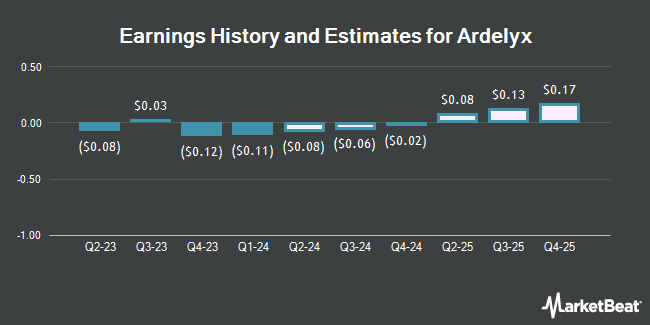

Ardelyx, Inc. (NASDAQ:ARDX - Free Report) - Leerink Partnrs upped their FY2027 EPS estimates for Ardelyx in a report released on Wednesday, December 4th. Leerink Partnrs analyst R. Ruiz now forecasts that the biopharmaceutical company will earn $0.99 per share for the year, up from their prior forecast of $0.95. The consensus estimate for Ardelyx's current full-year earnings is ($0.18) per share.

Other equities analysts have also recently issued reports about the stock. Citigroup cut their target price on shares of Ardelyx from $12.00 to $10.00 and set a "buy" rating for the company in a research note on Monday, November 4th. HC Wainwright downgraded shares of Ardelyx from a "buy" rating to a "neutral" rating and dropped their price objective for the company from $11.00 to $5.50 in a report on Monday, November 11th. Three analysts have rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $10.42.

Read Our Latest Stock Analysis on ARDX

Ardelyx Price Performance

ARDX traded up $0.22 during trading on Friday, reaching $5.72. 3,362,046 shares of the company traded hands, compared to its average volume of 5,258,549. The company has a market cap of $1.35 billion, a P/E ratio of -19.07 and a beta of 0.83. The company has a debt-to-equity ratio of 0.64, a quick ratio of 3.87 and a current ratio of 4.03. Ardelyx has a 12-month low of $4.34 and a 12-month high of $10.13. The firm has a fifty day simple moving average of $5.72 and a 200 day simple moving average of $5.98.

Insider Activity

In other Ardelyx news, CEO Michael Raab sold 35,000 shares of Ardelyx stock in a transaction on Wednesday, September 11th. The shares were sold at an average price of $5.61, for a total transaction of $196,350.00. Following the completion of the transaction, the chief executive officer now directly owns 1,220,608 shares of the company's stock, valued at $6,847,610.88. The trade was a 2.79 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider David P. Rosenbaum sold 49,564 shares of the business's stock in a transaction on Friday, September 27th. The shares were sold at an average price of $6.92, for a total transaction of $342,982.88. Following the transaction, the insider now owns 301,946 shares in the company, valued at $2,089,466.32. This trade represents a 14.10 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 252,068 shares of company stock worth $1,472,641. 5.90% of the stock is currently owned by corporate insiders.

Institutional Trading of Ardelyx

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. State Street Corp increased its stake in Ardelyx by 1.5% in the third quarter. State Street Corp now owns 12,141,850 shares of the biopharmaceutical company's stock worth $83,657,000 after purchasing an additional 176,789 shares during the period. Eventide Asset Management LLC grew its holdings in shares of Ardelyx by 11.2% in the third quarter. Eventide Asset Management LLC now owns 7,413,049 shares of the biopharmaceutical company's stock worth $51,076,000 after purchasing an additional 746,067 shares during the last quarter. Geode Capital Management LLC increased its stake in Ardelyx by 0.3% in the 3rd quarter. Geode Capital Management LLC now owns 5,487,742 shares of the biopharmaceutical company's stock worth $37,818,000 after buying an additional 17,296 shares during the period. Millennium Management LLC lifted its holdings in Ardelyx by 142.8% during the 2nd quarter. Millennium Management LLC now owns 3,203,090 shares of the biopharmaceutical company's stock valued at $23,735,000 after buying an additional 1,883,995 shares in the last quarter. Finally, Rubric Capital Management LP boosted its position in Ardelyx by 68.5% in the 3rd quarter. Rubric Capital Management LP now owns 3,060,191 shares of the biopharmaceutical company's stock valued at $21,085,000 after buying an additional 1,243,606 shares during the period. 58.92% of the stock is owned by hedge funds and other institutional investors.

Ardelyx Company Profile

(

Get Free Report)

Ardelyx, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines to treat gastrointestinal and cardiorenal therapeutic areas in the United States and internationally. The company's lead product candidate is tenapanor for the treatment of patients with irritable bowel syndrome with constipation.

Featured Articles

Before you consider Ardelyx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ardelyx wasn't on the list.

While Ardelyx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.