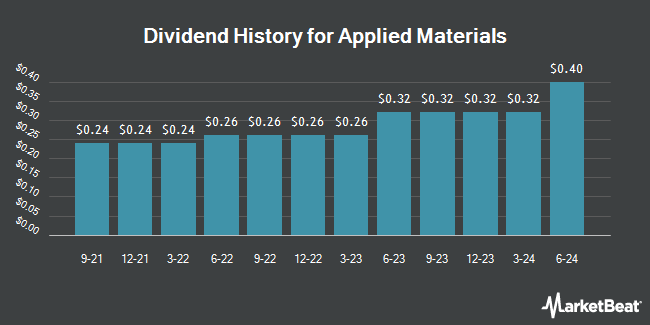

Applied Materials, Inc. (NASDAQ:AMAT - Get Free Report) announced a quarterly dividend on Friday, December 13th,RTT News reports. Shareholders of record on Thursday, February 20th will be given a dividend of 0.40 per share by the manufacturing equipment provider on Thursday, March 13th. This represents a $1.60 annualized dividend and a yield of 0.94%.

Applied Materials has raised its dividend payment by an average of 11.9% per year over the last three years. Applied Materials has a dividend payout ratio of 16.9% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect Applied Materials to earn $10.47 per share next year, which means the company should continue to be able to cover its $1.60 annual dividend with an expected future payout ratio of 15.3%.

Applied Materials Stock Performance

Shares of AMAT stock traded up $0.27 during trading on Friday, reaching $169.35. 7,049,633 shares of the company's stock were exchanged, compared to its average volume of 6,207,007. Applied Materials has a twelve month low of $148.05 and a twelve month high of $255.89. The firm's fifty day moving average price is $183.52 and its 200-day moving average price is $201.92. The company has a quick ratio of 1.87, a current ratio of 2.51 and a debt-to-equity ratio of 0.29. The stock has a market capitalization of $139.61 billion, a PE ratio of 19.64, a PEG ratio of 1.61 and a beta of 1.52.

Applied Materials (NASDAQ:AMAT - Get Free Report) last posted its earnings results on Thursday, November 14th. The manufacturing equipment provider reported $2.32 EPS for the quarter, beating the consensus estimate of $2.19 by $0.13. Applied Materials had a return on equity of 39.26% and a net margin of 26.41%. The company had revenue of $7.05 billion for the quarter, compared to the consensus estimate of $6.96 billion. During the same quarter in the prior year, the business earned $2.12 earnings per share. The firm's revenue for the quarter was up 4.8% on a year-over-year basis. As a group, sell-side analysts anticipate that Applied Materials will post 9.48 EPS for the current year.

Analysts Set New Price Targets

A number of analysts have issued reports on the stock. Needham & Company LLC cut their price objective on shares of Applied Materials from $240.00 to $225.00 and set a "buy" rating for the company in a report on Friday, November 15th. JPMorgan Chase & Co. increased their price target on Applied Materials from $240.00 to $250.00 and gave the stock an "overweight" rating in a research report on Friday, August 16th. Sanford C. Bernstein decreased their price target on Applied Materials from $220.00 to $210.00 and set an "outperform" rating on the stock in a research report on Friday, November 29th. Morgan Stanley restated an "underweight" rating and set a $164.00 price objective (down from $179.00) on shares of Applied Materials in a research report on Thursday, December 5th. Finally, Evercore ISI decreased their price target on shares of Applied Materials from $260.00 to $250.00 and set an "outperform" rating on the stock in a report on Friday, November 15th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating and fifteen have assigned a buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $220.29.

View Our Latest Analysis on AMAT

About Applied Materials

(

Get Free Report)

Applied Materials, Inc engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries. The company operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductor Systems segment develops, manufactures, and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits.

Featured Stories

Before you consider Applied Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Materials wasn't on the list.

While Applied Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.