U.S. Capital Wealth Advisors LLC boosted its position in shares of Apple Inc. (NASDAQ:AAPL - Free Report) by 8.9% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 354,994 shares of the iPhone maker's stock after acquiring an additional 28,891 shares during the quarter. Apple accounts for approximately 2.9% of U.S. Capital Wealth Advisors LLC's investment portfolio, making the stock its 4th biggest position. U.S. Capital Wealth Advisors LLC's holdings in Apple were worth $82,714,000 at the end of the most recent quarter.

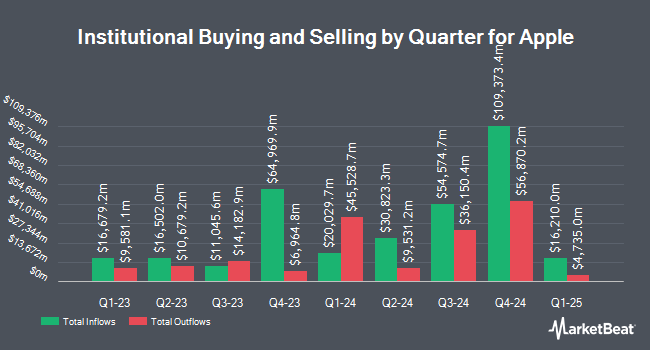

Several other institutional investors also recently bought and sold shares of AAPL. High Net Worth Advisory Group LLC boosted its holdings in Apple by 1.7% in the third quarter. High Net Worth Advisory Group LLC now owns 64,015 shares of the iPhone maker's stock valued at $14,916,000 after purchasing an additional 1,066 shares during the period. Granite Investment Partners LLC boosted its stake in shares of Apple by 2.7% in the 2nd quarter. Granite Investment Partners LLC now owns 289,421 shares of the iPhone maker's stock valued at $60,958,000 after buying an additional 7,606 shares during the period. Truist Financial Corp grew its position in shares of Apple by 1.8% during the second quarter. Truist Financial Corp now owns 6,994,703 shares of the iPhone maker's stock worth $1,473,224,000 after buying an additional 126,210 shares in the last quarter. EP Wealth Advisors LLC increased its stake in shares of Apple by 5.2% during the second quarter. EP Wealth Advisors LLC now owns 1,928,110 shares of the iPhone maker's stock worth $406,099,000 after buying an additional 95,235 shares during the period. Finally, CHICAGO TRUST Co NA raised its holdings in Apple by 15.2% in the third quarter. CHICAGO TRUST Co NA now owns 149,219 shares of the iPhone maker's stock valued at $34,768,000 after acquiring an additional 19,670 shares in the last quarter. 67.73% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

AAPL has been the topic of a number of recent analyst reports. Oppenheimer reissued a "buy" rating and issued a $250.00 price objective on shares of Apple in a research report on Tuesday, October 1st. UBS Group reissued a "neutral" rating and issued a $236.00 target price on shares of Apple in a report on Monday, December 2nd. KeyCorp downgraded Apple from a "sector weight" rating to an "underweight" rating and set a $200.00 price target for the company. in a report on Friday, October 25th. Monness Crespi & Hardt reiterated a "buy" rating and issued a $245.00 price objective on shares of Apple in a report on Monday, September 9th. Finally, Melius Research reaffirmed a "buy" rating and issued a $265.00 price target on shares of Apple in a report on Tuesday, August 27th. Two analysts have rated the stock with a sell rating, twelve have assigned a hold rating, twenty-three have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $236.78.

Get Our Latest Report on Apple

Insider Activity at Apple

In other Apple news, COO Jeffrey E. Williams sold 100,000 shares of the stock in a transaction on Monday, December 16th. The stock was sold at an average price of $249.97, for a total transaction of $24,997,000.00. Following the sale, the chief operating officer now owns 389,944 shares in the company, valued at approximately $97,474,301.68. This represents a 20.41 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Chris Kondo sold 4,130 shares of the business's stock in a transaction on Monday, November 18th. The stock was sold at an average price of $228.87, for a total value of $945,233.10. Following the completion of the transaction, the insider now directly owns 15,419 shares of the company's stock, valued at approximately $3,528,946.53. This trade represents a 21.13 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 508,170 shares of company stock valued at $117,004,745. Insiders own 0.06% of the company's stock.

Apple Price Performance

AAPL traded up $4.70 on Friday, hitting $254.49. 145,580,875 shares of the company were exchanged, compared to its average volume of 57,671,145. The business's fifty day moving average is $234.97 and its 200 day moving average is $225.70. Apple Inc. has a fifty-two week low of $164.07 and a fifty-two week high of $255.00. The company has a debt-to-equity ratio of 1.51, a quick ratio of 0.83 and a current ratio of 0.87. The firm has a market capitalization of $3.85 trillion, a P/E ratio of 41.86, a price-to-earnings-growth ratio of 2.41 and a beta of 1.23.

Apple (NASDAQ:AAPL - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The iPhone maker reported $1.64 earnings per share for the quarter, beating the consensus estimate of $1.60 by $0.04. The firm had revenue of $94.93 billion during the quarter, compared to the consensus estimate of $94.52 billion. Apple had a return on equity of 152.94% and a net margin of 23.97%. Apple's quarterly revenue was up 6.1% on a year-over-year basis. During the same period last year, the business posted $1.46 EPS. As a group, sell-side analysts anticipate that Apple Inc. will post 7.43 EPS for the current year.

Apple Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, November 14th. Investors of record on Monday, November 11th were given a $0.25 dividend. The ex-dividend date of this dividend was Friday, November 8th. This represents a $1.00 annualized dividend and a dividend yield of 0.39%. Apple's dividend payout ratio is presently 16.45%.

About Apple

(

Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

See Also

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report