Anson Funds Management LP lifted its holdings in Argan, Inc. (NYSE:AGX - Free Report) by 28.6% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 45,000 shares of the construction company's stock after purchasing an additional 10,000 shares during the quarter. Anson Funds Management LP owned 0.33% of Argan worth $4,564,000 as of its most recent SEC filing.

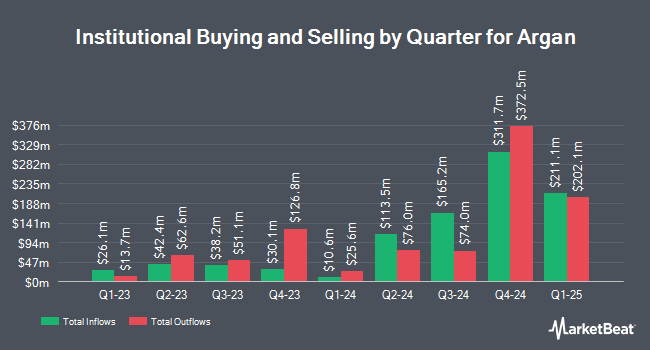

Several other large investors have also added to or reduced their stakes in the business. Wellington Management Group LLP boosted its position in Argan by 81.8% during the third quarter. Wellington Management Group LLP now owns 911,056 shares of the construction company's stock valued at $92,408,000 after purchasing an additional 409,948 shares during the last quarter. Renaissance Technologies LLC raised its stake in shares of Argan by 7.7% during the 2nd quarter. Renaissance Technologies LLC now owns 537,296 shares of the construction company's stock worth $39,309,000 after purchasing an additional 38,300 shares in the last quarter. State Street Corp boosted its holdings in shares of Argan by 4.8% in the 3rd quarter. State Street Corp now owns 353,984 shares of the construction company's stock valued at $35,905,000 after buying an additional 16,055 shares during the last quarter. American Century Companies Inc. grew its stake in shares of Argan by 31.8% in the second quarter. American Century Companies Inc. now owns 305,298 shares of the construction company's stock valued at $22,336,000 after buying an additional 73,658 shares in the last quarter. Finally, Acadian Asset Management LLC increased its holdings in Argan by 32.8% during the second quarter. Acadian Asset Management LLC now owns 175,245 shares of the construction company's stock worth $12,811,000 after buying an additional 43,258 shares during the last quarter. Institutional investors and hedge funds own 79.43% of the company's stock.

Insider Transactions at Argan

In other news, Director William F. Leimkuhler sold 10,000 shares of the stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $96.20, for a total transaction of $962,000.00. Following the sale, the director now directly owns 35,852 shares of the company's stock, valued at approximately $3,448,962.40. This represents a 21.81 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Rainer H. Bosselmann sold 10,105 shares of the company's stock in a transaction dated Monday, October 21st. The stock was sold at an average price of $130.10, for a total transaction of $1,314,660.50. Following the sale, the director now directly owns 219,879 shares of the company's stock, valued at $28,606,257.90. This represents a 4.39 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 39,703 shares of company stock valued at $4,257,794. 11.85% of the stock is currently owned by corporate insiders.

Argan Stock Performance

Shares of AGX stock traded down $1.70 during midday trading on Friday, hitting $147.12. 814,039 shares of the company were exchanged, compared to its average volume of 266,262. Argan, Inc. has a 52 week low of $39.74 and a 52 week high of $165.33. The firm has a market capitalization of $1.99 billion, a P/E ratio of 30.78 and a beta of 0.53. The firm's 50 day moving average price is $135.32 and its two-hundred day moving average price is $97.63.

Argan (NYSE:AGX - Get Free Report) last posted its earnings results on Thursday, December 5th. The construction company reported $2.00 EPS for the quarter, beating the consensus estimate of $1.26 by $0.74. The company had revenue of $257.00 million for the quarter, compared to the consensus estimate of $225.60 million. Argan had a return on equity of 14.80% and a net margin of 6.11%. The company's revenue was up 56.9% compared to the same quarter last year.

Argan Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, October 31st. Shareholders of record on Wednesday, October 23rd were given a dividend of $0.375 per share. This is a boost from Argan's previous quarterly dividend of $0.30. The ex-dividend date was Wednesday, October 23rd. This represents a $1.50 annualized dividend and a yield of 1.02%. Argan's dividend payout ratio (DPR) is presently 31.38%.

Analysts Set New Price Targets

A number of brokerages have commented on AGX. StockNews.com cut shares of Argan from a "buy" rating to a "hold" rating in a research note on Tuesday, October 29th. CJS Securities reiterated a "market perform" rating and issued a $150.00 target price on shares of Argan in a research note on Friday. Finally, Lake Street Capital cut Argan from a "buy" rating to a "hold" rating and raised their price objective for the company from $85.00 to $150.00 in a research report on Tuesday, December 3rd.

Read Our Latest Research Report on AGX

Argan Company Profile

(

Free Report)

Argan, Inc, through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market. The company operates through Power Services, Industrial Services, and Telecom Services segments. The Power Services segment offers engineering, procurement, and construction, as well as designing, building, and commissioning of large-scale energy projects to the owners of alternative energy facilities, such as biomass plants, wind farms, and solar fields; and design, construction, project management, start-up, and operation services for projects with approximately 18 gigawatts of power-generating capacity.

Read More

Before you consider Argan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Argan wasn't on the list.

While Argan currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report