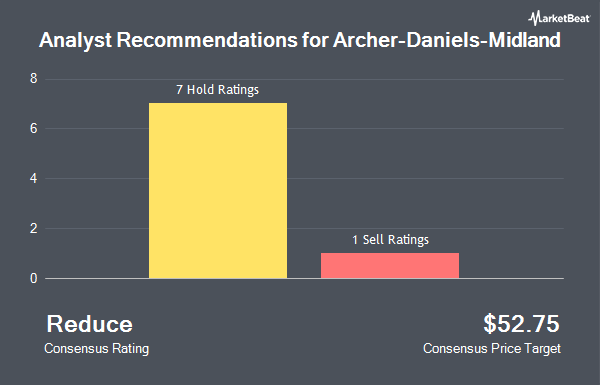

Archer-Daniels-Midland Company (NYSE:ADM - Get Free Report) has been assigned an average recommendation of "Reduce" from the fourteen analysts that are currently covering the stock, Marketbeat reports. One research analyst has rated the stock with a sell rating and thirteen have given a hold rating to the company. The average 1 year target price among brokerages that have issued a report on the stock in the last year is $62.83.

ADM has been the topic of a number of analyst reports. UBS Group boosted their price target on Archer-Daniels-Midland from $60.00 to $64.00 and gave the stock a "neutral" rating in a research report on Monday, September 9th. Morgan Stanley cut their target price on Archer-Daniels-Midland from $57.00 to $52.00 and set an "equal weight" rating on the stock in a research note on Tuesday, November 12th. Finally, JPMorgan Chase & Co. lifted their price target on Archer-Daniels-Midland from $65.00 to $66.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 31st.

Read Our Latest Analysis on ADM

Archer-Daniels-Midland Trading Down 0.1 %

Shares of NYSE ADM opened at $53.13 on Friday. Archer-Daniels-Midland has a 1 year low of $48.92 and a 1 year high of $77.35. The company has a debt-to-equity ratio of 0.34, a current ratio of 1.40 and a quick ratio of 0.88. The firm has a 50-day moving average of $56.60 and a 200 day moving average of $59.53. The stock has a market cap of $25.42 billion, a P/E ratio of 15.18 and a beta of 0.73.

Archer-Daniels-Midland Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Thursday, November 21st will be issued a $0.50 dividend. This represents a $2.00 annualized dividend and a yield of 3.76%. The ex-dividend date is Thursday, November 21st. Archer-Daniels-Midland's dividend payout ratio is currently 57.14%.

Insiders Place Their Bets

In other Archer-Daniels-Midland news, CEO Juan R. Luciano sold 170,194 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $60.51, for a total value of $10,298,438.94. Following the transaction, the chief executive officer now directly owns 265,210 shares of the company's stock, valued at approximately $16,047,857.10. This trade represents a 39.09 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In the last quarter, insiders sold 219,348 shares of company stock valued at $13,296,833. Company insiders own 1.20% of the company's stock.

Hedge Funds Weigh In On Archer-Daniels-Midland

A number of institutional investors and hedge funds have recently made changes to their positions in the business. Harbor Capital Advisors Inc. purchased a new position in shares of Archer-Daniels-Midland during the 3rd quarter worth $25,000. Ashton Thomas Securities LLC purchased a new position in Archer-Daniels-Midland during the third quarter valued at $26,000. Riverview Trust Co bought a new stake in Archer-Daniels-Midland during the second quarter valued at about $27,000. Altshuler Shaham Ltd purchased a new stake in Archer-Daniels-Midland in the second quarter worth about $28,000. Finally, Peterson Financial Group Inc. bought a new position in shares of Archer-Daniels-Midland in the third quarter worth about $28,000. Hedge funds and other institutional investors own 78.28% of the company's stock.

Archer-Daniels-Midland Company Profile

(

Get Free ReportArcher-Daniels-Midland Company engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally. It operates in three segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition.

See Also

Before you consider Archer-Daniels-Midland, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Archer-Daniels-Midland wasn't on the list.

While Archer-Daniels-Midland currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.