Ares Management (NYSE:ARES - Get Free Report) was upgraded by stock analysts at StockNews.com from a "sell" rating to a "hold" rating in a research report issued to clients and investors on Thursday.

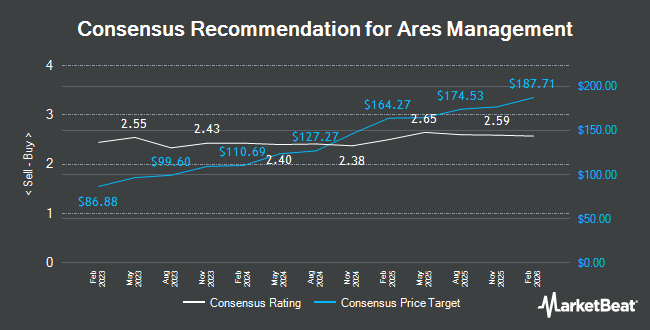

Other research analysts have also issued reports about the stock. UBS Group raised their price target on shares of Ares Management from $158.00 to $195.00 and gave the company a "buy" rating in a research report on Tuesday, October 22nd. The Goldman Sachs Group boosted their target price on shares of Ares Management from $145.00 to $160.00 and gave the company a "buy" rating in a report on Monday, September 30th. Wells Fargo & Company raised shares of Ares Management from an "equal weight" rating to an "overweight" rating and upped their price target for the stock from $176.00 to $212.00 in a report on Thursday, December 12th. Barclays raised their price objective on shares of Ares Management from $155.00 to $174.00 and gave the company an "overweight" rating in a research report on Monday, October 7th. Finally, JPMorgan Chase & Co. cut their target price on Ares Management from $176.00 to $174.00 and set an "overweight" rating for the company in a research note on Tuesday, November 5th. Six equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company's stock. According to data from MarketBeat.com, Ares Management has a consensus rating of "Moderate Buy" and a consensus target price of $169.64.

View Our Latest Research Report on Ares Management

Ares Management Trading Up 1.1 %

Shares of NYSE:ARES traded up $1.86 during midday trading on Thursday, reaching $171.08. The company's stock had a trading volume of 1,412,245 shares, compared to its average volume of 1,160,777. Ares Management has a fifty-two week low of $112.83 and a fifty-two week high of $185.06. The company has a debt-to-equity ratio of 0.53, a quick ratio of 1.05 and a current ratio of 1.05. The firm has a 50 day moving average price of $171.31 and a two-hundred day moving average price of $153.43. The firm has a market capitalization of $53.56 billion, a price-to-earnings ratio of 78.84, a PEG ratio of 1.99 and a beta of 1.19.

Ares Management (NYSE:ARES - Get Free Report) last posted its quarterly earnings results on Friday, November 1st. The asset manager reported $0.95 earnings per share for the quarter, beating the consensus estimate of $0.94 by $0.01. Ares Management had a net margin of 12.51% and a return on equity of 19.89%. The firm had revenue of $1.13 billion during the quarter, compared to the consensus estimate of $833.58 million. During the same period in the previous year, the firm posted $0.83 earnings per share. As a group, analysts forecast that Ares Management will post 4.06 earnings per share for the current year.

Insider Activity

In other news, Chairman Bennett Rosenthal sold 15,763 shares of the business's stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $167.24, for a total transaction of $2,636,204.12. Following the completion of the transaction, the chairman now directly owns 214,189 shares of the company's stock, valued at $35,820,968.36. The trade was a 6.85 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Ryan Berry sold 20,000 shares of the company's stock in a transaction on Friday, October 4th. The shares were sold at an average price of $160.07, for a total value of $3,201,400.00. Following the sale, the insider now owns 344,202 shares of the company's stock, valued at approximately $55,096,414.14. This trade represents a 5.49 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 634,167 shares of company stock worth $109,917,647 over the last three months. 1.20% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Ares Management

A number of institutional investors have recently bought and sold shares of the stock. Point72 DIFC Ltd bought a new position in shares of Ares Management in the third quarter worth about $36,000. Eastern Bank purchased a new position in shares of Ares Management in the third quarter worth $39,000. Key Financial Inc bought a new position in shares of Ares Management during the second quarter worth $53,000. Industrial Alliance Investment Management Inc. grew its stake in Ares Management by 80.4% during the second quarter. Industrial Alliance Investment Management Inc. now owns 451 shares of the asset manager's stock valued at $60,000 after acquiring an additional 201 shares in the last quarter. Finally, Ashton Thomas Private Wealth LLC bought a new stake in Ares Management in the 2nd quarter valued at $78,000. 50.03% of the stock is owned by institutional investors.

About Ares Management

(

Get Free Report)

Ares Management Corporation operates as an alternative asset manager in the United States, Europe, and Asia. The company's Tradable Credit Group segment manages various types of investment funds, such as commingled and separately managed accounts for institutional investors, and publicly traded vehicles and sub-advised funds for retail investors in the tradable and non-investment grade corporate credit markets.

Further Reading

Before you consider Ares Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ares Management wasn't on the list.

While Ares Management currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.