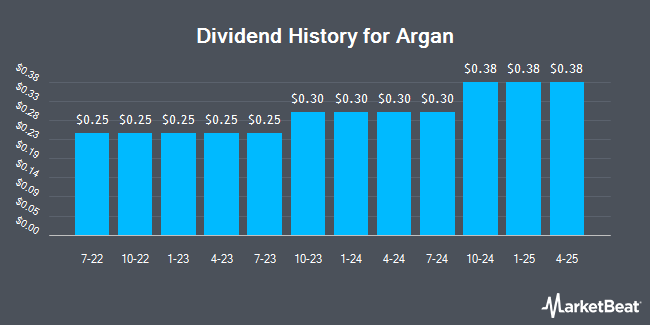

Argan, Inc. (NYSE:AGX - Get Free Report) announced a quarterly dividend on Friday, December 13th,Wall Street Journal reports. Investors of record on Thursday, January 23rd will be given a dividend of 0.375 per share by the construction company on Friday, January 31st. This represents a $1.50 dividend on an annualized basis and a dividend yield of 1.05%. The ex-dividend date of this dividend is Thursday, January 23rd.

Argan has decreased its dividend by an average of 5.7% annually over the last three years. Argan has a payout ratio of 28.0% meaning its dividend is sufficiently covered by earnings.

Argan Stock Down 0.9 %

Argan stock traded down $1.31 during trading on Friday, reaching $142.96. The stock had a trading volume of 193,557 shares, compared to its average volume of 181,558. Argan has a 52-week low of $43.00 and a 52-week high of $165.33. The stock has a market cap of $1.94 billion, a PE ratio of 29.91 and a beta of 0.53. The business has a 50 day moving average price of $138.76 and a 200 day moving average price of $99.34.

Argan (NYSE:AGX - Get Free Report) last released its quarterly earnings data on Thursday, December 5th. The construction company reported $2.00 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.26 by $0.74. Argan had a net margin of 8.20% and a return on equity of 21.66%. The business had revenue of $257.00 million during the quarter, compared to analysts' expectations of $225.60 million. Argan's revenue for the quarter was up 56.9% on a year-over-year basis.

Analysts Set New Price Targets

Several brokerages have recently weighed in on AGX. CJS Securities reissued a "market perform" rating and set a $150.00 target price on shares of Argan in a research report on Friday, December 6th. StockNews.com lowered shares of Argan from a "buy" rating to a "hold" rating in a research note on Tuesday, October 29th. Finally, Lake Street Capital downgraded shares of Argan from a "buy" rating to a "hold" rating and boosted their price objective for the stock from $85.00 to $150.00 in a research report on Tuesday, December 3rd.

Check Out Our Latest Stock Analysis on AGX

Insiders Place Their Bets

In related news, Director Rainer H. Bosselmann sold 4,598 shares of the stock in a transaction on Thursday, October 17th. The shares were sold at an average price of $131.01, for a total transaction of $602,383.98. Following the completion of the sale, the director now owns 236,745 shares in the company, valued at $31,015,962.45. This represents a 1.91 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Cynthia Flanders sold 5,000 shares of Argan stock in a transaction on Wednesday, September 25th. The shares were sold at an average price of $96.39, for a total transaction of $481,950.00. Following the completion of the transaction, the director now owns 17,332 shares in the company, valued at approximately $1,670,631.48. This represents a 22.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 29,703 shares of company stock valued at $3,360,994. 11.85% of the stock is currently owned by insiders.

Argan Company Profile

(

Get Free Report)

Argan, Inc, through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market. The company operates through Power Services, Industrial Services, and Telecom Services segments. The Power Services segment offers engineering, procurement, and construction, as well as designing, building, and commissioning of large-scale energy projects to the owners of alternative energy facilities, such as biomass plants, wind farms, and solar fields; and design, construction, project management, start-up, and operation services for projects with approximately 18 gigawatts of power-generating capacity.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Argan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Argan wasn't on the list.

While Argan currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.