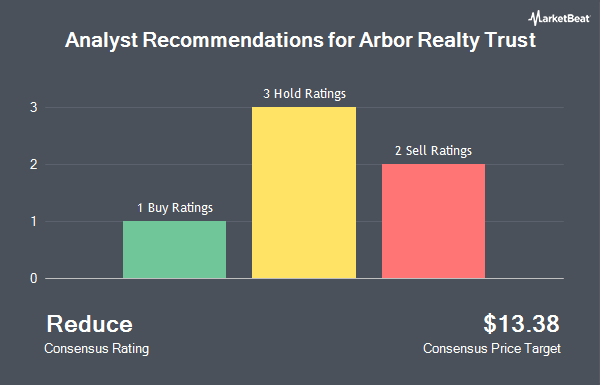

Shares of Arbor Realty Trust, Inc. (NYSE:ABR - Get Free Report) have received a consensus recommendation of "Hold" from the six analysts that are presently covering the company, Marketbeat reports. Two investment analysts have rated the stock with a sell rating, two have assigned a hold rating and two have issued a buy rating on the company. The average 12-month price objective among analysts that have updated their coverage on the stock in the last year is $14.25.

Several equities analysts recently issued reports on ABR shares. Raymond James boosted their price target on shares of Arbor Realty Trust from $15.00 to $16.00 and gave the company an "outperform" rating in a research report on Thursday, September 19th. Piper Sandler increased their target price on Arbor Realty Trust from $12.00 to $12.50 and gave the stock an "underweight" rating in a research report on Monday, August 5th. JPMorgan Chase & Co. raised their target price on Arbor Realty Trust from $12.00 to $13.50 and gave the company an "underweight" rating in a research note on Thursday, October 17th. Finally, JMP Securities upped their price target on Arbor Realty Trust from $16.00 to $16.50 and gave the stock a "market outperform" rating in a research note on Friday, September 27th.

View Our Latest Stock Report on ABR

Institutional Trading of Arbor Realty Trust

Institutional investors have recently bought and sold shares of the company. GAMMA Investing LLC increased its holdings in shares of Arbor Realty Trust by 75.5% in the 3rd quarter. GAMMA Investing LLC now owns 1,599 shares of the real estate investment trust's stock worth $25,000 after purchasing an additional 688 shares in the last quarter. Harbor Capital Advisors Inc. bought a new stake in Arbor Realty Trust in the 3rd quarter worth about $38,000. Glenmede Trust Co. NA raised its position in Arbor Realty Trust by 33.1% in the 3rd quarter. Glenmede Trust Co. NA now owns 2,818 shares of the real estate investment trust's stock worth $44,000 after buying an additional 701 shares during the last quarter. KBC Group NV lifted its stake in Arbor Realty Trust by 39.1% during the 3rd quarter. KBC Group NV now owns 6,395 shares of the real estate investment trust's stock valued at $100,000 after acquiring an additional 1,796 shares during the period. Finally, Prospera Private Wealth LLC purchased a new stake in shares of Arbor Realty Trust during the 3rd quarter valued at about $102,000. 57.25% of the stock is owned by hedge funds and other institutional investors.

Arbor Realty Trust Trading Down 0.8 %

Shares of Arbor Realty Trust stock traded down $0.12 during midday trading on Monday, reaching $14.56. 2,614,631 shares of the company's stock traded hands, compared to its average volume of 3,750,478. The stock has a 50 day moving average of $15.09 and a 200-day moving average of $14.23. Arbor Realty Trust has a 12 month low of $11.92 and a 12 month high of $16.35. The company has a market cap of $2.75 billion, a PE ratio of 10.89 and a beta of 2.06. The company has a debt-to-equity ratio of 2.67, a quick ratio of 35.68 and a current ratio of 35.68.

Arbor Realty Trust Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, November 27th. Stockholders of record on Friday, November 15th were given a $0.43 dividend. This represents a $1.72 annualized dividend and a dividend yield of 11.82%. The ex-dividend date was Friday, November 15th. Arbor Realty Trust's dividend payout ratio is presently 127.41%.

About Arbor Realty Trust

(

Get Free ReportArbor Realty Trust, Inc invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company operates through Structured Business and Agency Business segments. It primarily invests in bridge and mezzanine loans, including junior participating interests in first mortgages, and preferred and direct equity, as well as real estate-related joint ventures, real estate-related notes, and various mortgage-related securities.

See Also

Before you consider Arbor Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arbor Realty Trust wasn't on the list.

While Arbor Realty Trust currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.