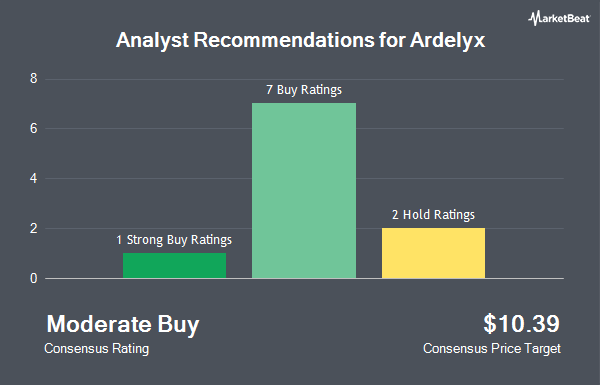

Shares of Ardelyx, Inc. (NASDAQ:ARDX - Get Free Report) have earned a consensus rating of "Moderate Buy" from the eight ratings firms that are covering the stock, Marketbeat.com reports. Two equities research analysts have rated the stock with a hold recommendation, five have given a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1-year price target among brokerages that have issued a report on the stock in the last year is $10.42.

Several brokerages recently commented on ARDX. Wedbush reiterated an "outperform" rating and set a $11.00 price target on shares of Ardelyx in a report on Friday, August 2nd. Citigroup cut their target price on Ardelyx from $12.00 to $10.00 and set a "buy" rating on the stock in a research note on Monday, November 4th. HC Wainwright lowered Ardelyx from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $11.00 to $5.50 in a research note on Monday, November 11th. Finally, StockNews.com upgraded Ardelyx from a "sell" rating to a "hold" rating in a report on Wednesday, July 31st.

Read Our Latest Analysis on ARDX

Insider Buying and Selling

In other Ardelyx news, CEO Michael Raab sold 32,225 shares of the stock in a transaction dated Tuesday, August 20th. The shares were sold at an average price of $5.86, for a total transaction of $188,838.50. Following the transaction, the chief executive officer now directly owns 1,227,009 shares in the company, valued at $7,190,272.74. This represents a 2.56 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Justin A. Renz sold 5,289 shares of the firm's stock in a transaction dated Tuesday, August 20th. The shares were sold at an average price of $5.86, for a total transaction of $30,993.54. Following the transaction, the chief financial officer now directly owns 295,257 shares in the company, valued at $1,730,206.02. This trade represents a 1.76 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 247,983 shares of company stock valued at $1,514,002 over the last quarter. 5.90% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Ardelyx

A number of hedge funds have recently made changes to their positions in ARDX. Nisa Investment Advisors LLC raised its holdings in Ardelyx by 1,026.3% in the second quarter. Nisa Investment Advisors LLC now owns 3,548 shares of the biopharmaceutical company's stock worth $26,000 after purchasing an additional 3,233 shares in the last quarter. Redwood Wealth Management Group LLC bought a new position in shares of Ardelyx during the 2nd quarter worth approximately $62,000. Coastal Bridge Advisors LLC bought a new position in shares of Ardelyx during the 2nd quarter worth approximately $74,000. Helen Stephens Group LLC purchased a new stake in Ardelyx during the third quarter valued at approximately $76,000. Finally, Paloma Partners Management Co acquired a new stake in Ardelyx in the first quarter valued at approximately $86,000. 58.92% of the stock is currently owned by hedge funds and other institutional investors.

Ardelyx Stock Up 5.5 %

Shares of ARDX opened at $4.97 on Friday. The company has a quick ratio of 3.87, a current ratio of 4.03 and a debt-to-equity ratio of 0.64. Ardelyx has a 52-week low of $3.83 and a 52-week high of $10.13. The company has a market cap of $1.18 billion, a PE ratio of -16.57 and a beta of 0.92. The business has a fifty day moving average of $5.93 and a 200 day moving average of $6.24.

About Ardelyx

(

Get Free ReportArdelyx, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines to treat gastrointestinal and cardiorenal therapeutic areas in the United States and internationally. The company's lead product candidate is tenapanor for the treatment of patients with irritable bowel syndrome with constipation.

Featured Articles

Before you consider Ardelyx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ardelyx wasn't on the list.

While Ardelyx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.