Jackson Creek Investment Advisors LLC decreased its stake in shares of Argan, Inc. (NYSE:AGX - Free Report) by 29.0% during the 4th quarter, according to its most recent Form 13F filing with the SEC. The fund owned 13,259 shares of the construction company's stock after selling 5,410 shares during the period. Jackson Creek Investment Advisors LLC owned about 0.10% of Argan worth $1,817,000 as of its most recent filing with the SEC.

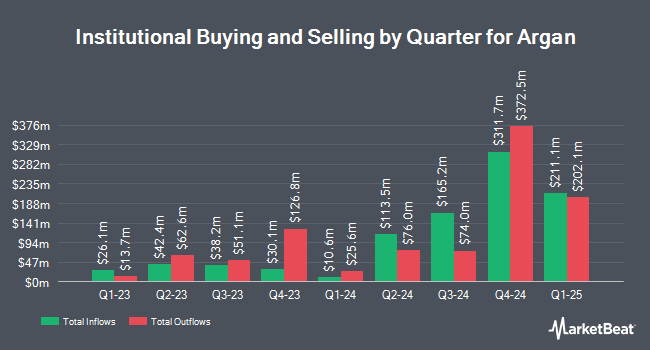

Several other large investors have also modified their holdings of the stock. Spire Wealth Management bought a new stake in Argan during the fourth quarter valued at $26,000. Global Retirement Partners LLC acquired a new position in shares of Argan in the 4th quarter valued at about $35,000. KBC Group NV bought a new stake in shares of Argan during the 4th quarter valued at about $93,000. FMR LLC grew its position in shares of Argan by 68.2% during the 3rd quarter. FMR LLC now owns 1,033 shares of the construction company's stock valued at $105,000 after buying an additional 419 shares during the last quarter. Finally, Private Trust Co. NA acquired a new stake in Argan during the fourth quarter worth about $151,000. Institutional investors own 79.43% of the company's stock.

Analyst Ratings Changes

A number of brokerages have commented on AGX. CJS Securities restated a "market perform" rating and issued a $150.00 target price on shares of Argan in a research note on Friday, December 6th. Lake Street Capital lowered Argan from a "buy" rating to a "hold" rating and boosted their price objective for the company from $85.00 to $150.00 in a research report on Tuesday, December 3rd.

Read Our Latest Analysis on AGX

Argan Price Performance

Shares of AGX stock traded up $7.10 during trading hours on Tuesday, reaching $111.15. The stock had a trading volume of 376,995 shares, compared to its average volume of 459,887. The firm has a market capitalization of $1.51 billion, a PE ratio of 23.25 and a beta of 0.58. The firm has a 50-day simple moving average of $146.12 and a 200-day simple moving average of $131.05. Argan, Inc. has a twelve month low of $47.42 and a twelve month high of $191.46.

Argan Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, January 31st. Shareholders of record on Thursday, January 23rd were paid a $0.375 dividend. The ex-dividend date was Thursday, January 23rd. This represents a $1.50 annualized dividend and a dividend yield of 1.35%. Argan's payout ratio is currently 31.38%.

Insider Activity

In other news, CEO David Hibbert Watson sold 10,000 shares of the stock in a transaction on Wednesday, December 18th. The stock was sold at an average price of $146.05, for a total value of $1,460,500.00. Following the completion of the transaction, the chief executive officer now owns 51,291 shares of the company's stock, valued at approximately $7,491,050.55. This represents a 16.32 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. Also, CFO Richard H. Deily sold 2,000 shares of Argan stock in a transaction dated Wednesday, January 8th. The shares were sold at an average price of $150.00, for a total transaction of $300,000.00. Following the sale, the chief financial officer now owns 9,367 shares in the company, valued at approximately $1,405,050. This represents a 17.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 20,185 shares of company stock valued at $3,105,359. Insiders own 11.85% of the company's stock.

About Argan

(

Free Report)

Argan, Inc, through its subsidiaries, provides engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting services to the power generation market. The company operates through Power Services, Industrial Services, and Telecom Services segments. The Power Services segment offers engineering, procurement, and construction, as well as designing, building, and commissioning of large-scale energy projects to the owners of alternative energy facilities, such as biomass plants, wind farms, and solar fields; and design, construction, project management, start-up, and operation services for projects with approximately 18 gigawatts of power-generating capacity.

Recommended Stories

Before you consider Argan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Argan wasn't on the list.

While Argan currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.