Natixis Advisors LLC lowered its stake in Applied Materials, Inc. (NASDAQ:AMAT - Free Report) by 17.3% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 687,969 shares of the manufacturing equipment provider's stock after selling 144,393 shares during the period. Natixis Advisors LLC owned approximately 0.08% of Applied Materials worth $139,004,000 as of its most recent SEC filing.

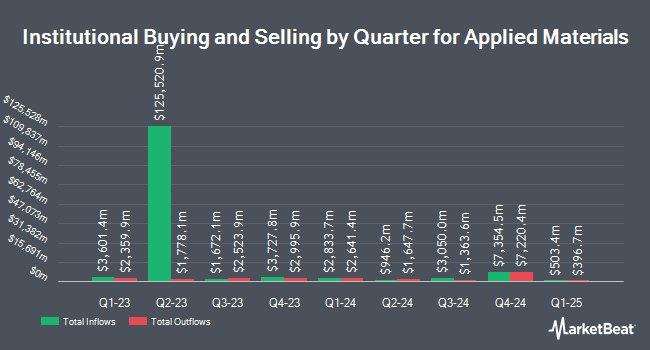

Other large investors also recently made changes to their positions in the company. Swedbank AB acquired a new stake in shares of Applied Materials in the first quarter valued at about $773,611,000. Van ECK Associates Corp raised its stake in Applied Materials by 29.8% during the 3rd quarter. Van ECK Associates Corp now owns 6,571,178 shares of the manufacturing equipment provider's stock valued at $1,327,707,000 after purchasing an additional 1,509,439 shares during the last quarter. Janus Henderson Group PLC boosted its holdings in Applied Materials by 126.4% in the 1st quarter. Janus Henderson Group PLC now owns 2,254,952 shares of the manufacturing equipment provider's stock valued at $464,974,000 after purchasing an additional 1,259,111 shares during the period. Assenagon Asset Management S.A. grew its position in Applied Materials by 262.5% in the 3rd quarter. Assenagon Asset Management S.A. now owns 1,390,501 shares of the manufacturing equipment provider's stock worth $280,951,000 after purchasing an additional 1,006,937 shares during the last quarter. Finally, EdgePoint Investment Group Inc. bought a new position in shares of Applied Materials during the 1st quarter worth about $162,873,000. Institutional investors own 80.56% of the company's stock.

Applied Materials Price Performance

NASDAQ:AMAT traded down $17.12 during mid-day trading on Friday, reaching $168.88. 16,287,484 shares of the company were exchanged, compared to its average volume of 6,137,177. Applied Materials, Inc. has a 12 month low of $141.94 and a 12 month high of $255.89. The stock has a market cap of $139.22 billion, a PE ratio of 18.98, a PEG ratio of 2.24 and a beta of 1.56. The company has a quick ratio of 2.09, a current ratio of 2.86 and a debt-to-equity ratio of 0.33. The company has a fifty day moving average of $190.88 and a 200 day moving average of $206.73.

Applied Materials (NASDAQ:AMAT - Get Free Report) last posted its quarterly earnings data on Thursday, August 15th. The manufacturing equipment provider reported $2.12 earnings per share for the quarter, topping the consensus estimate of $2.02 by $0.10. The firm had revenue of $6.78 billion during the quarter, compared to analysts' expectations of $6.68 billion. Applied Materials had a net margin of 27.74% and a return on equity of 39.99%. Applied Materials's revenue was up 5.5% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.90 EPS. On average, research analysts anticipate that Applied Materials, Inc. will post 8.51 EPS for the current fiscal year.

Applied Materials Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Thursday, November 21st will be issued a $0.40 dividend. This represents a $1.60 annualized dividend and a yield of 0.95%. The ex-dividend date is Thursday, November 21st. Applied Materials's dividend payout ratio is 17.98%.

Analyst Upgrades and Downgrades

AMAT has been the subject of several research reports. Susquehanna reduced their target price on shares of Applied Materials from $190.00 to $170.00 and set a "neutral" rating for the company in a research note on Monday, November 11th. B. Riley decreased their price objective on Applied Materials from $300.00 to $280.00 and set a "buy" rating on the stock in a report on Friday, August 16th. UBS Group lowered their price objective on Applied Materials from $220.00 to $210.00 and set a "neutral" rating on the stock in a research report on Thursday, September 12th. Evercore ISI reduced their target price on Applied Materials from $260.00 to $250.00 and set an "outperform" rating for the company in a research report on Friday. Finally, Stifel Nicolaus lowered their price target on shares of Applied Materials from $270.00 to $250.00 and set a "buy" rating on the stock in a report on Tuesday. Eight investment analysts have rated the stock with a hold rating and fifteen have given a buy rating to the company. According to data from MarketBeat, Applied Materials presently has a consensus rating of "Moderate Buy" and an average price target of $219.81.

View Our Latest Stock Analysis on Applied Materials

Applied Materials Company Profile

(

Free Report)

Applied Materials, Inc engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries. The company operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductor Systems segment develops, manufactures, and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits.

Featured Stories

Before you consider Applied Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Materials wasn't on the list.

While Applied Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.