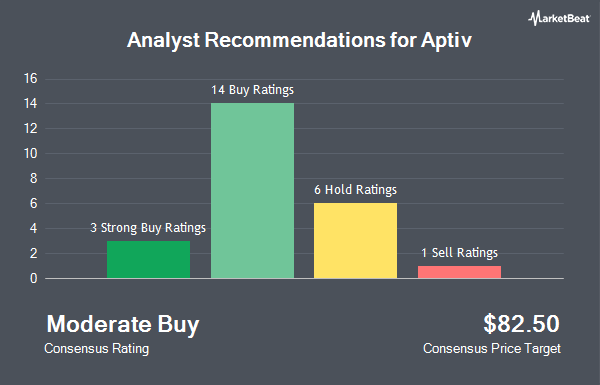

Shares of Aptiv PLC (NYSE:APTV - Get Free Report) have been given a consensus rating of "Moderate Buy" by the nineteen research firms that are currently covering the firm, MarketBeat Ratings reports. Two investment analysts have rated the stock with a sell recommendation, four have issued a hold recommendation and thirteen have assigned a buy recommendation to the company. The average 1-year price target among brokers that have issued ratings on the stock in the last year is $87.00.

Several research firms recently commented on APTV. Fox Advisors cut shares of Aptiv from an "overweight" rating to an "equal weight" rating in a research report on Tuesday, October 1st. Wolfe Research started coverage on Aptiv in a report on Thursday, September 5th. They set an "outperform" rating and a $89.00 target price on the stock. JPMorgan Chase & Co. raised their target price on shares of Aptiv from $107.00 to $113.00 and gave the company an "overweight" rating in a research note on Monday, October 21st. Citigroup dropped their price target on shares of Aptiv from $128.00 to $108.00 and set a "buy" rating on the stock in a research report on Friday, July 12th. Finally, StockNews.com initiated coverage on shares of Aptiv in a research report on Sunday. They issued a "hold" rating for the company.

Check Out Our Latest Report on Aptiv

Institutional Investors Weigh In On Aptiv

Several institutional investors and hedge funds have recently made changes to their positions in APTV. First Trust Direct Indexing L.P. increased its stake in shares of Aptiv by 21.6% in the first quarter. First Trust Direct Indexing L.P. now owns 3,902 shares of the auto parts company's stock valued at $311,000 after buying an additional 692 shares during the period. Janney Montgomery Scott LLC increased its stake in shares of Aptiv by 36.6% in the first quarter. Janney Montgomery Scott LLC now owns 47,934 shares of the auto parts company's stock valued at $3,818,000 after buying an additional 12,835 shares during the period. Hemenway Trust Co LLC boosted its position in shares of Aptiv by 25.2% during the 1st quarter. Hemenway Trust Co LLC now owns 55,968 shares of the auto parts company's stock valued at $4,458,000 after purchasing an additional 11,270 shares in the last quarter. Broderick Brian C boosted its position in shares of Aptiv by 0.6% during the 1st quarter. Broderick Brian C now owns 21,728 shares of the auto parts company's stock valued at $1,731,000 after purchasing an additional 132 shares in the last quarter. Finally, Duality Advisers LP bought a new stake in shares of Aptiv during the 1st quarter valued at about $2,993,000. Institutional investors and hedge funds own 94.21% of the company's stock.

Aptiv Trading Down 2.6 %

APTV traded down $1.41 during mid-day trading on Wednesday, hitting $53.83. The stock had a trading volume of 6,858,133 shares, compared to its average volume of 3,081,167. Aptiv has a 1-year low of $52.81 and a 1-year high of $91.66. The firm has a market capitalization of $14.31 billion, a price-to-earnings ratio of 6.17, a price-to-earnings-growth ratio of 0.52 and a beta of 1.81. The company has a debt-to-equity ratio of 0.91, a current ratio of 1.50 and a quick ratio of 1.06. The stock's fifty day simple moving average is $68.94 and its 200-day simple moving average is $72.23.

Aptiv (NYSE:APTV - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The auto parts company reported $1.83 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.68 by $0.15. Aptiv had a return on equity of 14.51% and a net margin of 12.29%. The company had revenue of $4.85 billion during the quarter, compared to the consensus estimate of $5.10 billion. During the same period in the prior year, the company earned $1.30 earnings per share. The company's revenue for the quarter was down 5.1% compared to the same quarter last year. As a group, research analysts forecast that Aptiv will post 6.2 EPS for the current fiscal year.

About Aptiv

(

Get Free ReportAptiv PLC engages in design, manufacture, and sale of vehicle components in North America, Europe, Middle East, Africa, the Asia Pacific, South America, and internationally. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two segments, Signal and Power Solutions, and Advanced Safety and User Experience.

Featured Articles

Before you consider Aptiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aptiv wasn't on the list.

While Aptiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.