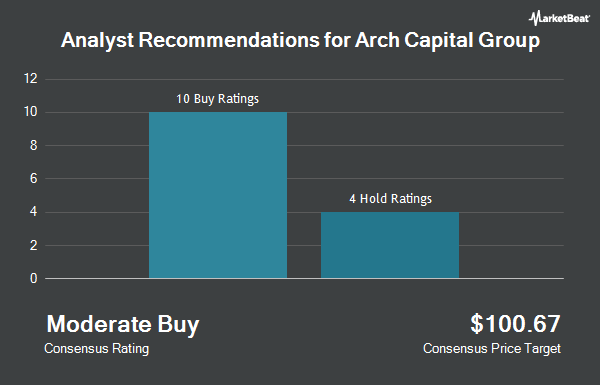

Arch Capital Group Ltd. (NASDAQ:ACGL - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the fifteen analysts that are presently covering the company, Marketbeat reports. Five equities research analysts have rated the stock with a hold recommendation and ten have assigned a buy recommendation to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $116.53.

A number of analysts have recently issued reports on the stock. JMP Securities reiterated a "market outperform" rating and issued a $125.00 price objective on shares of Arch Capital Group in a report on Tuesday. Morgan Stanley lowered their target price on shares of Arch Capital Group from $115.00 to $110.00 and set an "overweight" rating on the stock in a report on Friday. Keefe, Bruyette & Woods lowered their target price on shares of Arch Capital Group from $120.00 to $113.00 and set an "outperform" rating on the stock in a report on Thursday. BMO Capital Markets lifted their price objective on shares of Arch Capital Group from $98.00 to $104.00 and gave the stock a "market perform" rating in a research report on Wednesday, November 6th. Finally, Royal Bank of Canada reduced their target price on shares of Arch Capital Group from $125.00 to $110.00 and set an "outperform" rating for the company in a research report on Wednesday.

Get Our Latest Stock Report on Arch Capital Group

Arch Capital Group Trading Down 2.2 %

Arch Capital Group stock traded down $1.96 during midday trading on Tuesday, hitting $88.20. 1,823,977 shares of the stock were exchanged, compared to its average volume of 1,974,106. The company has a fifty day simple moving average of $92.53 and a two-hundred day simple moving average of $100.93. Arch Capital Group has a 52 week low of $83.97 and a 52 week high of $116.47. The stock has a market capitalization of $33.18 billion, a PE ratio of 5.92, a P/E/G ratio of 1.53 and a beta of 0.64. The company has a quick ratio of 0.58, a current ratio of 0.58 and a debt-to-equity ratio of 0.17.

Arch Capital Group (NASDAQ:ACGL - Get Free Report) last announced its earnings results on Monday, February 10th. The insurance provider reported $2.26 EPS for the quarter, topping the consensus estimate of $1.90 by $0.36. Arch Capital Group had a net margin of 33.86% and a return on equity of 18.94%. During the same quarter in the prior year, the company posted $2.45 EPS. Equities research analysts anticipate that Arch Capital Group will post 8.86 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors have recently bought and sold shares of the business. Farther Finance Advisors LLC increased its stake in shares of Arch Capital Group by 12.8% in the third quarter. Farther Finance Advisors LLC now owns 890 shares of the insurance provider's stock valued at $100,000 after buying an additional 101 shares during the period. Oregon Public Employees Retirement Fund boosted its holdings in Arch Capital Group by 0.3% in the fourth quarter. Oregon Public Employees Retirement Fund now owns 32,147 shares of the insurance provider's stock valued at $2,969,000 after acquiring an additional 110 shares during the last quarter. KG&L Capital Management LLC boosted its holdings in Arch Capital Group by 1.1% in the third quarter. KG&L Capital Management LLC now owns 10,854 shares of the insurance provider's stock valued at $1,214,000 after acquiring an additional 115 shares during the last quarter. Marks Group Wealth Management Inc boosted its holdings in Arch Capital Group by 4.2% in the third quarter. Marks Group Wealth Management Inc now owns 2,884 shares of the insurance provider's stock valued at $323,000 after acquiring an additional 115 shares during the last quarter. Finally, Harbor Capital Advisors Inc. boosted its holdings in shares of Arch Capital Group by 1.3% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 8,878 shares of the insurance provider's stock worth $993,000 after buying an additional 116 shares in the last quarter. Institutional investors and hedge funds own 89.07% of the company's stock.

Arch Capital Group Company Profile

(

Get Free ReportArch Capital Group Ltd., together with its subsidiaries, provides insurance, reinsurance, and mortgage insurance products worldwide. The company's Insurance segment offers primary and excess casualty coverages; loss sensitive primary casualty insurance programs; directors' and officers' liability, errors and omissions liability, employment practices and fiduciary liability, crime, professional indemnity, and other financial related coverages; medical professional and general liability insurance coverages; and workers' compensation and umbrella liability, as well as commercial automobile and inland marine products.

Further Reading

Before you consider Arch Capital Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arch Capital Group wasn't on the list.

While Arch Capital Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.