Applied Finance Capital Management LLC lessened its stake in shares of Hasbro, Inc. (NASDAQ:HAS - Free Report) by 94.8% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 638 shares of the company's stock after selling 11,553 shares during the period. Applied Finance Capital Management LLC's holdings in Hasbro were worth $46,000 as of its most recent filing with the SEC.

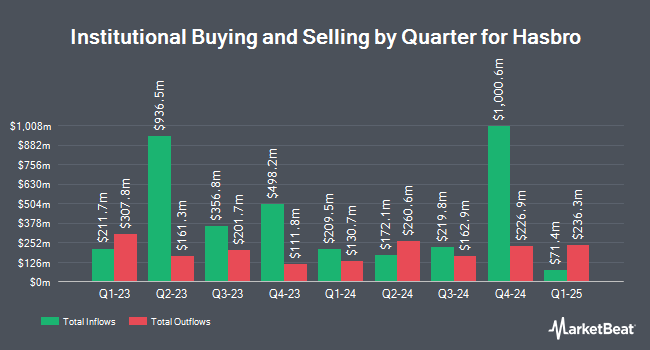

Several other large investors have also recently bought and sold shares of the stock. Dimensional Fund Advisors LP raised its holdings in shares of Hasbro by 7.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,858,541 shares of the company's stock valued at $108,723,000 after purchasing an additional 135,548 shares during the period. Samlyn Capital LLC increased its position in Hasbro by 87.4% during the second quarter. Samlyn Capital LLC now owns 1,833,374 shares of the company's stock worth $107,252,000 after buying an additional 855,099 shares during the last quarter. Swedbank AB bought a new stake in Hasbro in the first quarter valued at approximately $82,523,000. Point72 Asset Management L.P. lifted its position in shares of Hasbro by 43.2% in the second quarter. Point72 Asset Management L.P. now owns 707,809 shares of the company's stock valued at $41,407,000 after buying an additional 213,664 shares during the last quarter. Finally, AQR Capital Management LLC lifted its position in shares of Hasbro by 469.4% in the second quarter. AQR Capital Management LLC now owns 686,144 shares of the company's stock valued at $40,037,000 after buying an additional 565,645 shares during the last quarter. 91.83% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of research analysts recently weighed in on HAS shares. JPMorgan Chase & Co. boosted their target price on Hasbro from $76.00 to $82.00 and gave the stock an "overweight" rating in a report on Monday, October 21st. Bank of America upped their price objective on shares of Hasbro from $90.00 to $95.00 and gave the company a "buy" rating in a report on Tuesday, October 15th. Jefferies Financial Group raised their target price on shares of Hasbro from $75.00 to $83.00 and gave the stock a "buy" rating in a research note on Tuesday, October 1st. Morgan Stanley upped their price target on shares of Hasbro from $80.00 to $92.00 and gave the company an "overweight" rating in a research note on Friday, October 25th. Finally, DA Davidson raised their price objective on shares of Hasbro from $59.00 to $73.00 and gave the stock a "neutral" rating in a research report on Friday, October 25th. Two equities research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $80.67.

View Our Latest Research Report on HAS

Hasbro Price Performance

Shares of NASDAQ HAS traded up $0.24 during midday trading on Friday, reaching $64.38. The company's stock had a trading volume of 1,060,705 shares, compared to its average volume of 1,518,028. The company has a debt-to-equity ratio of 2.64, a quick ratio of 1.29 and a current ratio of 1.47. The company has a market cap of $8.98 billion, a P/E ratio of -13.88, a P/E/G ratio of 0.59 and a beta of 0.63. The business's 50 day moving average price is $69.45 and its two-hundred day moving average price is $64.28. Hasbro, Inc. has a fifty-two week low of $42.66 and a fifty-two week high of $73.46.

Hasbro (NASDAQ:HAS - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The company reported $1.73 earnings per share for the quarter, beating the consensus estimate of $1.28 by $0.45. The firm had revenue of $1.28 billion during the quarter, compared to analysts' expectations of $1.30 billion. Hasbro had a positive return on equity of 47.91% and a negative net margin of 14.83%. The company's quarterly revenue was down 14.8% compared to the same quarter last year. During the same period in the previous year, the firm earned $1.64 EPS. On average, analysts forecast that Hasbro, Inc. will post 3.93 EPS for the current fiscal year.

Hasbro Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 4th. Shareholders of record on Wednesday, November 20th will be paid a dividend of $0.70 per share. The ex-dividend date of this dividend is Wednesday, November 20th. This represents a $2.80 dividend on an annualized basis and a yield of 4.35%. Hasbro's payout ratio is -60.34%.

About Hasbro

(

Free Report)

Hasbro, Inc, together with its subsidiaries, operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong. The company operates through Consumer Products; Wizards of the Coast and Digital Gaming; Entertainment; and Corporate and Other segments.

See Also

Before you consider Hasbro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hasbro wasn't on the list.

While Hasbro currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.