Aramark (NYSE:ARMK - Get Free Report) was upgraded by investment analysts at StockNews.com from a "hold" rating to a "buy" rating in a research report issued to clients and investors on Monday.

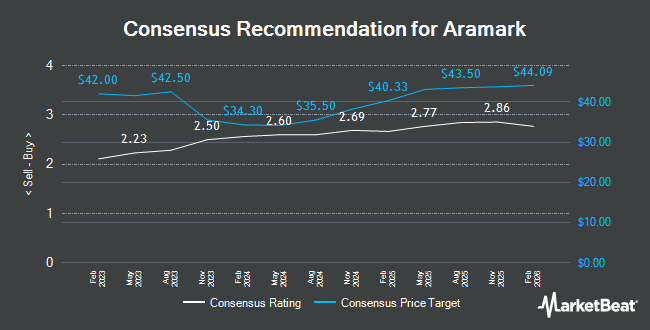

A number of other research analysts have also recently commented on the stock. Stifel Nicolaus boosted their target price on shares of Aramark from $43.00 to $45.00 and gave the stock a "buy" rating in a research report on Tuesday, November 12th. Royal Bank of Canada upgraded shares of Aramark from a "sector perform" rating to an "outperform" rating and boosted their price objective for the stock from $36.00 to $42.50 in a report on Tuesday, September 17th. Truist Financial raised their target price on Aramark from $42.00 to $46.00 and gave the company a "buy" rating in a research note on Tuesday, November 12th. Robert W. Baird lifted their target price on Aramark from $44.00 to $45.00 and gave the stock a "neutral" rating in a research report on Thursday, December 12th. Finally, Morgan Stanley increased their price target on Aramark from $40.00 to $43.00 and gave the company an "equal weight" rating in a report on Thursday, December 12th. Two equities research analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $42.59.

View Our Latest Analysis on Aramark

Aramark Trading Down 0.5 %

ARMK stock traded down $0.18 during trading on Monday, reaching $37.25. 1,241,852 shares of the stock traded hands, compared to its average volume of 2,190,828. The firm has a market capitalization of $9.87 billion, a PE ratio of 37.63 and a beta of 1.63. The company has a debt-to-equity ratio of 1.42, a current ratio of 0.81 and a quick ratio of 0.72. The business's 50 day moving average price is $39.06 and its 200-day moving average price is $36.82. Aramark has a 52-week low of $27.47 and a 52-week high of $42.49.

Aramark (NYSE:ARMK - Get Free Report) last announced its quarterly earnings results on Monday, November 11th. The company reported $0.54 earnings per share for the quarter, meeting analysts' consensus estimates of $0.54. Aramark had a net margin of 1.51% and a return on equity of 14.06%. The firm had revenue of $4.42 billion for the quarter, compared to analysts' expectations of $4.46 billion. During the same period in the previous year, the company posted $0.64 earnings per share. Aramark's revenue was up 5.2% compared to the same quarter last year. As a group, sell-side analysts forecast that Aramark will post 1.92 earnings per share for the current year.

Hedge Funds Weigh In On Aramark

Several hedge funds and other institutional investors have recently made changes to their positions in ARMK. Franklin Resources Inc. raised its stake in shares of Aramark by 7.2% during the third quarter. Franklin Resources Inc. now owns 6,570,938 shares of the company's stock valued at $254,427,000 after purchasing an additional 441,711 shares in the last quarter. Wilmington Savings Fund Society FSB acquired a new position in Aramark during the 3rd quarter valued at about $761,000. Sanctuary Advisors LLC bought a new stake in shares of Aramark during the 3rd quarter worth about $309,000. Geode Capital Management LLC lifted its stake in shares of Aramark by 1.1% in the 3rd quarter. Geode Capital Management LLC now owns 4,363,113 shares of the company's stock worth $169,028,000 after acquiring an additional 45,384 shares during the period. Finally, M&T Bank Corp increased its stake in shares of Aramark by 5.5% during the third quarter. M&T Bank Corp now owns 16,206 shares of the company's stock valued at $628,000 after acquiring an additional 838 shares during the period.

About Aramark

(

Get Free Report)

Aramark provides food and facilities services to education, healthcare, business and industry, sports, leisure, and corrections clients in the United States and internationally. It operates through two segments, Food and Support Services United States, and Food and Support Services International. The company offers food-related managed services, including dining, catering, food service management, and convenience-oriented retail services; non-clinical food and food-related support services, such as patient food and nutrition, retail food, environmental services, and procurement services; and plant operations and maintenance, custodial/housekeeping, energy management, grounds keeping, and capital project management services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Aramark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aramark wasn't on the list.

While Aramark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.