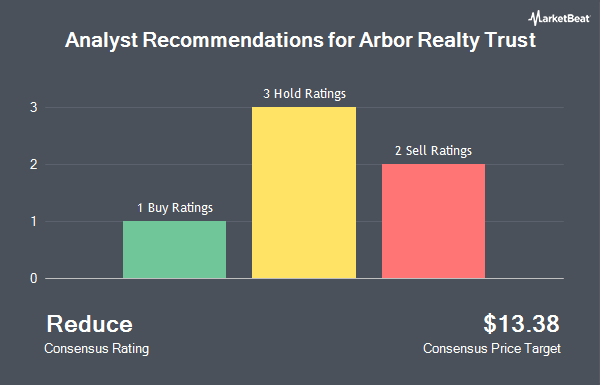

Arbor Realty Trust, Inc. (NYSE:ABR - Get Free Report) has earned an average rating of "Hold" from the six analysts that are presently covering the stock, MarketBeat reports. Two research analysts have rated the stock with a sell rating, two have issued a hold rating and two have given a buy rating to the company. The average 12-month price objective among brokers that have covered the stock in the last year is $14.25.

ABR has been the subject of several research reports. Piper Sandler upped their price target on shares of Arbor Realty Trust from $12.00 to $12.50 and gave the company an "underweight" rating in a research report on Monday, August 5th. Raymond James increased their price target on shares of Arbor Realty Trust from $15.00 to $16.00 and gave the stock an "outperform" rating in a research report on Thursday, September 19th. JPMorgan Chase & Co. boosted their price objective on shares of Arbor Realty Trust from $12.00 to $13.50 and gave the company an "underweight" rating in a research report on Thursday, October 17th. JMP Securities raised their target price on Arbor Realty Trust from $16.00 to $16.50 and gave the stock a "market outperform" rating in a report on Friday, September 27th. Finally, Keefe, Bruyette & Woods upped their price target on Arbor Realty Trust from $13.25 to $14.00 and gave the stock a "market perform" rating in a research report on Wednesday, July 10th.

View Our Latest Stock Report on Arbor Realty Trust

Arbor Realty Trust Stock Performance

Shares of NYSE:ABR traded up $0.11 during midday trading on Thursday, reaching $15.14. 2,004,519 shares of the company's stock traded hands, compared to its average volume of 3,850,438. The company has a market cap of $2.85 billion, a price-to-earnings ratio of 11.13 and a beta of 2.06. The company has a debt-to-equity ratio of 2.67, a quick ratio of 37.31 and a current ratio of 35.68. Arbor Realty Trust has a one year low of $11.77 and a one year high of $16.35. The stock has a 50 day moving average of $14.75 and a 200 day moving average of $14.02.

Arbor Realty Trust Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, November 27th. Stockholders of record on Friday, November 15th will be given a $0.43 dividend. The ex-dividend date of this dividend is Friday, November 15th. This represents a $1.72 annualized dividend and a dividend yield of 11.36%. Arbor Realty Trust's payout ratio is 127.41%.

Hedge Funds Weigh In On Arbor Realty Trust

Several large investors have recently made changes to their positions in ABR. UniSuper Management Pty Ltd purchased a new stake in shares of Arbor Realty Trust in the first quarter worth about $667,000. Avantax Advisory Services Inc. lifted its position in shares of Arbor Realty Trust by 8.4% in the first quarter. Avantax Advisory Services Inc. now owns 33,321 shares of the real estate investment trust's stock worth $442,000 after buying an additional 2,568 shares in the last quarter. Price T Rowe Associates Inc. MD lifted its position in shares of Arbor Realty Trust by 7.6% in the first quarter. Price T Rowe Associates Inc. MD now owns 95,129 shares of the real estate investment trust's stock worth $1,261,000 after buying an additional 6,697 shares in the last quarter. Cetera Investment Advisers lifted its position in shares of Arbor Realty Trust by 358.5% in the first quarter. Cetera Investment Advisers now owns 220,559 shares of the real estate investment trust's stock worth $2,922,000 after buying an additional 172,454 shares in the last quarter. Finally, QRG Capital Management Inc. purchased a new stake in shares of Arbor Realty Trust in the first quarter worth about $2,520,000. 57.25% of the stock is currently owned by hedge funds and other institutional investors.

About Arbor Realty Trust

(

Get Free ReportArbor Realty Trust, Inc invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company operates through Structured Business and Agency Business segments. It primarily invests in bridge and mezzanine loans, including junior participating interests in first mortgages, and preferred and direct equity, as well as real estate-related joint ventures, real estate-related notes, and various mortgage-related securities.

Featured Stories

Before you consider Arbor Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arbor Realty Trust wasn't on the list.

While Arbor Realty Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.