a research note on Tuesday, September 10th. Finally, Oppenheimer restated a "buy" rating and issued a $250.00 price objective on shares of Apple in a research note on Tuesday, October 1st. Two equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating, twenty-two have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Apple currently has an average rating of "Moderate Buy" and an average price target of $235.25.

Get Our Latest Analysis on AAPL

Insider Activity at Apple

In other Apple news, insider Chris Kondo sold 4,130 shares of the business's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $228.87, for a total value of $945,233.10. Following the completion of the transaction, the insider now directly owns 15,419 shares in the company, valued at approximately $3,528,946.53. The trade was a 21.13 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO Timothy D. Cook sold 223,986 shares of Apple stock in a transaction on Wednesday, October 2nd. The stock was sold at an average price of $224.46, for a total transaction of $50,275,897.56. Following the completion of the transaction, the chief executive officer now directly owns 3,280,180 shares in the company, valued at $736,269,202.80. This represents a 6.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 408,170 shares of company stock worth $92,007,745. Company insiders own 0.06% of the company's stock.

About Apple

(

Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

Recommended Stories

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.